WhatsApp pours fuel on Metro Bank’s PR fire

On Thursday lunchtime I decided to take a break from my editorial deliberations and have a stroll down to St Paul’s Cathedral to clear my head. As I was waiting to cross the road at the traffic lights a group...

Uber’s IPO collides with reality as stock slumps

Is there a point in every successful investment banker’s career when they lose touch with reality? Probably when they start making serious money. Young financial journalists talk to and sometimes befriend traders, analysts and bankers their own age or a...

Taiwan’s stellar returns attract higher levels of risk

Taiwan has outperformed expectations this year. The local dollar has strengthened, government bond yields have hit record lows and equities have been on a roll, pumped up by plentiful capital inflows. Mainly this reflects the fact Taiwan has benefited enormously...

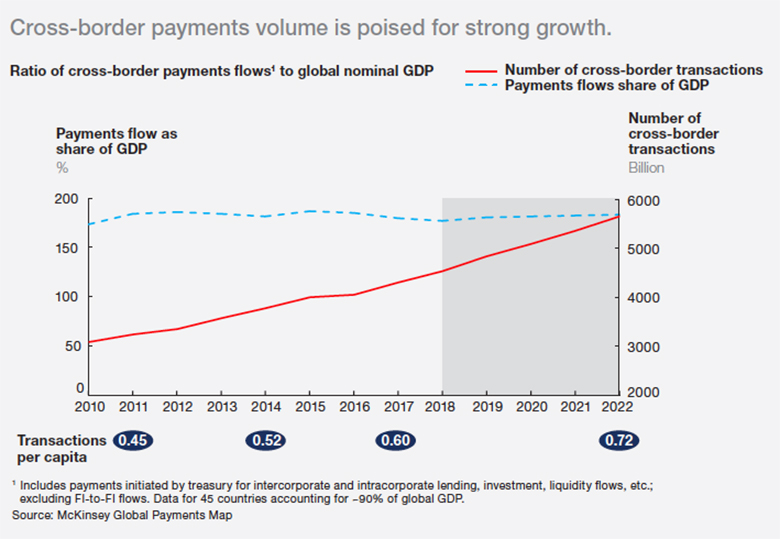

Cross-border instant payments could be one step closer

As the frequency of cross-border payments continues to rise, cross-border instant payments will slowly gain traction, given corporates’ need to quickly settle international payments in a global arena, says Andy Schmidt, vice president, global financial services at technology consulting firm...

Analysts prepare to downgrade Brazil as the heat rises

A fire burns a tract of Amazon jungle in Machadinho d’Oeste, Rondônia state, Brazil Brazil’s country risk score remained largely stable through the first half of 2019, according to Euromoney’s risk survey. The country even moved up one place in...

Deutsche Bank Wealth Management – a dark horse?

At the end of 2018, DBWM had $243 billion under management – about one-10th the amount at UBS. Indeed, it might be tempting to write the business off as a basketcase, given the constant turmoil at Deutsche Bank more broadly...

Money-laundering scandals spark new risk retrenchment

Ever since the 2008 financial crisis, US financial misconduct fines have led the world. However, defenders of Europe’s more collegiate approach to tackling banks’ money-laundering shortcomings say US banks also lead the world for de-risking, shunning some of the globe’s...

What they said about CIB in 2Q19: a guide to bank results

Most of the corporate and investment banking (CIB) earnings commentary from banks this quarter was on their markets businesses, rather than debt and equity capital markets (DCM and ECM). The latter were mostly a little weaker than the previous year....

Alternative remedies scheme boosts supply of SME lending at the wrong moment

At the end of June, UK Finance, the trade body of the UK banking industry, unveiled a survey of 18,000 small and medium-sized enterprises, which produced the happy finding that most are succeeding in accessing finance from banks, with 80% of...

Country risk: Jamaica’s surge continues

Sunnier times: Investors have their eyes on Jamaica Jamaica’s risk score has continued to rise in Euromoney’s crowd-sourcing survey this year, extending a five-year trend that has pushed the country three places higher in the global risk rankings, to 107th...

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals