The COT report is a weekly sentiment report that can provide forex traders with important information on the positioning of currency pairs. Issued by the Commodities Futures Trading Commission (CFTC) the COT report can be cross-referenced with a trader’s underlying forex strategy.

The forex market is not the only financial market included in the COT report analysis, which makes this valuable commentary for all traders.

COT Report Analysis in Forex Trading: Main Talking Points

NOTE: if you have no time to study all the tools of the trade and you have not funds for errors and losses – trade with the help of our best forex robot developed by our professionals. It is fully automated, you need install it in your Metatrader only. Write us to support@signal2forex.com and we’ll help you with installation and answer all questions.

What is the Commitment of Traders Report?

It is a requirement of the CFTC that the largest futures traders in the world must report their positions. These positions can be easily tracked due to the margin they must pay to hold their large positions which the CFTC has been publishing since 1962.

More recently since the year 2000, reports are released every Friday at 3:30ET pm. This information can be highly valuable to traders due to the nature of people who come into the futures market. This includes institutions like hedge funds who enter to make a return above their respective index. Some of the largest companies in the world with real-time data of the health of an economy come to the futures market to hedge their exposure to price fluctuations of raw materials that they use to make their product. This allows traders to gauge the positioning of the market at that specific time.

Breakdown of the three main groups mentioned in the COT report:

- Commercial Traders – These are most often large multi-national corporations with commercial hedging interest in their respective futures markets. For example, a large Japanese manufacturer may want to hedge their exposure to fluctuations in the USD/JPY exchange rate.

- Non-Commercial Traders – This data most often relates to large speculators such as Commodity Trading Advisors and similarly large institutions speculating in specific futures markets. For example, a major commodity fund believes that the US Dollar will appreciate against the Euro and, as such, place bets on Euro forex futures.

- Non-Reportable Traders – Non-Reportable Traders are traders who don’t fall into either group. Most often seen as small speculators, these are arguably less significant and do not frequently figure into COT report analysis. For example, these traders refer to the leveraged players without deep pockets who are shaken out on big moves

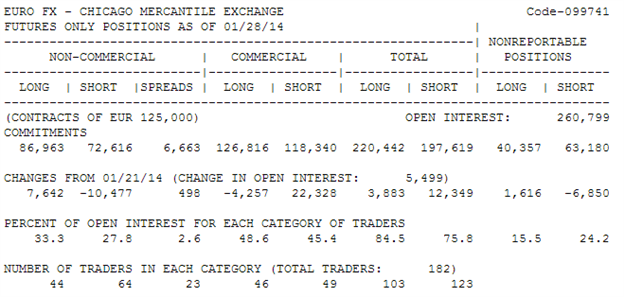

With these general definitions in mind, traders can then decide how to use this information. The image below depicts an extract from the COT report with the three main groups as outlined above.

Read how to trade Forex profitably and what are trading robots…

EUR/USD COT Report:

Source: CFTC

COT Report Trading Strategies

Upon the first reading of the COT report, it may seem confusing how future positions in USD, JPY, GBP or EUR could be helpful for trading EUR/USD, USD/JPY, or EUR/GBP. There is a lot to learn about the COT report but what’s often helpful is to find where there is a strong divergence between large speculators and large commercials.

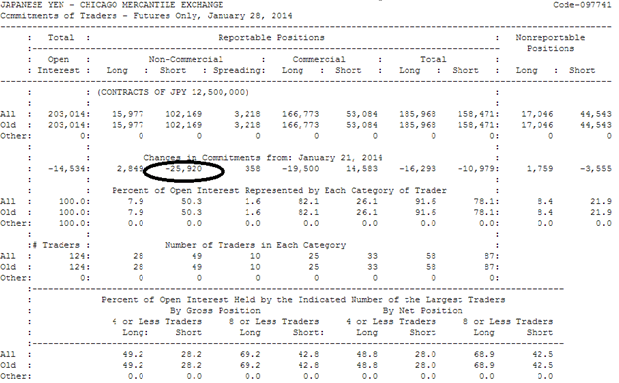

USD/JPY COT Report:

USD/JPY chart confirmation of Non-Commercials selling USD/JPY long positions:

<alt image desc> USD/JPY chart COT report

*New to forex trading? We are professional software developers for the forex market. Check out our expert advisors.

The first place to start with is a clean understanding of ‘net positioning’ which is shown clearly on the report itself, as well as the week over week differential of major market bias (circled above).

The specific number is not necessarily important, but rather a clear sign in percentage terms of open interest which makes it easy in identifying ‘Non-Commercials’ flipping against the primary trend. Furthermore, when a key flip in sentiment of ‘Non-Commercials’ is realized and there is a confirmation on the charts that a trend is exhausting, traders are likely trading in the same direction of the big kids.

From the report located above, the number of funds off-loading the JPY shorts increased dramatically from the week prior. When this type of shift from major funds is observed, traders can look for other signs that show the prior trend is losing steam which could indicate a possible exit of open positions. The chart above of USD/JPY notes that there have been four bearish key days (highlighted in red) on USD/JPY since the start of 2014 at the same time non-commercials have unloaded their USD/JPY long positions giving credence that this move down may have more to go. Further validated by the technical indicators used in the chart – RSI and 100-day moving average which both signal a bearish bias.

Using the DailyFX COT Analysis Report

Another excellent tool, is the Commitment of Traders Analysis from DailyFX. This weekly report provides analysis of the CFTC report, showing the positioning of forex futures trades with a synopsis of the key flips in positioning. This report also helps traders by providing 52-week percentiles of major moves, showing annual bullish / bearish extremes which assist in trade execution – tightening stops or looking for price action to confirm the funds are selling out.

Summary: Look for chart validation of how the ‘Non-Commercial’ traders are positioning themselves. With a large percentage (greater than 10%) of ‘Non-Commercials’ flipping their bias, traders should take note of this. Lastly, traders can increase their understanding of market sentiment and get a better feel for how a sample group of the ‘Non-Reportable’ or smaller traders are positioned in OTC forex via the IG Client Sentiment Index which is updated twice a day.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals