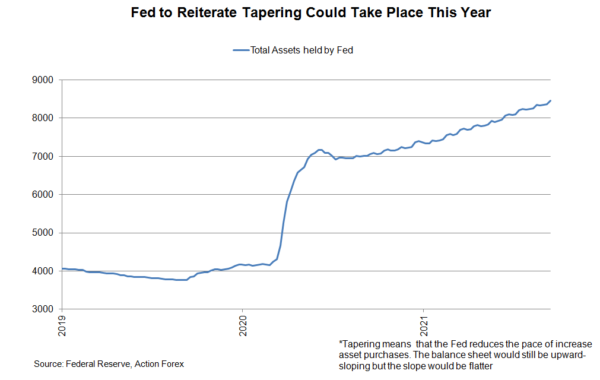

FOMC Preview: Fed to Affirm Tapering Could Come This Year. Focus Turns to Dot Plot

Since the Jackson Hole symposium and the FOMC minutes, the pandemic has worsened in the US, while economic growth appears to be losing steam. These suggest that all monetary policy measures will stay unchanged with asset purchases staying at US$120B...

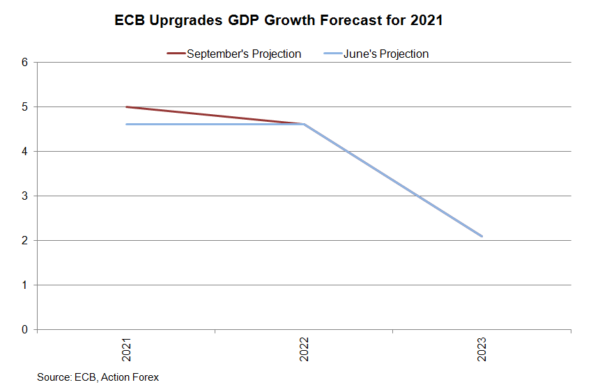

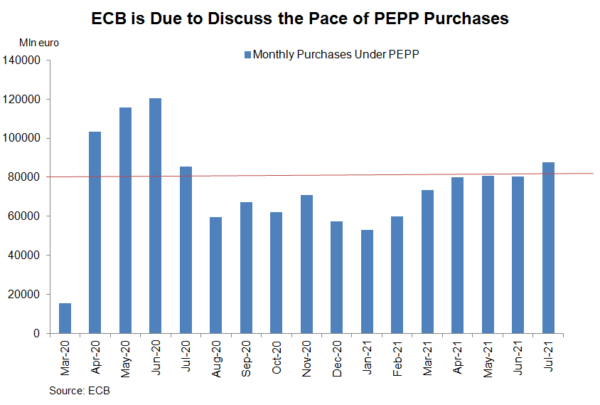

ECB to Slow Asset Purchases via PEPP. Growth and Inflation Outlook Upgraded

Two important messages delivered at the ECB meetings are: 1) the end of the front-loading of PEPP asset purchases and 2) acknowledgement of a more persistent inflation pressure. The policy rates were all kept unchanged with the main refi rate,...

BOC Stood Pat but Delivered Cautiously Optimistic Message

The loonie recovered modestly after the BOC meeting. As widely expected, policymakers left the overnight rate unchanged at 0.25% and QE purchases at CAD 2B/ week. Yet, they remained cautiously optimistic over the medium term economic outlook, despite disappointing GDP...

BOC Preview – QE Tapering to Pause as Economy Contracted in 2Q21

Torn between disappointing economic activities but rising inflation, higher vaccination rate but worsening Delta outbreak, and a federal election just 12 days after this week’s meeting, the BOC will likely stand on the sideline this month. Policymakers will keep its...

RBA Adopts Dovish Tapering as Delta Outbreak Expected to Hurt Growth in 3Q

At the September meeting, the RBA decided to reduce QE asset purchases to AUD 4B/week, from ADU 5B/ week previously. It also left the cash rate, as well as the yield target on the April 2024 bond, unchanged at 0.1%....

ECB Preview – Time to Lower Asset Purchases?

The pace of asset purchases in the Pandemic Emergency Purchase Program (PEPP) in 4Q21 is the focus of this week’s ECB meeting. Following hawkish comments from some council members, especially chief economist Philiip Lane, hopes that an announcement related to...

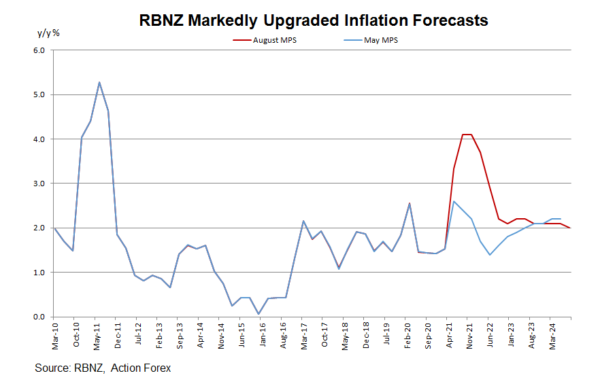

RBNZ Left OCR Unchanged Amidst Latest Lockdown. Hawkishness Maintained

To everyone’s surprise, the RBNZ left the OCR unchanged at 0.25% in August. The decision was made in light of the renewed New Zealand’s lockdown after a report of one coronavirus case. Policymakers, however, maintained a hawkish stance, suggesting that...

RBNZ Preview – Raising Rate as Least Regrets Option

The market has priced in a 25 bps hike, bringing the OCR to 0.5%, at this week’s RBNZ meeting. Much stronger-than-expected economic recovery since the last meeting, the rapidly rising inflation and inflation expectations, and a better job market are...

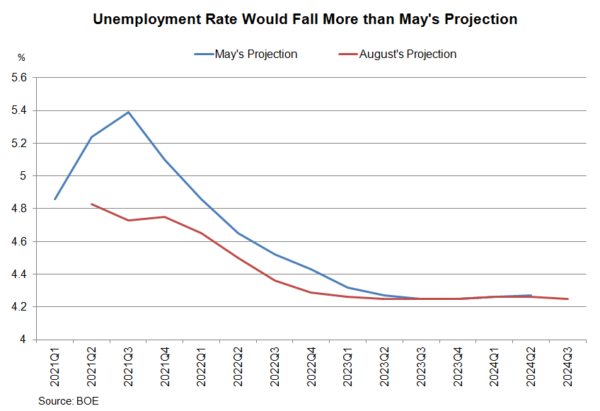

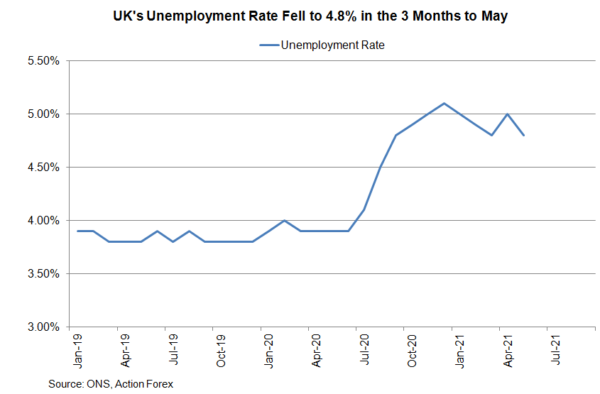

BOE Signals Earlier Unwinding of Balance Sheet. Modest Tightening On the Way

The BOE voted unanimously to keep Bank rate at 0.1%, and 7-1 to leave purchases of government bond at 875B pound. While the latter decision came less hawkish than we had anticipated (we expected 2 dissents), British pound got a...

BOE Preview – Awaiting Signals to Exit

The focus of this week’s BOE is whether the result of the policy review would be revealed. In particular, whether there will be guideline on BOE’s exit sequence of QE and record low policy rate. Meanwhile, economic projections in reflection...

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals