The Weekly Bottom Line: Accelerating Wages Lag Behind Moderating Home Prices

U.S. Highlights The U.S. labor market continues to impress – churning out jobs like nobody’s business (+250k), keeping the unemployment rate near record lows (3.7%), drawing people into the labor force (participation rate up +0.2 percentage points), and pushing up...

Week Ahead: US Midterms, Three Central Banks and More Earnings

As another volatile week is about to conclude, equity markets were coming under a bit of pressure and were giving back a big chunk of their gains from earlier in the week. In large part, this was due to a...

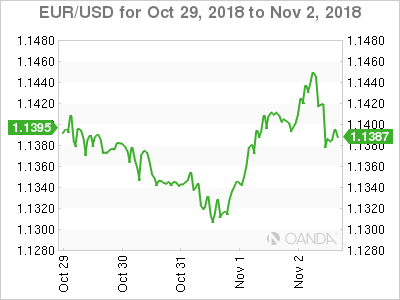

Strong Fundamentals Boost Dollar with US Midterms in Focus

The dollar is higher against major pairs on Friday after the release of the October U.S. non farm payrolls (NFP) report showed a massive 250,000 jobs gain and the fastest wage growth pace since 2009. US fundamentals have been solid...

How the US Midterm Elections Could Impact the Dollar and Equities

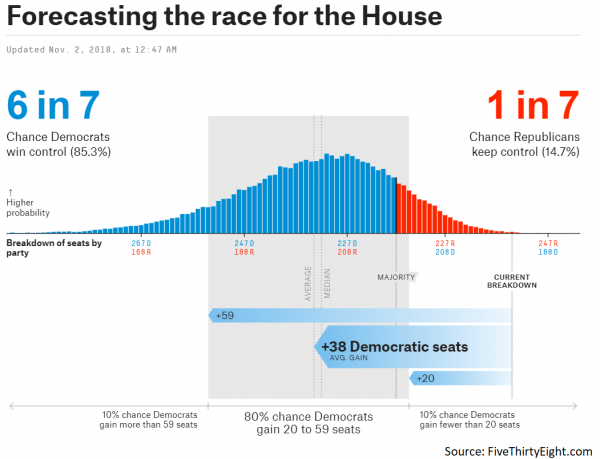

The US midterm elections next week are widely expected to produce a split Congress. Investors appear somewhat complacent on the outcome, which allows room for notable market reactions in case of a surprise, like one of the parties taking control...

US-China Trade: 60% Chance of Ceasefire at Xi-Trump Meeting

Key points Trump signals he may be ready for a trade war ceasefire at the Xi- Trump meeting on 1 December. This is positive for markets and the global economy, as it reduces the probability of a very negative scenario...

Week Ahead – Fed Meets Amid Stock Market Wobble; US Midterms and UK Q3 GDP also in Spotlight

The Federal Reserve will be holding its first monetary policy meeting next week since US and global stocks posted a sharp corrective move from record highs. Investors will be looking for some sign from the Fed that it’s paying attention...

Australia & New Zealand Weekly: RBA Will Stick to Positive Forecasts but Risks are Mounting

Week beginning 5 November 2018 RBA will stick to positive forecasts but risks are mounting. RBA: policy meeting, Statement on Monetary Policy. Australia: housing finance. NZ: RBNZ policy meeting, employment, wages, inflation expectations. China: trade balance, foreign reserves, CPI. Europe:...

Weekly Focus: Global Slowdown

Market Movers ahead The US mid-term elections will attract a lot of attention but are unlikely to lead to any changes in economic policy. The FOMC meeting is a small one and we do not expect any policy or signal...

Canada: October Sees a Few More Jobs

On net, 11.2k more Canadians were at work in October. Fewer of us were looking for work, helping send the unemployment rate a tick lower to 5.8% Continuing the see-saw pattern of late, full-time employment was in the driver’s seat,...

Revisions Move Canada’s Trade Calance to Deficit

Canada posted a surprise -$0.42 billion trade deficit in September, defying expectations for a $0.2 billion surplus. This follows a revised -$0.55 billion deficit in August (previously reported as a $0.53 billion surplus). The narrowing of the deficit in September...

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals