Yen, Swiss and Dollar Rise as Risk Aversion Comes Back after FOMC

Yen, Swiss Franc and Dollar strengthen generally today as risk appetite is having a setback after dovish FOMC announcement overnight. While NASDAQ continued to defy gravity and extended the record run, DOW and S&P 500 closed mildly lower. Asian markets...

More Signs of Dollar Weakness as Fed Awaited

Stock markets are generally mixed today as NASDAQ seems unstoppable. But other indices, in Asia, Europe and even US look sluggish. OECD noted the equal probability of having a second wave of coronavirus spread or not. But that’s largely ignored...

Dollar Softens ahead of FOMC, Fed to Release New Economic Projections

Dollar is back under pressure against and focus turns to FOMC meeting. NASDAQ managed to break 10k level for the first time, and closed up 0.29% at 9953. But DOW and S&P 500 ended lower. Mixed trading in stocks carry...

Risk Markets Setting Stage for Pullback, But To Be Confirmed

Yen and Swiss Franc rise broadly today as global stock markets look set for a pull back after recent strong run. Major European indices are trading generally in red while US futures point to a lower open. On the other...

Yen Firm after Strong Rebound, Ignore Stocks Rally

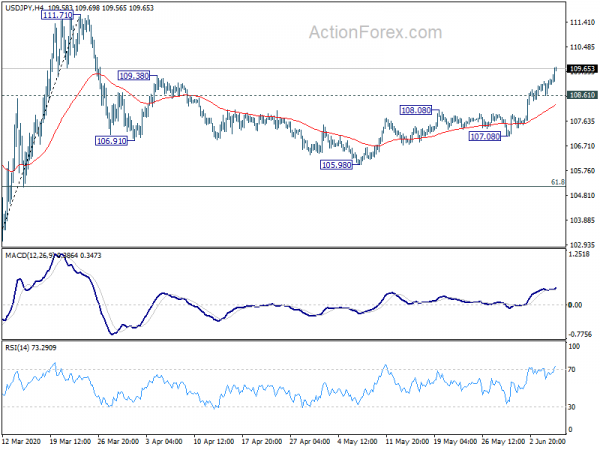

Yen surges broadly this week and remains generally firm in Asian session. Pull back in treasury yield is seen as a factor driving the Yen higher. Yet, the lack of selling in Yen despite strong risk appetite, with NASDAQ extending...

Yen Recovers While Yields Retreat, Dollar Softens

The forex markets are rather consolidative today as traders are waiting for the next direction. European and Asian stock display some mild strength but that is far from being impressive. US futures are also mixed as NASDAQ might has a...

Risk Rally Pauses in Asia, Forex Markets Await Next Move

Asian markets are relatively quiet as another week starts. There is no follow through from Friday’s strong rally in the US. Trade data from China released over the weekend also provide little inspirations. There is also practically no reaction to...

Investors in Euphoria, Betting on a V-Shaped Recovery

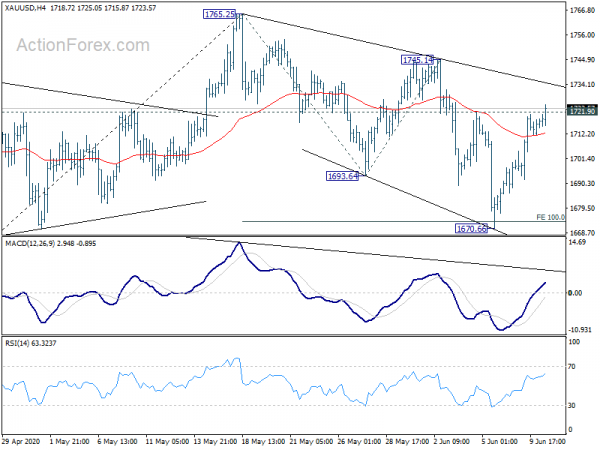

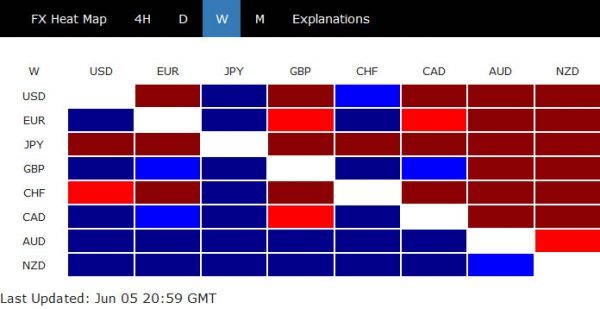

The global financial markets were basically in euphoria last week. Lockdown restrictions continued to be eased. ECB provided more stimulus by expanding the crisis purchase program. Surprised growth in US and Canadian employment in May argue that the worst of...

Dollar Trying a Rebound as NFP Grew in May, Yen and Franc Weaken

Dollar attempts to rebound after non-farm payroll employment unexpectedly rebounded while unemployment rate fell. But strength is mainly centered against Yen, Swiss Franc, and to a lesser extent Euro. Commodity currencies continue to be the strongest ones, together with Sterling....

Dollar Stays Weak as Risk Takes a Breather, NFP Unlikely to Rescue

Dollar and Yen remain the overwhelmingly weakest ones for the week even though risk appetite seems to be taking a breather again. In particular, the greenback suffered steep selling after Euro bulls cheered ECB’s PEPP expansion. The common currency is...

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals