Trading Ranges with IG Client Sentiment (IGCS)

The IG Client Sentiment (IGCS) tool can assist range trading strategies by using its potentially leading indicator capacity in combination with traditional mean-reversion dynamics. Markets are usually either ranging or trending so this can apply to many different trading scenarios. This article will explain the fundamentals of how IGCS can be implemented into a range trading strategy via two approaches.

Different ways to incorporate IGCS within Range Trading

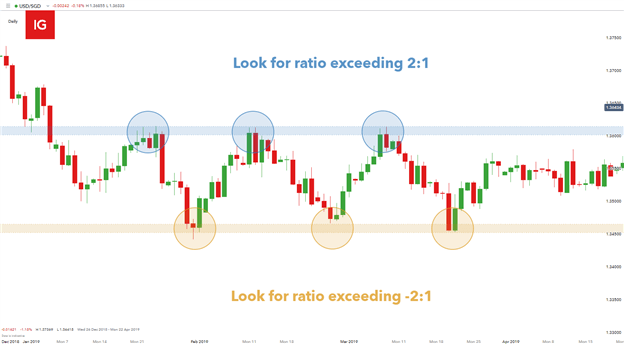

The two methods are similar in outlook but simply refers to varying time frames. The USD/SGD example below goes through a step-by-step outline of how IGCS can be used in a ranging market.

USD/SGD daily chart:

Chart prepared by Warren Venketas, IG

- Short-term ranges– A range includes a support (yellow) and

resistance zone (blue). Price tends to respect these zones and trades within the two areas of confluence. IGCS readings can aid in short-term range trading by looking for ratios exceeding +/-2. When price approached resistance (blue), and IGCS indicates a ratio greater than +2 (retail traders are more net long than short) – and because IGCS is considered a contrarian indicator, a hold of resistance may prelude a move-lower, towards range support.

The same is applicable for support zones (yellow) whereby a bounce off support may be supported by a IGCS reading of -2 (retail traders are more net short than net long). It is important to note that the IGCS +/-2:1 ratio is a general rule of thumb and not a definite line in the sand.

Recommended by Warren Venketas

Download our guide to learn more about sentiment trading

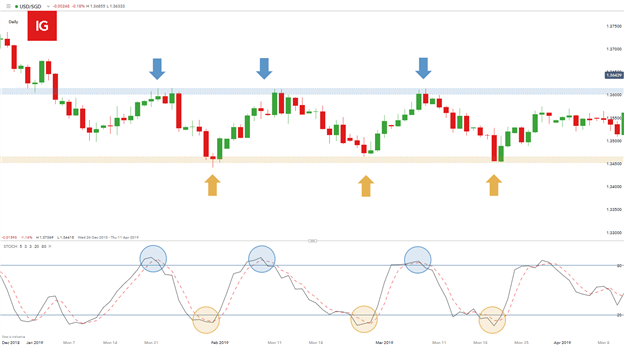

Chart prepared by Warren Venketas, IG

After the IGCS filter, the implementation of range strategy logic through indicators such as RSI, stochastic or MACD may be used. The chart above implements the stochastic oscillator which shows how an additional layer of ancillary data input can enhance/improve a trading decision.

2. Long-term ranges – A similar approach can be adopted with long- term ranges. Looking for IGCS reversals to go along with a longer-term support/resistance hold, incorporating the IGCS signal into the bigger-picture range. Additional support from other indicators can also be beneficial for informed trading decisions. The main difference between the two approaches is the longer time frame.

Steps to follow:

- Identify support and resistance zones

- Use IGCS readings to confirm buy/sell signals

- Use supplementary indicators to re-confirm prior steps

Recommended by Warren Venketas

Traits of Successful Traders

Range Trading with IGCS: Summary

Ranging markets typically fluctuate between an overbought (resistance) and oversold (support) zone. Deciding on whether price will respect the zones or not can be tricky. IGCS in conjunction with other indicators classically associated with range trading can be extremely useful in validating trade assessments.

Looking to trade in a simulated environment to better learn strategies, tactics and approach? Click here to request a free demo with IG group.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals