Aussie Rebounds on Strong Job Growth, Sterling Awaits BoE

Australian Dollar recovers broadly today on stronger than expected job data. Though, upside is limited so far as unemployment rate remains a long way from RBA’s rate of full employment. New Zealand Dollar is also among the strongest following better...

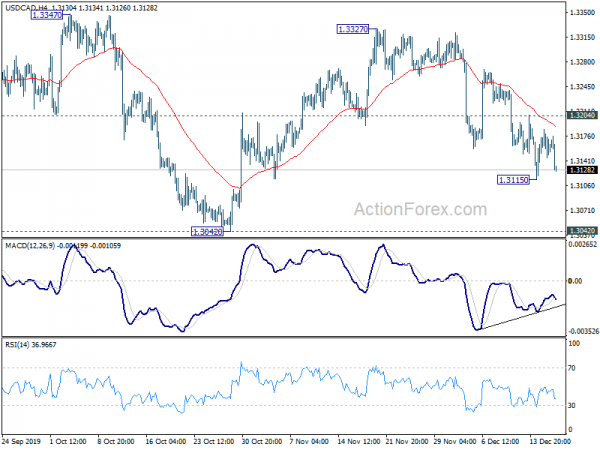

Canadian Dollar Supported by CPI and Oil Price, European Majors Weak

Canadian Dollar is trading as the strongest one for today, as helped by resilience in oil price and solid consumer inflation data. Dollar is currently following closely as the second strongest. On the other hand, European majors are the weakest...

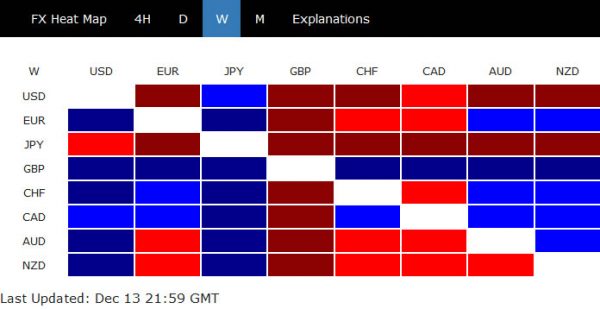

Dollar and Yen Mildly Higher, Sterling Weak ahead of CPI

Dollar and Yen trade mildly higher in Asian session as markets turned into mild risk avers mode. Sterling remains the weakest one on concern of another Brexit cliff-edge at the end of transition period. The Pound will face another test...

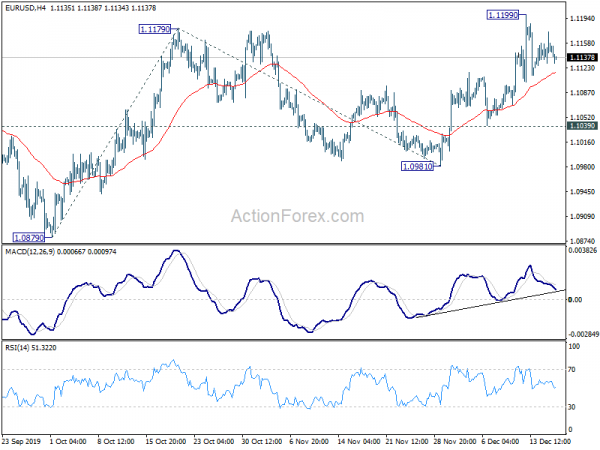

Euro and Swiss Lifted by Pull Back in Sterling, Dollar Mixed

Sterling’s pull back extends deeper today on renewed Brexit concern. Setting a hard deadline of December 2020 for trade negotiations UK and EU could create another Brexit cliff-edge. Meanwhile, Australian and New Zealand Dollars follow the Pound as next weakest,...

Sterling Extends Retreat on Johnson’s New Brexit Move, Aussie Soft on RBA

Trading in the forex markets continue to be relative quiet today. Sterling is mildly softer as consolidations continues. It’s weighed down slightly by Boris Johnson’s move to block transition period extension. Australian Dollar is the second weakest after RBA minutes...

Investors Shrug Poor Eurozone and UK Data, Risk Appetite Continues

Commodity currencies are general higher today, with the help from risk appetite in European markets, and US futures. Poor Eurozone and UK data are largely shrugged off by investors. Canadian Dollar is so far the strongest, additionally supported by mild...

Risk Appetite Takes a Back Seat, Sterling to Face More Event Risks Ahead

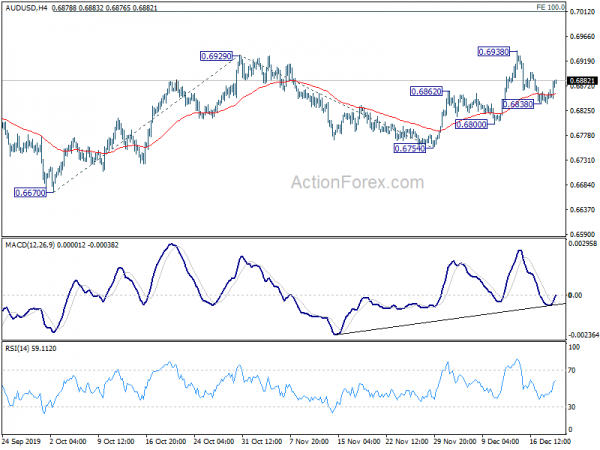

Risk appetite is taking a back seat for now as investors are not too satisfied with the tiny tariff rollback in the US-China phase one trade deal. Better than expected economic data from China also provide little inspiration. Australian Dollar...

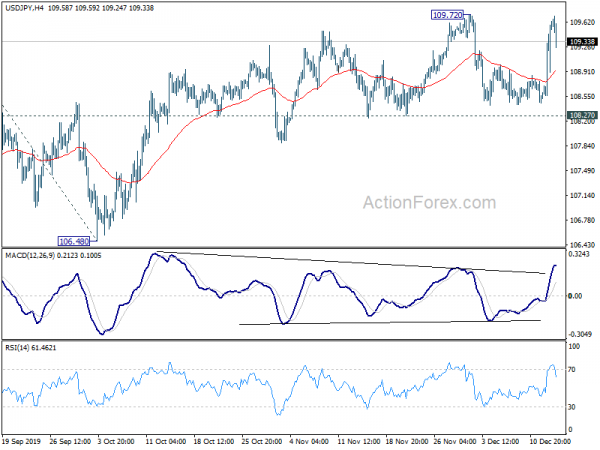

Dissatisfied With Tiny US-China Tariff Rollbacks, Risk Appetite Might Struggle to Push Forward

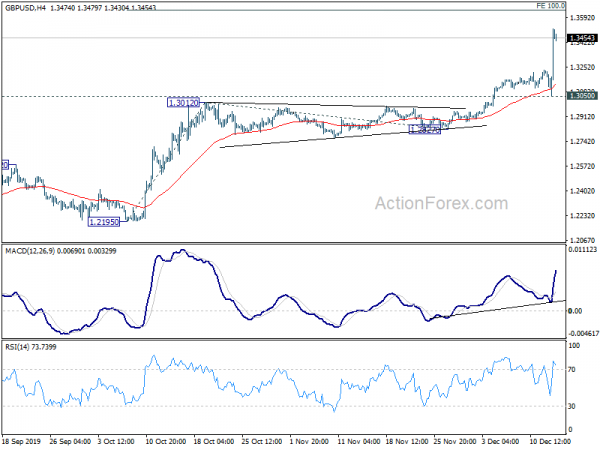

The markets were rocked by three key events last week, UK Election, US-China trade deal and FOMC rate decision. Sterling ended as the strongest one last week as boosted by the Conservative’s landslide victory in UK election, removing a large...

US-China Tariffs Rollback in Question, Sterling Firm on Brexit Certainty

Sterling remains undoubtedly the strongest one for today, and the week, cheering Conservative’s landslide victory in UK elections. Boris Johnson pledged that “we will get Brexit done on time by the 31st of January, no ifs, no buts, no maybes.”...

Markets in Ecstasy on UK Election and US-China Trade Deal

Sterling strengthens broadly today as an important hurdle for Brexit is cleared with Conservative’s landslide victory in the UK election. Yen and Swiss Franc are broadly pressured on return of risk appetite, helped also by completion of US-China trade deal...

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals