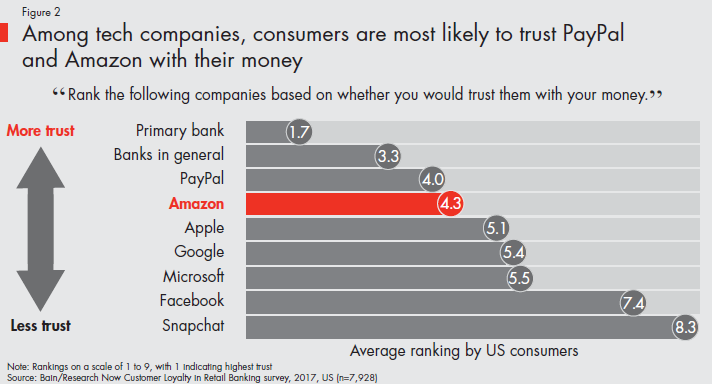

Amazon could rival the nation’s big banks in as few as five years, capitalizing off its digital prowess and massive consumer base, according to a Bain & Company report.

“We could imagine Amazon’s banking services growing to more than 70 million U.S. consumer relationships over the next five years or so — the same as Wells Fargo, the third-largest bank in the US.,” wrote Bain’s Gerard du Toit and Aaron Cheris. “Although many retail bankers and observers have pegged the nimble fintech start-ups as the likely disrupters, it has become clear that established technology firms pose a bigger threat.”

Pushing customers toward a co-branded banking account also allows Amazon to cut down on transaction costs, Bain said.

Amazon could – according to Bain calculations – avoid more than $250,000,000 in credit card interchange fees every year if finds a bank willing to partner on checking accounts.

if you want to have a stable profit, use our forex bot.

Source: Bain & Company

The e-commerce giant is in early talks with financial institutions including J. P. Morgan Chase. The project is aimed at younger customers and those without banking accounts, The Wall Street Journal reported Monday. That focus on a younger demographic may be key, Bain told CNBC, as younger consumers appear to be the most willing to buy financial products from technology firms.

“[Amazon] can afford to go after this previously unprofitable segment in part because it will be able to transform the economics of banking,” the researchers explained. “Instead, Amazon could steer new customers to ‘just ask Alexa,’ its voice assistant on the Echo device.”

Traditional banks have “barely touched” technologies that are becoming ubiquitous in the American economy, Bain found. Nearly one-fifth of U.S. survey respondents use voice assistants at home while one-quarter would consider using voice-controlled assistants for everyday banking.

Source: Bain & Company

Amazon also has a big opportunity in banking services given its immense data platform, a critical advantage over the small, nascent fintech companies that struggle for name recognition, Bain said.

“Once Amazon has established a cobranded basic banking service, we expect the company to move steadily but surely into other financial products, including lending, mortgages, property and casualty insurance, wealth management, and term life insurance,” du Toit and Cheris added. “Online shopping patterns already tell Amazon what it needs to know about customers’ life events, from getting married to having children to buying a house, which will allow the company to offer relevant financial services products.”

The Bain researchers also cited Asian e-commerce giant Alibaba’s success in finance over the past few years as reason for optimism.

“In China, Alibaba has amassed the world’s largest money market fund, issued $96 billion of loans in five years … [and] sent $1.7 trillion in total payments through Alibaba’s Alipay service last year, roughly five times the global payment volume that flowed through PayPal,” the researchers explained.

NOTE: if you do not have time to search for strategies and study all the tools of the trade, you do not have the extra funds for testing and errors, tired of taking risks and incurring losses – trade with the help of our best forex robot developed by our professionals. Also you can testing in Metatrader our forex auto scalper robot free download .

To be sure, there is still time for Wall Street’s banking titans to prepare for a new, tech-savvy competitor, but only if they act.

Ditching the outdated model of decision-making by committee and partnerships with the Googles, Facebooks or Microsofts of the world could be good places to start, Bain said.

“Banks and other financial services companies that focus on customers over products, on episodes over functions, on fast test-and-learn over business cases and on customer outcomes over internal consensus may stand up to Amazon’s flywheel when it spins into their market.”

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals