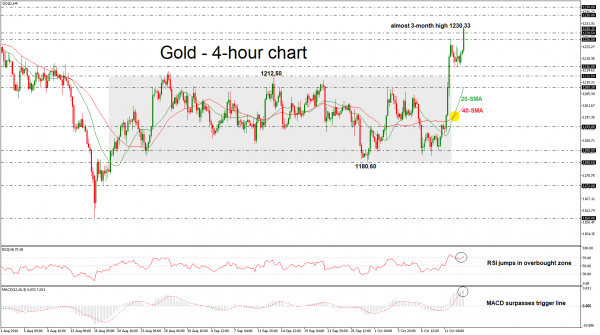

Gold reached a fresh near three-month high of 1230.33 today, continuing the aggressive bullish rally that started in the preceding week. The price successfully surpassed the narrow 1180.60 – 1212.50 range that had been holding since August 20, suggesting further upside moves in the near term.

Having a look at the technical indicators, in the 4-hour chart, the RSI surged to overbought territory and is still pointing to the upside, while the MACD created a bullish crossover with the trigger line in the positive zone. Moreover, the 20-simple moving average (SMA) jumped above the 40-SMA endorsing the aggressive run.

Further upside movement could drive the precious metal towards the 1235 resistance level, taken from the high on July 26. A significant leg above this barrier could send prices until the next immediate resistance of 1238, achieved on July 3. Moreover, a jump higher could challenge the 1265.60 resistance, where it topped on July 6.

On the flipside, in case of a bearish retracement the market could meet support at around 1216, identified by the latest lows. More losses could see the price retesting the 1212.50 hurdle before it heads lower to the 20-SMA, currently at 1208.30.

Overall, gold prices seem to be in a sharp upside movement over the last hours. Overbought conditions may justify some caution though.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals