AUD/USD Analysis: Recovery Touches 0.7250 Level

On Tuesday, the rate conducted another decline to the September low and December high-level zone at 0.7170/0.7185, before starting a sharp recovery. By 16:00 GMT, the rate had already touched the 0.7250 level. The 0.7250 mark caused a minor decline,...

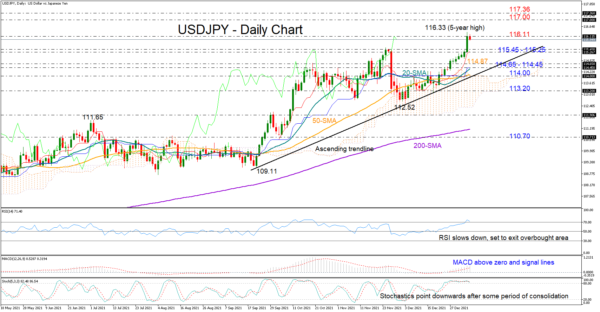

USDJPY Looks Overbought after Sharp Ascent; Bullish Overall

USDJPY resumed its broad positive trend after the bulls drove aggressively to a five-year high of 116.33 on Tuesday, marking seven consecutive days of gains. Despite the fast ascent, the pair could not close above the 116.11 limitation taken from late 2016...

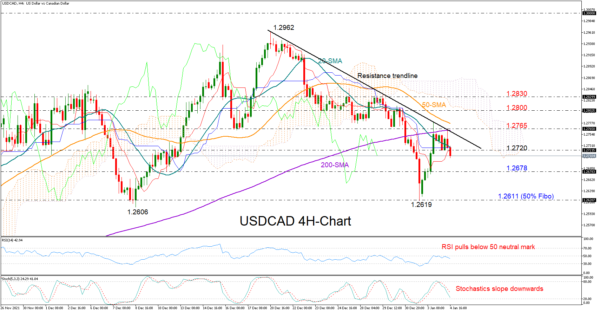

USDCAD Gives Up Rally Near Familiar Resistance

USDCAD swiftly bounced back to the 1.2700 territory after almost touching December’s low of 1.2606 last week, but the descending trendline drawn from the top of 1.2962 managed to put the brakes to the rally once again. The area around...

New! Intraday Market Analysis – US dollar Recoups Losses

NZDUSD breaks support The New Zealand dollar tumbles against its US counterpart amid soaring Treasury yields. The pair is looking to consolidate its recent gains after it rallied above the 30-day moving average (0.6820). The December high at 0.6860 is...

Technical Outlook and Review

DXY: On the H4, prices are on bearish momentum and abiding to our descending trendline. We see the potential for a dip from our 1st resistance at 95.927 in line with 23.6% Fibonacci retracement and 38.2% Fibonacci retracement towards our...

Market Morning Briefing: Dollar-Yen Has Paused Below 115

STOCKS Dow and Dax have risen sharply today and can test 37000 and 16200 on the upside respectively. Nikkei and Shanghai have come down, but have supports at current levels which if holds can produce a bounce towards 29500 &...

Elliott Wave View: Natural Gas (NG) Near The End Of Correction

Elliott Wave View in Natural Gas (NG) suggests it is correcting cycle from June 22, 2020 low in larger degree 3, 7, or 11 swing. The decline is unfolding as a flat elliott wave structure. Down from October 6, 2021...

WTI Futures’ Rally Stalls Above 77 Mark

WTI oil futures have stretched towards 77.35 and are sitting above the 50-day simple moving average (SMA) at 75.71 after an upward surge from around the 66.00 mark. The positive incline in the SMAs has faded recently. However, they have...

AUDUSD Downside Risks Linger Despite Latest Climb

AUDUSD buyers are in the process of trying to extend the ascent from the 13-month low of 0.6992 beyond the falling 50- and 100-day simple moving averages (SMAs). Nevertheless, the bearish SMAs are demonstrating that the directional trend remains skewed...

US Oil Seeks Support

WTI crude rallied after the EIA report showed a larger-than-expected fall in US inventories. The bulls are looking to hold onto their recent gains after they cleared the 30-day moving average and daily resistance at 73.20. 79.00 from November’s sharp...

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals