The Weekly Bottom Line: Higher Inflation On The Horizon

U.S. Highlights Consumer price inflation accelerated to 5.0% year-on-year (y/y) in May, once again coming in ahead of expectations. Soaring prices for used cars and trucks (up 30% y/y) were a major factor in higher inflation in the month. Job...

Week Ahead: Is it Time for the Fed to Start Talking about Tapering?

After the BOC and the ECB provided markets with little new information regarding their bond buying programs at their respective interest rate decision meetings last week, the FOMC gets its turn this week. With higher inflation and weaker than expected...

FOMC Meeting Preview: Will the Fed Fret about Inflation?

Traders often discuss central bank “decisions” as a major event risk, but when it comes to Wednesday’s Federal Reserve meeting, there’s really no immediate decision to be made. The FOMC will almost certainly leave interest rates unchanged in the 0.00%-0.25%...

UK and Australian Jobs Reports Could Spur GBP/AUD

On June 4th, both the US and Canada released their May jobs figures. The US added 559,000 jobs to the economy vs an expectation of 650,000 and Canada lost 68,000 vs an estimate of -20,000. Both weaker than expected. This...

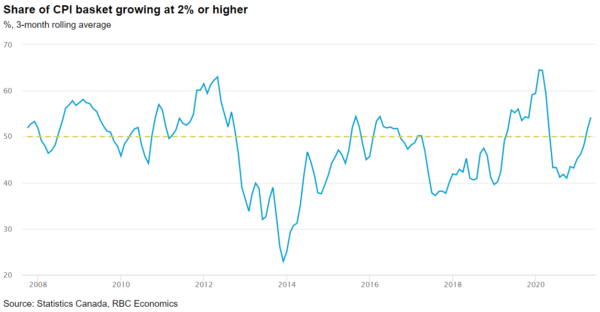

Forward Guidance: Canadian Inflation Pressures Holding Steady ahead of Economy’s Re-Opening

We expect next week’s inflation report to show the headline rate held firm at 3.4% in May—matching April’s rise. This would mark the strongest back-to-back increases in a decade, although the jump is off of an exceptionally low base set...

British Pound Quiet on Mixed Data

The British pound is slightly lower in the Friday session. The pair is currently trading at 1.4157, down 0.13% on the day. UK GDP rises The UK economy continues to forge ahead. GDP for April climbed 2.3% MoM, up from...

Hot US Inflation Data Injects Some Life into Markets

Investors who have been craving for some volatility this afternoon had their wishes fulfilled following the May inflation report that showed prices rising in the United States at their fastest rate since 2008. The consumer price index (CPI) jumped to...

The Bank of Canada Maintains Monetary Policy Stance

ActionForex.com was set up back in 2004 with the aim to provide insightful analysis to forex traders, serving the trading community for over a decade. Empowering the individual traders was, is, and will always be our motto going forward. Contact...

Oil In Search Of A Bears’ Pain Threshold

The stock and currency markets have been weak since the beginning of the week, with little major reason to move in any direction. Active players on stock and FX markets pause to assess the situation, but Oil continues climbing. Over...

Japanese Yen Edges Lower on GDP Decline

The Japanese yen is slightly higher in Tuesday trade. In the North American session, USD/JPY is trading at 109.47, up 0.20%. The week started with a data dump out of Japan. The highlight was GDP for the first quarter, which...

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals