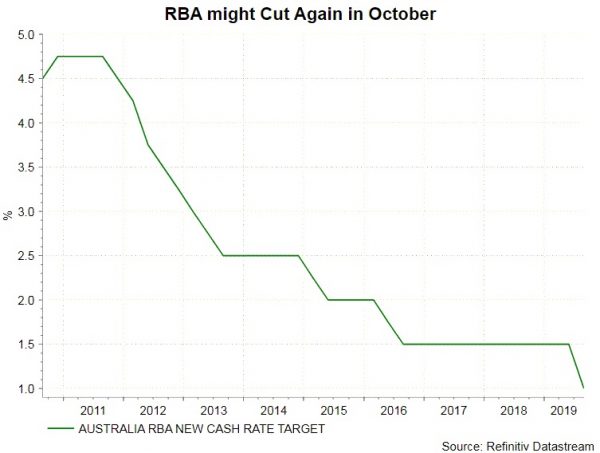

RBA Preview – Staying Put before Further Easing

Although the market generally expects RBA to leave the cash rate unchanged at 1% this week, the chance of a surprise cut is not negligible. Despite mild pickup in confidence after the back-to back rate cuts in June and July,...

BOC Prepares for Insurance Rate Cut

Global economic slowdown, escalations of US- China trade war and further Fed funds rate cut have heightened speculations that BOC would have to lower its policy rate in coming months. We agree on this assessment but expect that the insurance...

FOMC Minutes Explained the Rationale for Precautionary Rate Cut. Further Reduction Likely in Coming Months

The FOMC minutes for the July meeting explained that the key reasons for the rate cut are slowdown in global economic outlook and subdued US inflation. An insurance reduction was needed to prevent these factors from dragging US economy. Yet,...

RBA Minutes Indicates Data- Dependence in Future Policy. Further Rate Cuts Likely Given Limited Decline in Unemployment Rate

RBA’s minutes for the August meeting indicated that future monetary policy action would be data-dependent. While acknowledging some improvements in the economic developments after the two consecutive rate cuts, spare capacity in the labor market remained significant. The country’s unemployment...

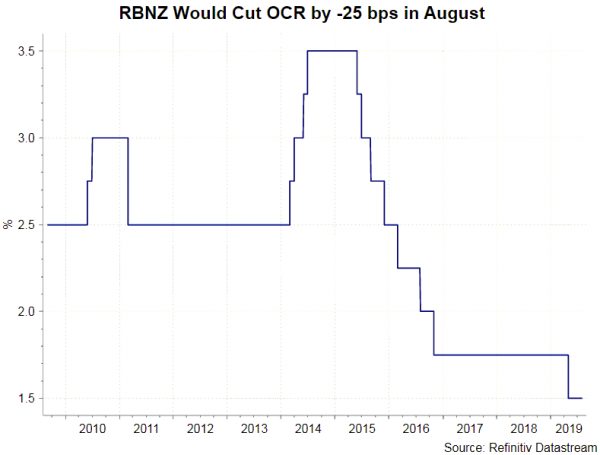

RBNZ Cut Policy Rate by -50 bps, Hinting Negative Interest Rate

RBNZ surprised the market by reducing the OCR, by -50 bps, to 1%. The market had only anticipated a -25 bps cut. The aggressive rate cut is “necessary” to help support employment and inflation in the country as downside risks...

RBNZ Preview – Another Rate Cut is Needed to Boost Inflation and Support Employment

We expect RBNZ to cut the OCR, by -25 bps, to 1.25% in August. Given the disappointment in the inter-meeting data flow, the central bank would likely signal further easing later in the year. Meanwhile, the policy statement might focus...

RBA Preview – Pausing (Not Ending) after Two Consecutive Rate Cuts

Following two consecutive rate cuts, RBA is widely expected to leave the cash rate unchanged at 1% in August. Incoming economic data since the last meeting have also supported the pause. Yet, given the aggressive target in the longer-term unemployment...

FOMC Review – Market Disappointed as Powell Described Rate Cut as “Mid-Cycle Adjustment”

Fed announced to lower the policy rate by -25 bps to 2-2.25% in July. US dollar jumped while Wall Street declined although the decision came in widely anticipated. The market was probably disappointed by the lack of commitment of future...

BOE Preview – Standing On Sideline and Sending More Neutral Bias

We expect BOE to leave the Bank rate unchanged at 0.75% and keep the size of the asset purchase program at 435B pound. Heightened risk of no-deal Brexit, downside risks to economic outlook, market pricing of a rate cut later...

FOMC Preview – Expecting -25 bps Cut From a Divided Fed

We expect the Fed to announce a rate cut of -25 bps, bringing the Fed funds rate target to 2-2.25%, this week. Yet, this decision is unlikely unanimous. Although there has been voice suggesting a deeper cut is needed, we...

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals