NFP Preview: Reasons for Optimism?

Background After last month’s rather depressing Non-Farm Payroll report, which itself closed out one of the more depressing weeks in US weeks in US history, there are some signs that this month’s jobs report could bring cause for optimism. Most...

Have The Rules Changed For Trading The US Dollar?

Throughout the past several months, a risk rally ordinarily meant a weaker US Dollar. The DXY index, which measures the greenback’s value against a basket of six world currencies, slid 6.7% in 2020 recording its second worst annual performance since...

ADP Impresses, Crude Rally Continues, Gold Stumbles on Strong US Data

US stocks initially pushed higher on big-tech earnings, expectations Senate Democrats will pass Biden’s stimulus plan on a party-line vote, and after the ADP private payroll report shows the labor market rebounded in January. The morning rally fizzled at the...

Eurozone Inflation Jumps In Jan, Italian Politics Remain In Focus

Notes/Observations Italian political situation remains in focus; former ECB chief Draghi said to be the front-runner to form a new govt Major European Services PMI data mixed in session but staying in contraction territory (Beats: Euro Zone, France, Italy and...

Bank Of England: Cautiously Optimistic With Negative Rates Still On The Table

When? Thursday at 12:00 noon followed by Andrew Bailey’s press conference at 12:30 What to watch? The Bank of England is not expected to move on policy when it makes its monetary policy announcement and updates the bank’s quarterly forecasts.The...

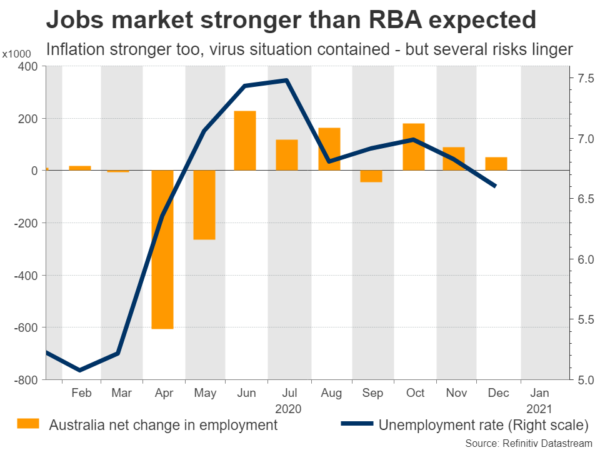

Aussie Dips Lower as RBA Adds QE

The Australian dollar has recorded slight losses on Tuesday. Currently, AUD/USD is trading at 0.7599, down 0.28% on the day. Earlier in the day, the Aussie fell below the 0.76 level for the first time in 2021. RBA extends QE...

China Monetary Tightening? Not so Fast

Summary For the past week or so, the People’s Bank of China (PBoC) seems to have engaged in sporadic operations that effectively tighten monetary policy in China. Pulling liquidity out of China’s financial system has pushed short-term borrowing rates higher,...

Upbeat RBA Could Lift Aussie, But All Eyes on Stocks

The Reserve Bank of Australia (RBA) will wrap up its latest meeting at 03:30 GMT Tuesday. No policy changes are on the menu, so any reaction in the aussie will come down to the signals in the accompanying statement and...

Vaccine Delays Causing Limited EU Critique

Market movers today Today the main mover is the US ISM manufacturing index for January. It has been on a rising path since April but is probably close to a peak as Chinese PMI’s point to a peak in the...

Weekly Economic & Financial Commentary: Loss of Momentum Sets Up Weak Q1

U.S. Review Loss of Momentum Sets Up Weak Q1, but Recovery Pace Contingent on Vaccine Deployment Economic data came in largely as expected this week and suggest continued economic recovery. Real GDP growth advanced at a strong 4% annualized rate...

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals