ECB Lacks Confidence that Economic Forecasts Could be Achieved. Focus on June for TLTROs Details

Reinforcing the dovish tone, the minutes for April’s ECB meeting exemplified the members’ pessimism over the economic outlook. They were becoming less confident that the baseline scenario of growth can be achieved. As such, the central bank would try to...

FOMC Minutes Reinforced Patience Approach to Monetary Decision

The FOMC minutes for the meeting in May unveiled that the members remained optimistic about the economic outlook. They also viewed that soft inflation was a transitory phenomenon. These resulted in the judgment that “a patient approach” to monetary policy...

RBA Removes Rhetoric of “No Strong Case” for Near-Term Rate Cut

RBA turned more dovish, than what was suggested in the meeting statement, in May. As the minutes revealed, policymakers expected to cut the policy rate if inflation remains weak while the unemployment rate climb higher. The latest economic forecasts, published...

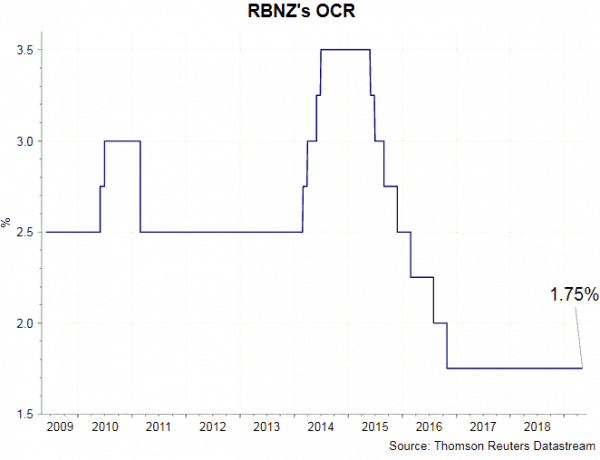

RBNZ Cut Policy Rate to 1.5%, Resuming Rate Cut for the First Time since 2016

For the first time since November 2016, RBNZ lowered the OCR, by +25 bps, to 1.5% in May. At the monetary policy statement, it indicated that “a lower OCR is necessary to support the outlook for employment and inflation consistent...

RBA Left Rate at 1.5%. Pledged to Monitor Job Market

RBA left the cash rate unchanged at 1.5% in May. Yet, the accompanying statement remained dovish, citing sharp deceleration in core inflation, decline in house price and subdued household consumption as key areas of concerns. On the monetary policy outlook,...

RBNZ Preview – Chance of Rate Cut Increases as Job Market and Inflation Disappoint

The market has priced in over 50% chance that the RBNZ would lower the OCR, by -25 bps, to 1.50% in May. Major economic indicators since the last meeting weakened. In particular, disappointing employment report and inflation in the first...

BOE Upgraded GDP Growth Outlook, Warned of Faster- than- Expected Rate Hike Path

BOE voted unanimously to leave the Bank rate unchanged at 0.75% and the asset purchase program at 435B pound. As expected, the central bank delivered a slightly more hawkish tone as Brexit was delayed to October 31, temporarily lowering the...

Fed Judges Weak Inflation as Transitory, Dismissing Rate Cut Chance

FOMC members decided unanimously to keep the target range for the fed funds rate unchanged at 2.25-2.50%. Meanwhile, the IOER was lowered to 2.35% from 2.4%. The slight change in the accompanying statement showed a more upbeat assessment on the...

BOE Preview: Looking Through Strong First Quarter, with Focus on Softer Inflation and Prolonged Brexit Uncertainty

Some positive notes are seen in the first quarter, both domestically and globally. Yet, these are neither sufficient not strong enough to alter BOE’s stance in May, the first monetary policy meeting since Brexit was offered an extension until October...

FOMC Preview -Fed to Reiterate Patience Rhetoric Despite Strong First Quarter Growth, Focus on Soft Inflation

Despite the pleasant surprise in the first quarter GDP growth, the Fed would still leave its policy rate unchanged at the upcoming meeting. The Fed funds rate target is expected to stay at 2.25-2.50%. Its forward guidance would stay unchanged,...

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals