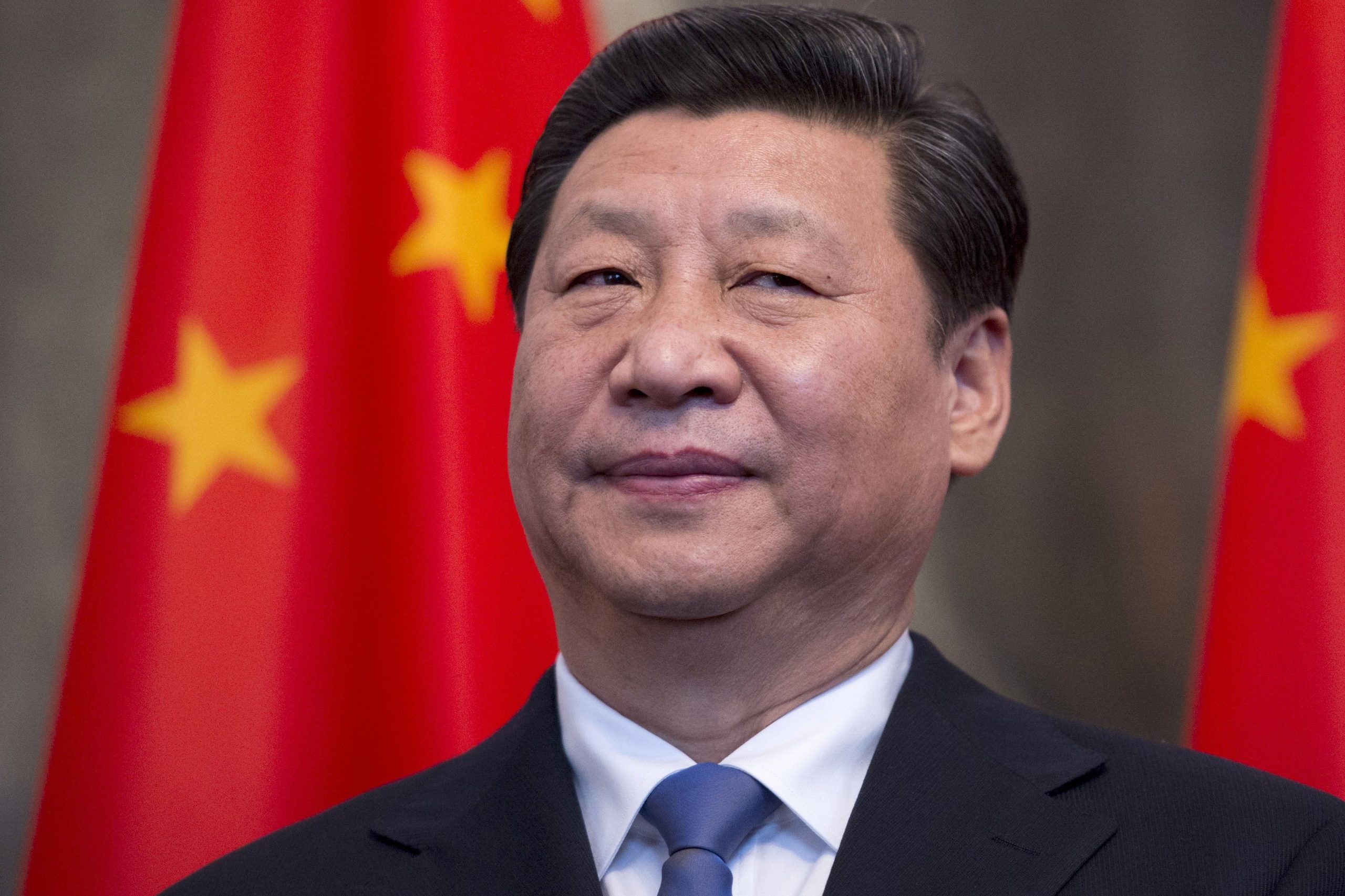

Chinese President Xi Jinping stands by national flags.

Johannes Eisele | AFP | Getty Images

The International Monetary Fund is urging the world’s two largest economies to resolve the escalating trade war quickly and fairly.

In a new report published Friday by the executive board at the IMF, directors recommended a “comprehensive” agreement on trade that avoids “undermining the international system.”

“China and its trading partners should work cooperatively and constructively to settle their disputes in a rules-based multilateral framework and make joint efforts to reform the WTO in a good faith and win-win approach,” Jin Zhongxia, executive director for China at the IMF, said in a press release. “That is not only good for China and the U.S., but also for the international community as a whole.”

The report outlined tariff-related headwinds for China’s economy. Directors emphasized that China would benefit from “further opening up of the economy and other reforms that enhance competition.” The country’s GDP growth slowed to 6.6 percent in 2018 and is projected to moderate to 6.2 percent this year, according to the IMF. China’s planned stimulus was offset by the U.S. imposing tariffs on $200 billion of Chinese goods.

The IMF said trade tensions have “inevitably affected” the Chinese economy, “but the impact is manageable.”

“While a moderate slowdown is expected in 2019, uncertainty around trade tensions remains high and risks are tilted to the downside,” the IMF directors said.

‘Little evidence’ of currency intervention

The trade war boiled over this week as China announced it would stop buying American agricultural products in retaliation for Trump’s surprise tariffs threat. China also allowed its currency to drop against the dollar to a key level unseen since 2008. The Trump administration later labeled Beijing a “currency manipulator. “

The IMF pushed back on that designation in the report and said that “estimates suggest little FX intervention by the PBC.” Still, the IMF said greater exchange rate policy transparency would be important. Some directors called for disclosure of currency interventions by China.

On Friday, President Donald Trump said that the U.S. government will no longer do business with Chinese telecom giant Huawei. The administration blacklisted Huawei in May over national security concerns.

This comes after Trump abruptly ended the cease-fire with China by announcing 10% tariffs on $300 billion worth of Chinese goods last week, claiming China failed to buy U.S. farm goods as it promised. The threat sent shock waves through financial markets and caused the S&P 500 to have its worst day of the year on Monday.

“In the event a comprehensive and durable agreement is not reached, uncertainty is likely to persist and weigh on both the near- and longer-term outlook as China’s access to foreign markets and technology may be significantly reduced,” the IMF said.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals