Canadian Dollar Retreats Ahead Of The BOC Interest Rate Decision

The relentless rally of US equities continued in the overnight session as investors remained optimistic about the earnings season. The S&P 500 soared to a record high of $4,570 while the Dow Jones rose to more than $35,742. Some of...

ECB Could Play Some Defense

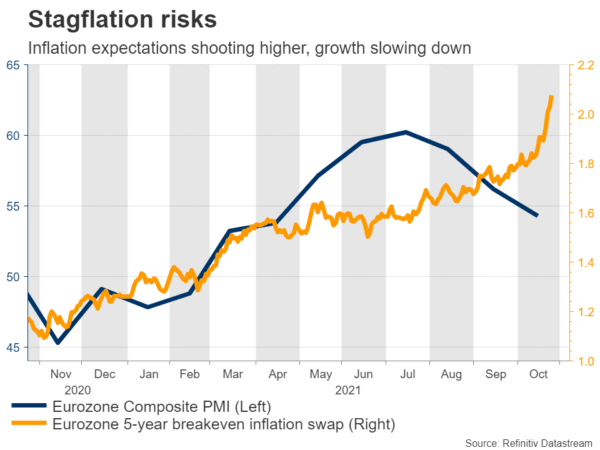

The European Central Bank (ECB) will wrap up its latest meeting at 11:45 GMT Thursday. Markets are pricing in the first rate increase for next year, which seems premature as the region continues to grapple with growth risks. The ECB...

Corporate Earnings In Focus

ActionForex.com was set up back in 2004 with the aim to provide insightful analysis to forex traders, serving the trading community for over a decade. Empowering the individual traders was, is, and will always be our motto going forward. Contact...

Japanese Yen Calm

The Japanese yen is drifting in the Monday session. Currently, USD/JPY is trading at 113.66, up 0.10% on the day. Yen rebounds with a winning week The yen has looked weak against the US dollar recently, and I for one...

Calm Day ahead of Busy Week; Oil around $85

US futures near new highs; Facebook releases its earnings Today’s economic calendar is light, but the rest of the week promises to be very interesting, with central bank meetings in the Eurozone, Canada, and Japan, as well as earnings reports from...

Week Ahead: Central Banks Return, Political Drama and BIG Earnings

Without many catalysts for the markets over the last few weeks, potential market moving events will return in force this week! After a few weeks out of the limelight for major central banks, the BOC, BOJ, and ECB meet to...

Mexico’s Inflation Continues to Rise Despite Interest Rate Increases USD/MXN

At Mexico’s last central bank meeting on September 30th , Banxico hiked interest rates from 4.5% to 4.75% and said that the recent rise in inflation is transitory (like so many other central banks around the globe). They also stated...

The Weekly Bottom Line: Inflation Keeps on Persisting

U.S. Highlights Inflation remained top of mind this week as economic indicators offered little evidence of moderation in supply-side disruptions. The bond market continued to reassess the path of monetary policy, pulling its expectations for the first rate hike forward...

Weekly Economic & Financial Commentary: Economic Disruption in China & U.K. CPI Fueling BoE Rate Hike Bets

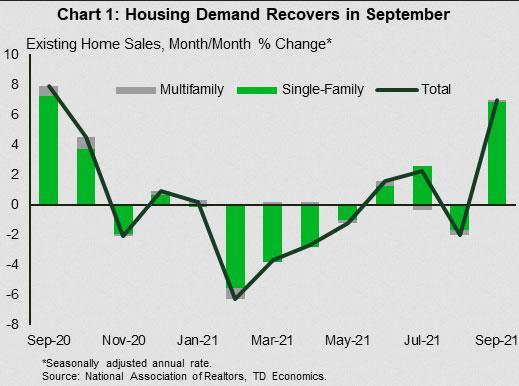

Summary United States: Snarled Supply Chains Stymie Production Supply chain snags continue to bedevil the factory sector. Industrial production fell 1.3% in September. Tangled value chains are worsening building material shortages and hampering new home construction. During September, housing starts...

Week Ahead – Between a Rock and a Hard Place

Inflation is a growing concern For years central banks have been operating under the assumption that inflation will eventually return to target while having the flexibility to wait until the economy is fully ready for higher rates. That luxury is...

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals