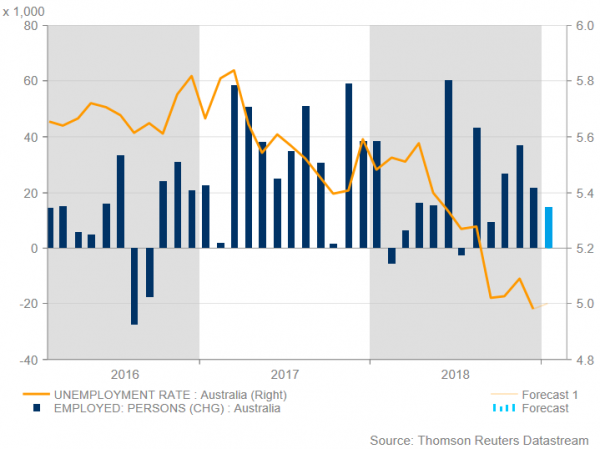

Aussie Retains Bearish View; Employment Report Key to the Australian Outlook

January’s employment report for Australia is likely to attract investor’s attention on Thursday at 0030 GMT as the Australian dollar has been losing some ground over the past week. Stronger figures in employment may provide some relief to the currency. The unemployment rate is...

Currencies: Sentiment Data (ZEW) To Ease Euro Downside Pressure?

Rates: Looking for clues from the ECBUS investors return after the long weekend, but the US eco calendar is razor-thin. EMU investors look for signs of improvement in the forward-looking German ZEW expectations index and for hints on possible future...

Asian Equities Give Up Gains After Reaching A Four-Month High

After a muted session in Europe, and the U.S. markets closed for Presidents’ Day, investors seem to be moved by news flows coming from U.S.- China trade negotiations. Asian stocks were near a four-month high today driven by Chinese and...

British Pound Edges Higher, Investors Eye UK Wage Growth

GBP/USD has lost ground in the Monday session. In North American trade, the pair is trading at 1.2928, up 0.30% on the day. On the release front, British Rightmove HPI improved in February, with a gain of 0.7%. There are...

Japanese Yen Steady as Markets Calm at Start of Week

USD/JPY is showing limited movement in the Monday session. In the North American session, the pair is trading at 110.58, up 0.11% on the day. On the release front, Japanese Core Machinery Orders declined 0.1% in December, above the estimate...

The US Dollar Slightly Weaked

On Friday, the US dollar slightly weakened against a basket of major currencies. The US dollar index (#DX) closed in the negative zone (-0.07%). At the moment, investors are focused on trade relations between the US and China. The next...

EUR/USD – Euro Yawns As Markets Start Week With US Holiday

EUR/USD has ticked higher in the Monday session. Currently, the pair is trading at 1.1308, up 0.12% on the day. It’s a quiet day on the release front. There are no data events out of the eurozone. In the U.S.,...

Weekly Economic and Financial Commentary: More Subdued Data from the Global Economy

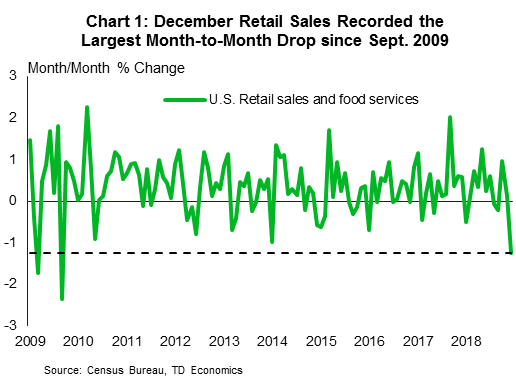

U.S. Review Retail Sales Go Rogue Energy prices weighed on both headline CPI and PPI. The January CPI was unchanged, while PPI fell 0.1%. Core measures were more firm, rising 0.3% and 0.2%, respectively. Retail sales unexpectedly plunged 1.2% during...

The Weekly Bottom Line: Wall of Uncertainty

U.S. Highlights December retail sales came in significantly weaker than expected, falling 1.2% m/m, with the decline being broad-based. Consumption in Q4 is now tracking around 2.6% annualized – softer than expected, but still a pretty good showing. The retail...

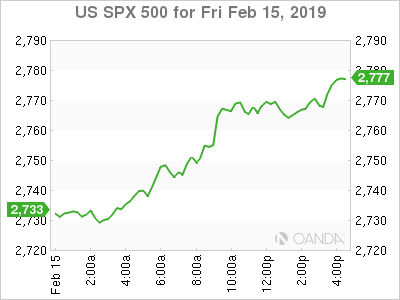

Stocks Surge on Optimism US-China Trade War Nearing An End

The global equity rally continues to be bolstered by optimism that the trade war could finally see a framework agreement. The US also avoided a second government shutdown as President Trump accepted the deal lawmakers worked on, only to declare...

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals