Selloff in Sterling is the main theme for today. UK become the first country to approve Pfizer-BioNTech coronavirus vaccine and shots are due next week. But the good news was overshadowed by Brexit uncertainties. As the negotiation deadline looms it’s reported that EU is insisting not rushing to a bad deal. Indeed, it’s also said that France and some other hardline EU countries are pushing for a no-deal if the UK doesn’t concede on the ever remaining issues.

For now, the markets are relatively mixed elsewhere, with Aussie pressured by escalating tension with China. Yen is also soft on general investor optimism. Swiss Franc, however, is the strongest one, probably benefited from Brexit uncertainties. Euro is the next strongest, probably for the same reason.

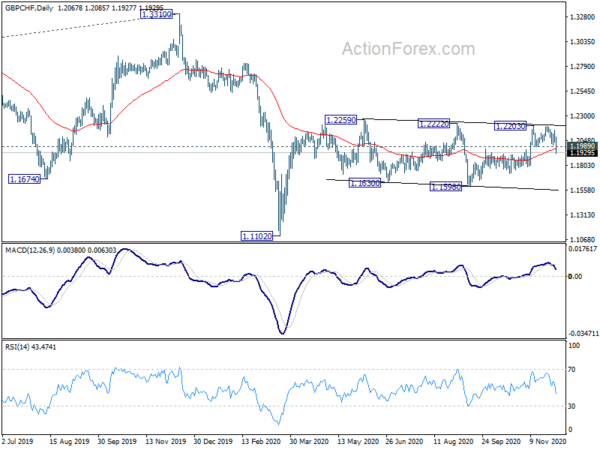

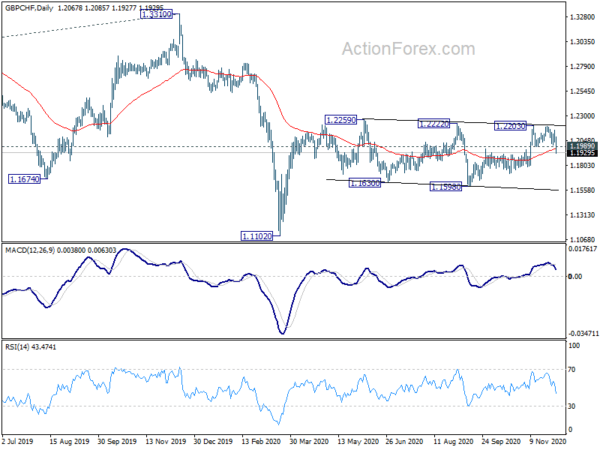

Technically, GBP/CHF’s break of 1.1989 support confirms that sideway pattern from 1.2559 has started another falling leg, back towards 1.1598 support. USD/CHF breaks through 0.8982 to resume medium term down trend. Question is on whether EUR/CHF will break through 1.0790 support to confirm short term topping.

In Europe, currently, FTSE is up 0.30%. DAX is down -0.79%. CAC is down -0.55%. Germany 10-year yield is up 0.008 at -0.515. Earlier in Asia, Nikkei rose 0.05%. Hong Kong HSI dropped -0.13%. China Shanghai SSE dropped -0.07%. Singapore Strait Times dropped -0.11%. Japan 10-year JGB yield rose 0.0024 to 0.026.

US ADP employment grew 307k, pace continues to slow

US ADP employment grew 307k in November, well below expectation of 500k. By company size, small businesses added 110k jobs, medium businesses 139k, large businesses 58k. By sector, goods-producing jobs grew 31k, service-providing jobs grew 276k.

“While November saw employment gains, the pace continues to slow,” said Ahu Yildirmaz, vice president and co-head of the ADP Research Institute. “Job growth remained positive across all industries and sizes.”

Eurozone unemployment dropped to 8.4% in Oct EU unchanged at 7.6%

Eurozone unemployment rate dropped to 8.4% in October, down from 8.5%, matched expectations. There were 13.825m unemployed in Eurozone, down -86k for the month.

EU unemployment rate was unchanged at 7.6% in October, 16.236m were unemployment, down -91k comparing to September.

Eurozone PPI at 0.4% mom, -2.0% yoy in Oct

Eurozone PPI came in at 0.4% mom, -2.0% yoy in October, versus expectation of 0.1% mom, -2.3% yoy. Industrial producer prices increased by 1.4% mom in the energy sector and by 0.1% mom for intermediate goods, capital goods and non-durable consumer goods, while prices remained stable for durable consumer goods. Prices in total industry excluding energy increased by 0.1% mom.

EU PPI came in at 0.3% mom, -2.0% yoy. The highest increases in industrial producer prices were recorded in Belgium (3.7% mom), Ireland (2.1% mom) and Croatia (1.1% mom), while the largest decreases were observed in Denmark (-2.4% mom), Cyprus (-0.5% mom), Spain and Latvia (both -0.4% mom).

Also released, Germany retail sales rose 2.6% mom in October versus expectation of 1.0% mom. Italy unemployment rate rose 0.2% to 9.8% in October. Swiss CPI dropped further by -0.1% to -0.7% yoy in November.

Australia GDP grew 3.3% qoq in Q3, technically out of recession

Australia GDP grew 3.3% qoq in Q3, above expectation of 2.5% qoq. Household spending drove the rebound by rising 7.9%. Final consumption expenditure rose 5.9%. Total gross fixed capital formation dropped -0.1%. Exports dropped -3.2% while imports rose 6.5%.

Head of National Accounts at the ABS, Michael Smedes said: “Following the record 7.0 per cent decline in the June quarter, Australia experienced a partial recovery in the September quarter. As a result, economic activity fell 3.8 per cent through the year to September quarter.”

Treasurer Josh Frydenberg said, “facing a once-in-a-century pandemic that has caused the greatest economic shock since the Great Depression, Australia has performed better on the health and economic fronts than nearly any other country in the world.”

“Technically, Australia’s recession may be over, but Australia’s economic recovery is not,” he said. “There is a lot of ground to make up and many Australian households and many Australian businesses are doing it tough – very tough.”

RBA Lowe: Australian economy has now turned the corner

In the remarks to a House committee, RBA Governor Philip Lowe said Australia has “now turned the corner” after an extremely difficult year, and economy recovery is “underway”. “The economic news has, on balance, been better than we were expecting. RBA is expected GDP growth to be “solidly positive” in both Q3 and Q4, followed by 5% growth over 2021 and 4% over 2022.

“Recent medical breakthroughs give us some hope that things will work out better than this,” Lowe added. ” If so, confidence would lift and there would be a further easing of restrictions. The result would be an upside surprise to growth and jobs, especially given the significant policy stimulus that is already in place, the generally strong balance sheets and the substantial government incentives for businesses to employ people and invest.”

On monetary policy, Lowe said the movement in market prices in response to the package announced in November was “broadly as we expected”. The board will “continue to review the details of this package” and policymakers are “prepared to do more, if that is required”. But he reiterated that negative interest rate is “extraordinarily unlikely, with any benefits being outweighed by the costs”.

RBNZ Orr: Actual use of negative rates depends on economic context at the time

RBNZ Governor Adrian Orr said in a speech that “monetary policy has been effective to date in supporting both inflation and employment as intended – at least at the aggregate level.”

New monetary policy tools will become “increasingly mainstream” in environment of low global inflation and low neutral interest rate.. But “price stability and contributing to maximum employment remain the targets for monetary policy,” after all.

Orr also reiterated that RBNZ “focused on being operationally ready to implement a negative OCR if necessary”. But, “its actual use will always depend on the economic context at the time, and its relative efficacy.”

Also from New Zealand, terms of trade index dropped -4.7% in Q3, versus expectation of -3.6%.

BoJ Amamiya: Will extend the duration of COVID-response measures if needed

BoJ Deputy Governor Masayoshi Amamiya said the current “powerful easing” is exerting an “intended effect” on the economy. Private consumption was gradually picking up, and likely to continue recovery. However, he expected corporate finance to remain under stress as “economic improvement to be moderate”.

“The BOJ will closely watch the impact of COVID-19 for the time being and take additional easing steps without hesitation as needed,” he added. “Will extend the duration of COVID-response measures beyond march deadline as needed, with an eye on pandemic impact on economy.”

Released from Japan, monetary base rose 16.5% yoy in November versus expectation of 18.1% yoy. Consumer confidence rose 0.1 to 33.7, above expectation of 33.0.

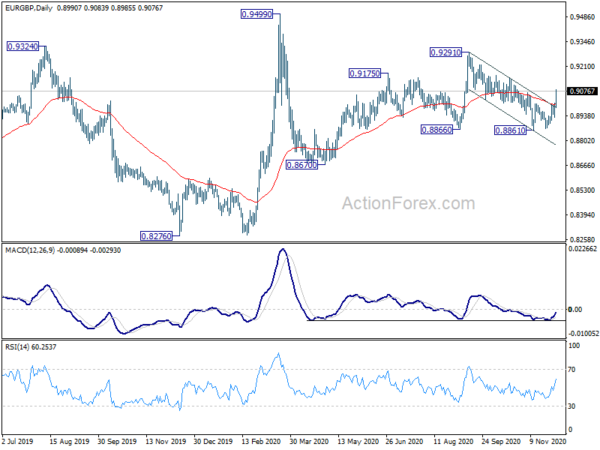

EUR/GBP Mid-Day Outlook

Daily Pivots: (S1) 0.8943; (P) 0.8976; (R1) 0.9022; More…

EUR/GBP’s strong break of 0.9004 resistance suggests that pull back from 0.9291 has completed at 0.8861. Choppy rebound from 0.8670 is possibly resuming. Intraday bias is back on the upside for 0.9291 resistance first. Break will target 0.9499 high. On the downside, below 0.9004 resistance turned support will turn intraday bias neutral again first.

In the bigger picture, at this point, we’re seeing the price actions from 0.9499 as developing into a corrective pattern. That is, up trend from 0.6935 (2015 low) would resume at a later stage. This will remain the favored case as long as 0.8276 support holds. Decisive break of 0.9499 will target 0.9799 (2008 high).

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:45 | NZD | Terms of Trade Index Q3 | -4.70% | -3.60% | 2.50% | 2.40% |

| 23:50 | JPY | Monetary Base Y/Y Nov | 16.50% | 18.10% | 16.30% | |

| 00:01 | GBP | BRC Shop Price Index Y/Y Oct | -1.80% | -1.30% | -1.20% | |

| 00:30 | AUD | GDP Q/Q Q3 | 3.30% | 2.50% | -7.00% | |

| 05:00 | JPY | Consumer Confidence Index Nov | 33.7 | 33 | 33.6 | |

| 07:00 | EUR | Germany Retail Sales M/M Oct | 2.60% | 1.00% | -2.20% | |

| 07:30 | CHF | CPI M/M Nov | -0.20% | 0.00% | 0.00% | |

| 07:30 | CHF | CPI Y/Y Nov | -0.70% | -0.60% | -0.60% | |

| 09:00 | EUR | Italy Unemployment Rate Oct | 9.80% | 9.90% | 9.60% | |

| 10:00 | EUR | Eurozone Unemployment Rate Oct | 8.40% | 8.40% | 8.30% | 8.50% |

| 10:00 | EUR | Eurozone PPI M/M Oct | 0.40% | 0.10% | 0.30% | 0.40% |

| 10:00 | EUR | Eurozone PPI Y/Y Oct | -2.00% | -2.30% | -2.40% | -2.30% |

| 13:15 | USD | ADP Employment Change Nov | 307K | 500K | 365K | 404K |

| 13:30 | CAD | Labor Productivity Q/Q Q3 | -10.30% | -6.90% | 9.80% | |

| 15:30 | USD | Crude Oil Inventories | -1.7M | -0.8M | ||

| 19:00 | USD | Fed’s Beige Book |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals