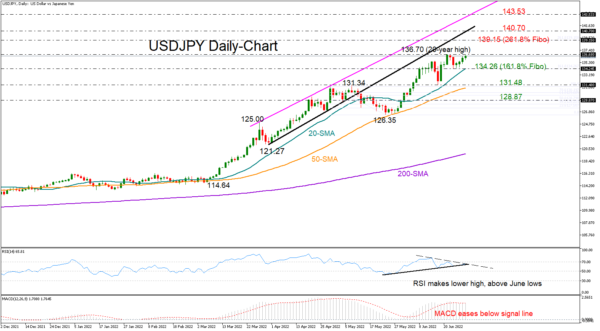

USDJPY Aims for an Uptrend Resumption; Caution Detected

USDJPY managed to gain fresh buying traction around the resistance-turned-support area of 134.42 last week, with the price currently looking to extend its broad uptrend above the 20-year high of 136.70. Although the clear positive slope in the simple moving...

Gold Storms to Fresh Lows as Negative Momentum Strengthens

Gold has been in a sustained downtrend after it failed to cross beyond the 1,857 region. Moreover, in the past few four-hour sessions, the price has dived beneath both 50- and 200-period simple moving averages (SMAs) and is currently battling...

Gold Storms to Fresh Lows as Negative Momentum Strengthens

Gold has been in a sustained downtrend after it failed to cross beyond the 1,857 region. Moreover, in the past few four-hour sessions, the price has dived beneath both 50- and 200-period simple moving averages (SMAs) and is currently battling...

USD/JPY Technical Analysis 29th June 2022

The US Dollar started a fresh increase from well below the 132.00 level against the Japanese Yen. The USD/JPY pair traded above the 134.50 resistance zone to start a fresh surge. The pair even climbed above the 136.00 level and...

AUD/USD: Aussie Remains Capped by 10DMA, Keeping Bearish Bias

The Aussie dollar eases from one-week high on Tuesday after failing to benefit more from positive news that China slashed Covid quarantine for international travelers. The price action fell back below 10DMA (0.6951) which caps the price since June 9...

Yen Selling is Back, Dollar Attempting to Rally

Yen is back as the worst performer on improving risk sentiment and rising yields. Dollar is trying to rally in early US session following rise in treasury yields. But strength is mainly seen against European majors and Yen only. Canadian...

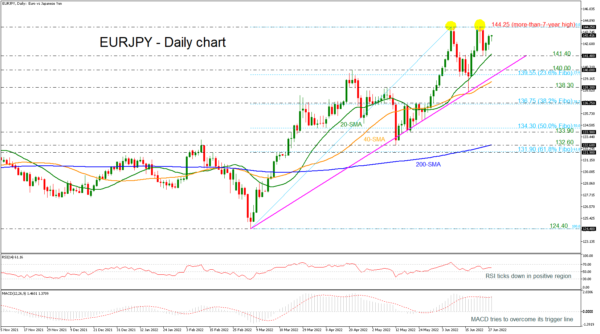

EURJPY Posts Double Top Near 7-Year High

EURJPY has posted a double top around the more-than-seven-year high of 144.25 over the last couple of weeks. The MACD oscillator is extending its positive momentum above its trigger and zero lines; however, the RSI indicator is pointing slightly lower...

SPACs wipe out half of their value as investors lose appetite for risky growth stocks

A trader works on the floor of the New York Stock Exchange (NYSE) in New York, June 16, 2022. Brendan McDermid | Reuters SPACs, once Wall Street’s hottest tickets, have become one of the most hated trades this year. The...

Crude Oil Is Consolidating

On Monday morning, the Brent price is balancing at $113 per barrel The commodity marker remains uncertain – the supply isn’t expanding as quick as it is expected to, and the demand might drop as well. China is cancelling lockdowns...

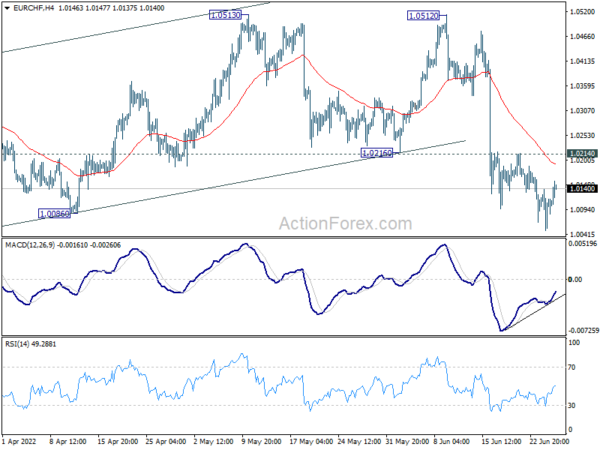

Dollar in Weak Recovery, Swiss Franc Retreats Mildly

Price actions in forex markets are indecisive today. Dollar is trying to rise after better than expected durable goods orders. It’s also support by recovery in treasury yields. But there is no follow through buying. Canadian Dollar is still the...

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals