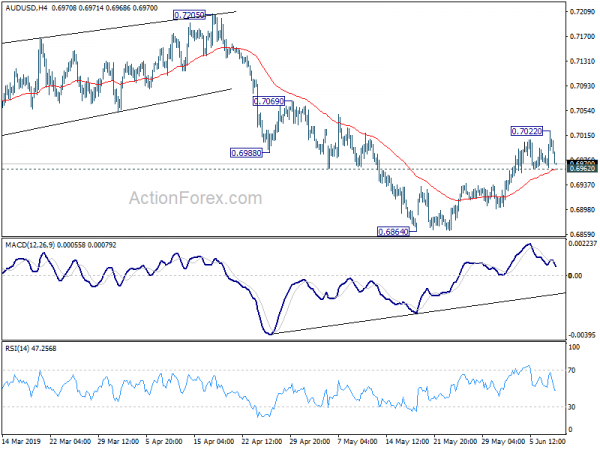

Australian Dollar Pressured Despite Improvement in Risk Appetite

US stocks closed generally higher overnight even though the rally looks a bit stretched. Positive sentiments continue in Asian session today. Yen is naturally one of the weakest on risk appetite. But Australian and New Zealand Dollar are also among...

Sterling Tumbles on GDP Contraction and Weak Manufacturing Outlook

Sterling trades broadly lower today after data showed unexpected GDP contraction in April. More importantly, the deterioration in manufacturing after Brexit stockpiling appeared to be much worse than expected. Other survey data indicated little recovery momentum in Q2 so far,...

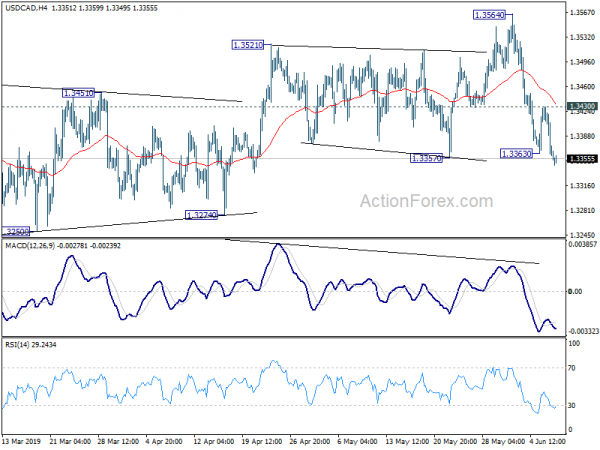

Dollar Recovers on US-Mexico Deal, Aussie Weighed Down by China Imports

Dollar recovers broadly today while stocks markets rebound. Threat of US-Mexico trade war vanished after Trump announced to suspend indefinitely the plan to impose tariffs on all Mexican imports. An agreement was made between the US and Mexico on migration...

Dollar in Steep Decline… Before Trump Drops Mexico Tariffs

Dollar weakness was the main theme over the whole week. It started with worries over Trump’s tariff threats to Mexico. Then Fed officials came out acknowledging the risks from Trump’s tariff policies and signaled their openness to rate cuts should...

Dollar and Yield Tumble as Poor NFP Affirms Fed’s Rate Cut

Dollar tumbles sharply in early as poor non-farm payroll report affirms the case for Fed rate cut this year. The headline number of 75k is a big miss. Equally importantly, weaker than expected wage growth argues that inflation pressure could...

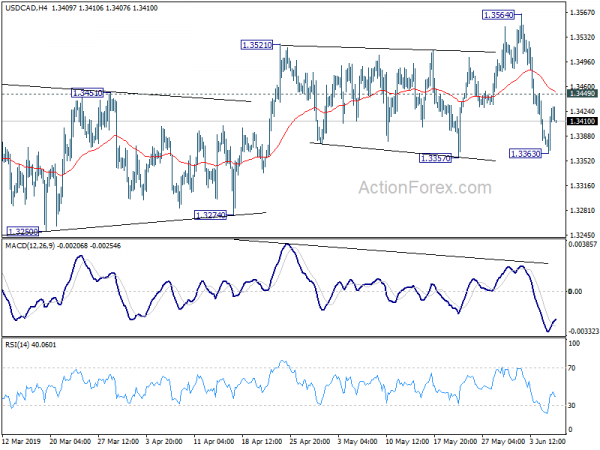

Dollar Recovers ahead of Job Data, But More Downside Still in Favor

Dollar recovers mildly today, continuing to stabilize from this week’s selloff. The greenback is staying in range established earlier except versus Canadian. There is some optimism on the outcome of US-Mexico negotiations. Or at least, tariffs won’t go up to...

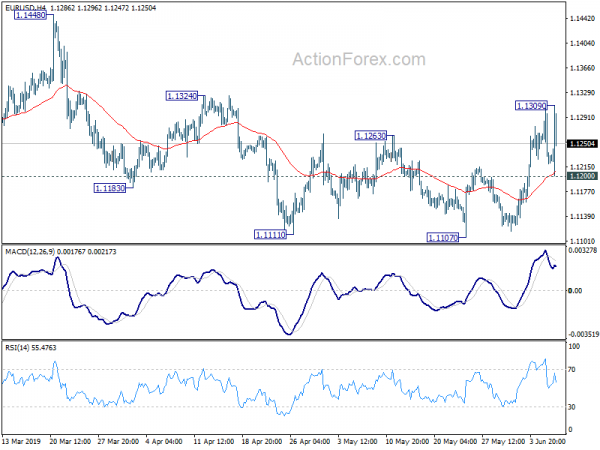

Euro in Range after Rough Ride on ECB’s Not Dovish Enough Meeting

It’s a roller coaster ride for Euro. It initially dipped after ECB said there will be no rate hike at least through mid 2020. Then it recovered and breaks yesterday’s higher against Dollar as the press conference and new economic...

Dollar Recovered From Overly Bearish Sentiments as Focus Turns to ECB

Dollar tried to stage a reversal overnight after initial selloff, but upside is so far limited and there is no confirmation of bottoming yet. There are a couple of factors behind the move. Post ADP employment decline was largely undone...

Dollar Selloff Extends on Poor ADP Job, Yields Dive Again

Dollar suffers another round off selloff after terribly poor ADP job data, which showed only 27k growth in May. 10-year yield also takes a steep dive breaching Monday’s low at 2.081. Gold breaks 1344 and is on track to take...

Dollar in Deep Selloff as Markets Price in 90% Chance of Fed Cut by September

Talks of Fed rate cut intensified overnight after comments from Fed Chair Jerome Powell. Markets are now even pricing in 90% of a cut by September FOMC meeting. US stocks rebounded strongly with DOW closed up 512.40 pts or 2.06%....

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals