The Weekly Bottom Line: Things Are Slowly Getting Back to Normal

U.S. Highlights GDP growth slowed to 2.0% quarter-over-quarter (annualized) in the third quarter of this year, down from 6.7% in the second quarter. The shift in the composition of consumer spending away from goods and into services signals some long-awaited...

Week Ahead: The Fed and the BOE Take the Hotseat; OPEC+ and Non-Farm Payrolls

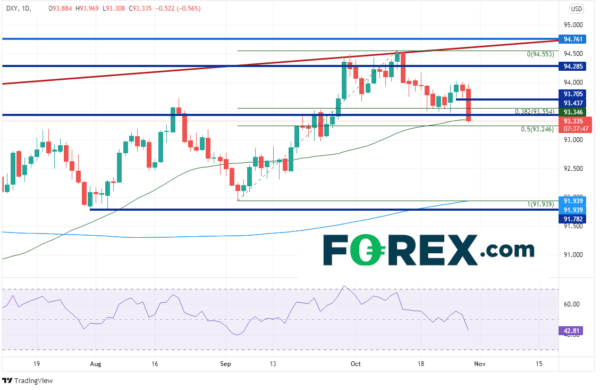

Last week, central banks and earnings were all the rage. The Bank of Canada surprised that markets by ending its QE program and moving forward its forecast for interest rate increases. The ECB told markets that inflation is everywhere, but...

Week Ahead – Interest Rates Are Rising

Fed and BoE to fight back against high inflation Central banks have provided unprecedented amounts of stimulus over the last decade and took that to another level during the pandemic as the world went into lockdown. Now the pandemic has...

Inflation, Inflation, Inflation

As inflation data continues to remain excessively high in the around the world, central banks are struggling to justify that a majority of the inflation is transitory Although Christine Lagarde seemed to mince words at yesterday’s ECB press conference following...

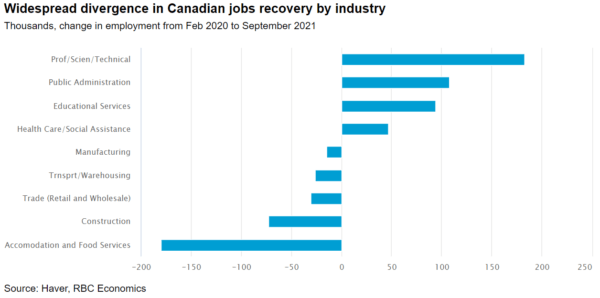

Forward Guidance: Canada’s Labour Market Data in Focus after BoC Shift

The Canadian jobs recovery is expected to continue in October, with a 50k increase expected to build on the 157k jump in September. The number of workers receiving regular employment insurance payments has fallen sharply, by about 600k by our...

Aussie Vulnerable As RBA Could Fight Markets

The Reserve Bank of Australia (RBA) will complete its latest meeting at 03:30 GMT Tuesday. It will be quite explosive as there is a massive discrepancy between the central bank’s own guidance and market pricing for rate increases. The RBA...

US Q3 GDP Much Worse Than Q2. But Will It Continue?

The Advanced look at Q3 GDP for the US was only 2% vs 6.7% in Q2. And although economists expected the economy to slow to 2.7% due to supply chain issues and the Delta variant of the coronavirus, the headline...

Euro Edges Higher after ECB Meeting

The euro is showing little movement after the ECB policy meeting. Currently, EUR/USD is trading at 1.1634, up 0.27% on the day. ECB policy meeting a non-event Many central banks are currently in a tightening cycle, notably the Federal Reserve...

Bank of Canada Ends Quantitative Easing Program

The Bank of Canada surprised markets today by reducing its bond purchase program from $C2 billion per week to C$0, ending its Quantitative Easing Program. Expectations were that the BOC would cut bond purchases in half, by lowering them to...

BoC Ends QE, Advances Rate Hike Timing

BoC switching to reinvestment phase of QE Economic slack to be absorbed around mid-2022 Guidance puts April rate hike on the table Strong inflation data and growing concerns about the persistence of price pressures intensified focus on today’s Bank of...

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals