GBPJPY Falters Around 158 Level But Upside Still Intact

GBPJPY is consolidating across the 156.00 mark that is the upper part of a support barrier moulded by the highs reached at the end of May until the later part of June. The simple moving averages are sponsoring the positive...

USDCAD Is On The Sidelines But Indicators Suggest Bullish Action

USDCAD has been moving sideways over the last few days, remaining above the 1.2285 support and below the simple moving averages (SMAs). Technically, the MACD oscillator is jumping above its trigger line, holding well below the zero level, while the...

EURJPY Points To More Losses Ahead Of ECB Policy Meeting

EURJPY entered a downhill race following the peak at a four-month high of 133.47 in the four-hour chart, correcting below its shorter-term simple moving averages (SMA) and more recently below the Ichimoku cloud, which kept the bears under control on...

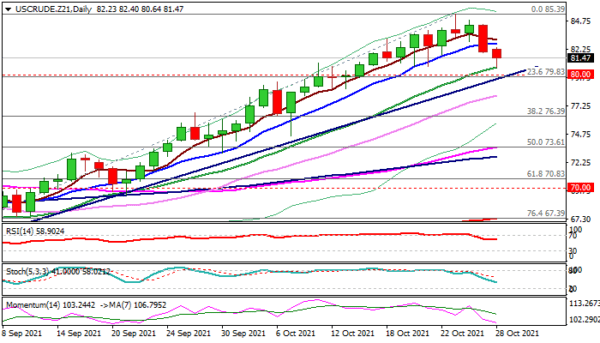

WTI Oil Outlook: Oil Risks Deeper Pullback On Surprise Build Of Inventories

The WTI oil extends weakness on Thursday and hit two-week low, following Wednesday’s 2.8% drop (the biggest one-day loss since Aug 4). Oil prices came under increased pressure on surprise rise of US crude inventories last week (4.26 mln bls...

USD/CAD Breaks Channel Pattern

Downside risks dominated the USD/CAD currency pair on Wednesday. As a result, the US Dollar fell by 114 pips or 0.92% against the Canadian Dollar during Wednesday’s trading session. Given that a breakout has occurred, bears could continue to drive...

GBPJPY Sellers Struggle to Amplify Price Pullback

GBPJPY is currently finding its feet around a support barrier shaped between the 156.00 handle and the highs reached in late May and early June. Even though the 100- and 200-period simple moving averages (SMAs) are defending the positive structure,...

Gold Eases After Failing To Hold Gains Above $1800, Weighed By Expectations For Start Of Reducing Stimulus And Rate Hike

Spot Gold eases after repeated failure to sustain gains above psychological $1800 barrier, with rising expectations that the US Federal Reserve could finally announce the start of reducing stimulus in its Nov 3 policy meeting and market participants operating with...

Elliott Wave View: Nasdaq (NQ) Should Continue Higher

Nasdaq Futures (NQ) breaks to a new all time high above the previous peak on September 7, 2021 at 15708.75. This suggests that buyers remain in control and the next leg higher has started. Short term Elliott Wave view suggests...

EUR/AUD False Breakout Possible: If The Price Doesn’t Break W L4

EUR/AUD technical analysis The market is still bearish. The break of 1.5440 will mark the continuation. Selling the rallies is possible. Order block zone. Breakout. Order block 2. Downside target. Descending Trendline. The price is still in downtrend. There are...

EURJPY Buyers Resurface At 23.6% Fibonacci At 132

EURJPY’s minor pullback is finding its feet at the 132.00 handle, that being the 23.6% Fibonacci retracement of the up leg from 125.08 until 134.12, after its latest rally that began at 128.32 lost steam just shy of the 133.47-134.12...

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals