It seems markets will either need to see substantial progress on trade or stronger easing signals to yield any major moves. Light volumes are expected until we get to Friday’s employment report, which economists see rebounding to 164,000 jobs. Fed funds futures contract are fully pricing in a rate cut at the July 31st meeting, with markets split whether we see an additional one or two cuts by the end of the year. Regarding trade both the US and China continue to highlight positive steps and that talks are ongoing. Markets will become more optimistic if we see both sides agree to schedule another meeting to iron out details on enforcement and structural reform. If the Xi and Trump want a deal to finalize before October, the Chinese need to take back some of the red ink they put in place in May when talks blew up.

Stocks

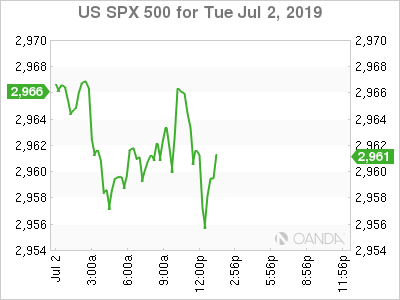

For US stocks to continue the march further into uncharted territory, the world’s largest two economies need to show some trade war concessions on both sides and for the Fed to signal they will not signal they will stand pat after delivering a 25 basis-point cut. Markets need a punch bowl and not just a drink to continue drive stocks higher.

Note: our programmers have developed a profitable forex advisor with low risk and stable profit!

Oil

Oil producing countries signaled production cuts will be extended another nine months, taking the effort to balance the oil market to beyond three years. Oil prices are trading sharply lower after a wrath of softer global manufacturing data hinted that central banks are behind the curve in delivery fresh stimulus. If we are in the beginning of global slowdown, the effects of fresh stimulus will take months before filtering into the economy.

Crude prices appear vulnerable markets are beginning to price in this will be the last production cuts we see from OPEC +. It is hard to imagine a scenario that would see all countries remain supportive for cuts at the next meeting which will be closer to the end of the year.

Gold

Safe-havens are shining bright today as global slowdown worries are growing. The initial trade truce risk-on rally is over, and markets have little to show in hopes of a trade deal getting finalized anytime soon. The de-escalation in fresh tariff threats might not be enough to ease falling sentiment concerns. The other key catalyst for safe-haven demand is the expectations on how accommodative the Fed will be in the coming months. If we continue to see the US data points deteriorate, we could see safety trades reign supreme this summer. The Japanese yen is also benefiting with the flight to safety and is the best performing currency on the day.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals