Sterling’s selloff accelerates as UK CPI missed market expectations. And that lowers the chance of a should-be-done-deal August BoE hike. In the background, Brexit uncertainty is also weighing on sentiments towards the Pound. Meanwhile, Australian Dollar and Euro are trading as the second and third weakest ones. Dollar is generally firm today as support by Fed Chair Jerome Powell’s optimistic comments. But the greenback is firstly overwhelmed by the strength in Swiss Franc. Yen is also lifted by some buying in early US session as China seems to be stepping up with its rhetorics against US protectionism again.

In other markets, major European indices are trading in blue at the time of writing. Notably FTSE is lifted by the sharp by in Sterling and it’s up 0.63%. DAX is trading up 0.65% while CAC is up 0.40%. Earlier today, China SSE suffered another day of decline, by -0.39% to 2787.26. Nikkei, though, rose 0.43%. WTI crude oil is extending this week’s sharp fall and hits as low as 67.37, now at 67.61. Spot gold hits as low as 1221.25 and is set to take on 1220 handle.

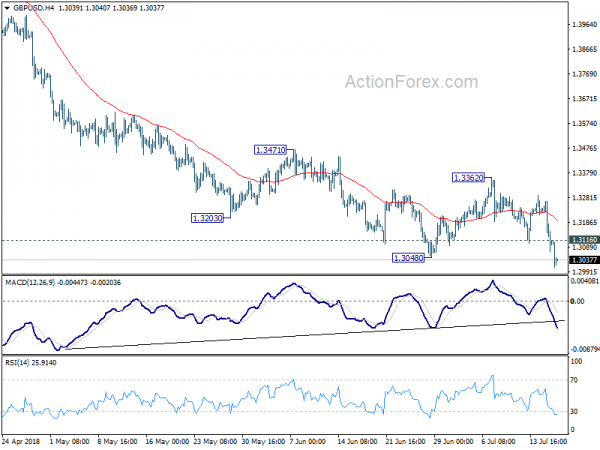

Technically, GBP/USD’s break of 1.3048 confirms resumption of fall from May top at 1.4376. EUR/GBP’s recent rally resumes albeit with weak momentum. GBP/JPY’s break of 147.63 suggests near term reversal, back towards 143.76 support. USD/CAD’s break of 1.3216 is now paving the way to retest 1.3385. AUD/USD’s break of 0.7359 minor support would like bring deeper fall to 0.7309 low. Also, EUR/CHF’s break of 1.1618 support suggests that the corrective rise from May’s low at 1.1366 is possibly finished.

Released from US, housing starts dropped 1.17M annualized rate in June. Building permits dropped to 1.27M. Eurozone CPI was finalized at 2.0% yoy in June, core CPI at 0.9% yoy.

Sterling hammered after CPI miss, August BoE hike in doubt

Sterling drops sharply as UK consumer inflation missed market expectations. Headline CPI was unchanged at 2.4% yoy in June, below expectation of 2.6% yoy. Core CPI slowed to 1.9% yoy, down from 2.1% and missed expectation of 2.2%. RPI accelerated to 3.4% yoy, up from 3.3% yoy but missed expectation of 3.5% yoy. Also from UK, PPI input rose to 10.2% yoy, up from 9.6% yoy and above expectation of 10.2% yoy. PPI output rose to 3.1% yoy, up from 3.0% yoy but missed expectation of 3.2% yoy. PPI output core was unchanged at 2.1%, below expectation of 2.3%.

BoE has been expecting pickup in inflation that is now not happening. And indeed core CPI actually slowed. The once near confirmed August BoE rate hike is now back as a question. Tomorrow’s retail sales data will be another test for the Pound. And there will be UK PMIs in around two weeks’ time. The path to a hike is not easy for BoE.

Everyone’s preparing for no-deal Brexit as uncertainty stays

In the background, there Brexit uncertainty is always there despite all the things the Prime Minister Theresa May has done. May insisted to the Parliament today that “the Chequers agreement, the white paper are the basis for our negotiation with the European Union and we have already started those negotiations.” And she also added that the EU “need to be in no doubt that we are making those preparations” for no deal Brexit.

Irish taoiseach, Leo Varadka warned today that “We can’t make assumptions that the withdrawal agreement will get through Westminster. ” And he added that “It’s not evident, or not obvious, that the government of Britain has the majority for any form of Brexit, quite frankly.” He’s government is stepping up the preparation for a no-deal Brexit. EU chief Brexit negotiator Michel Barnier will report to European Council regarding May’s white paper. And, it’s reported that Barnier’s draft document including words like the consequences of no-deal Brexit will be “very real for citizens, professionals and business operators”.

China to take further action to balance impacts of US steel tariffs

The Chinese Ministry of Commerce said in a statement today that it will take “further actions” to balance the impacts of the US section 232 steel and aluminum tariffs. It condemns the US of using “national security” as excuse for practicing trade protectionism. And criticized the steel tariff measures are a ” a serious damage to multilateral trade rules and undermine the legitimate rights and interests of WTO members”. Further then that, the US “refused to respond” to Chin’s WTO complaints.

Fed Powell to have second half of Congressional Testimony

Fed chair Jerome Powell will have his second half of Congressional testimony today, at the House Financial Services Committee. As a recap to his remarks yesterday, he painted an optimistic picture of the US economy. He noted that “with appropriate monetary policy, the job market will remain strong and inflation will stay near 2 percent over the next several years.” And, “risk of the economy unexpectedly weakening as roughly balanced with the possibility of the economy growing faster than we currently anticipate.” He also affirmed the known policy path and said “the best way forward is to keep gradually raising the federal funds rate.”

Later in the Q&A section, he also talked about the hot topic of flattening yield curve and recession. Powell pointed out that what matters is the yield at the long end as an indication of the so called neutral rate. Right now, 30 year yield is at around 2.96 after hitting as high as 3.247 earlier this year. 10 year yield is at around 2.85 after hitting as high as 3.115.

Regarding US trade policy, Powell didn’t comment directly as expected. It should be reminded that Powell has already made his stance clear before. He doesn’t comment on policies he doesn’t make. And to guard the line of independence of Fed, he has to refrain from commenting on the administration’s policies too. Instead, he takes them as given. Though, he was willing to talk about trade from “principles” perspective. And to him, countries that embraced free trade and low tariffs used to have better results and higher productivity. Countries that have been more protectionist “have done worse”.

GBP/USD Mid-Day Outlook

Daily Pivots: (S1) 1.3036; (P) 1.3152; (R1) 1.3233; More…

GBP/USD drops to as low as 1.3009 so far today. The break of 1.3048 low confirms resumption of whole decline from 1.4376. Intraday bias remains on the downside for 1.2874 fibonacci level next. Sustained break there will carry larger bearish implications. On the upside, above 1.3116 minor resistance will turn intraday bias neutral and bring consolidations first. But recovery should be limited well below 1.3362 resistance to bring fall resumption.

In the bigger picture, whole medium term rebound from 1.1946 (2016 low) should have completed at 1.4376 already, after rejection from 55 month EMA (now at 1.4179). Fall from 1.4376 should extend to 61.8% retracement of 1.1946 (2016 low) to 1.4376 at 1.2874 next. Decisive break of 1.2874 will raise the chance of long term down trend resumption through 1.1946 low. On the upside, break of 1.3471 resistance is needed to be the first indication of medium term bottoming. Otherwise, outlook will remain bearish even in case of strong rebound.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 00:30 | AUD | Westpac Leading Index M/M Jun | 0.00% | -0.22% | ||

| 08:30 | GBP | CPI M/M Jun | 0.00% | 0.20% | 0.40% | |

| 08:30 | GBP | CPI Y/Y Jun | 2.40% | 2.60% | 2.40% | |

| 08:30 | GBP | Core CPI Y/Y Jun | 1.90% | 2.20% | 2.10% | |

| 08:30 | GBP | Retail Price Index M/M Jun | 0.30% | 0.40% | 0.40% | |

| 08:30 | GBP | Retail Price Index Y/Y Jun | 3.40% | 3.50% | 3.30% | |

| 08:30 | GBP | PPI Input M/M Jun | 0.20% | 1.60% | 2.80% | 3.30% |

| 08:30 | GBP | PPI Input Y/Y Jun | 10.00% | 10.10% | 9.20% | 9.60% |

| 08:30 | GBP | PPI Output M/M Jun | 0.30% | 0.20% | 0.40% | 0.50% |

| 08:30 | GBP | PPI Output Core Y/Y Jun | 3.10% | 3.10% | 2.90% | 3.00% |

| 08:30 | GBP | PPI Output M/M Jun | 0.20% | 0.10% | 0.20% | |

| 08:30 | GBP | PPI Output Core Y/Y Jun | 2.10% | 2.30% | 2.10% | |

| 08:30 | GBP | House Price Index Y/Y May | 3.00% | 3.80% | 3.90% | 3.50% |

| 09:00 | EUR | Eurozone CPI M/M Jun | 0.10% | 0.10% | 0.50% | |

| 09:00 | EUR | Eurozone CPI Y/Y Jun F | 2.00% | 2.00% | 2.00% | |

| 09:00 | EUR | Eurozone CPI Core Y/Y Jun F | 0.90% | 1.00% | 1.00% | |

| 12:30 | USD | Housing Starts Jun | 1.17M | 1.32M | 1.35M | 1.34M |

| 12:30 | USD | Building Permits Jun | 1.27M | 1.33M | 1.30M | |

| 14:30 | USD | Crude Oil Inventories | -3.4M | -12.6M | ||

| 18:00 | USD | Federal Reserve Beige Book |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals