How Much More Is the Fed Likely to Tighten?

We use an analytical framework we recently developed to inform our view of Fed policy going forward. We look for the FOMC to raise rates another 125 bps before it cuts rates at the end of 2020. Is Fed Policy...

A New Framework for Estimating the Optimal Policy Interest Rate

Executive Summary A primary tool of monetary policy is the federal funds rate (FFR), which is the rate at which banks lend reserves to each other and functions as a key benchmark interest rate. The Federal Open Market Committee (FOMC),...

Channel One’s Confidence

Channel one’s confidence USDJPY and Emerging markets traded with a more positive tone overnight, although EM is hardly out of the weeds just yet, as US equity markets ignored a shaky start to finish higher on the day led by...

Canadian August Housing Starts Moderate

Highlights: August housing starts unexpectedly dropped 2.3% in the month to an annualized 201.0k from 205.8k in July. Market expectations had been a rebound in August starts to 216.3k largely premised on indications of still very robust housing permits data....

Canada Housing Starts Unexpectedly Drop in August

Canadian housing starts dipped to 201.0k (annualized) units in August, down 2.3% from July’s 205.8k level. The pace disappointed forecasts calling for an increase to 216k. On a longer-term six month moving average basis, starts edged slightly lower to 215k....

GBP/JPY Carving Out a Bottom?

This morning saw European equity indices fall sharply with the DAX hitting a new multi-month low, before bouncing back noticeably. Risk assets were once again hit amid rising trade tensions. This followed reports that China is asking the Wold Trade...

Week Ahead: Volatility Should Remain Elevated

It is going to be a busy week in the markets, particularly for the pound with the upcoming release of key UK economic data, BoE’s rate decision and perhaps more importantly Brexit-related headlines. As my US colleague Matt Weller highlighted...

Another Brexit Bounce

Another Brexit bounce Global investors were encouraged by a breakthrough on the European political landscape when reports suggested the European Union chief Brexit negotiator Barnier has been given enormous latitude to get Brexit signed and even stated he expects a...

GBP/USD Back Above 1.30 as Barnier says Brexit Deal “Realistic” in 6-8 Weeks

Sometimes, it’s best to keep the analysis simple. As the informal “deadline” for a Brexit deal draws nearer, sterling is becoming more attuned to headlines about the likelihood and structure of a deal. The UK’s relationship with its peers in...

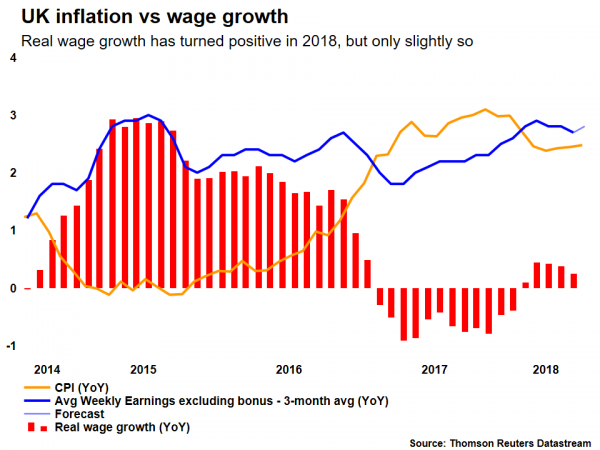

UK Employment Report Due as Sterling Attempts a Rebound

The British pound saw a recovery in recent days, aided by a more conciliatory tone by the EU on Brexit. While political and Brexit developments will remain front and center, having the capacity to spur sharp and unexpected movements in...

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals