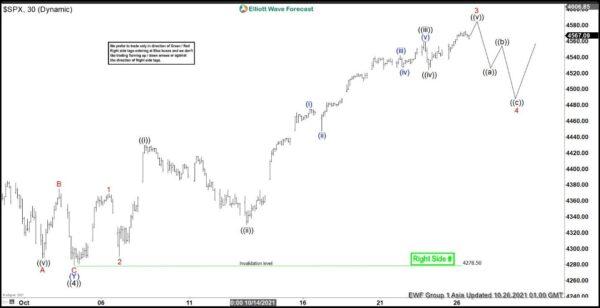

Elliott Wave View: S&P 500 Futures Breaking To New High

In larger degree context, the rally from October 1, 2021 low in S&P 500 Futures (ES) is unfolding as a 5 waves impulse Elliott Wave structure. Up from October 1 low, wave 1 ended at 4365.75 and pullback in wave...

Risk Attitude Pushes Euro to Strengthen

Early in the new week of October, EUR/USD is looking good and trading at 1.1660. the factor that supports the European currency is the global risk attitude. So far, the US Fed hasn’t given any signals of the QE programme...

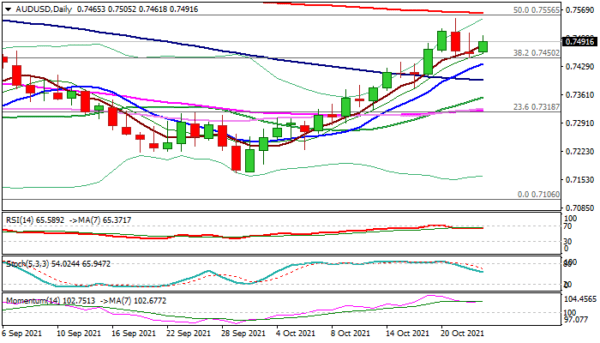

AUD/USD Outlook: Aussie Rises On Higher Metal’s Prices

The Australian dollar bounces on Monday after last week’s two-day pullback from new multi-week high (0.7546), inflated by fresh rise in metal’s prices. Bulls regained traction after shallow dip but face headwinds from good offers at 0.7500 zone that caps...

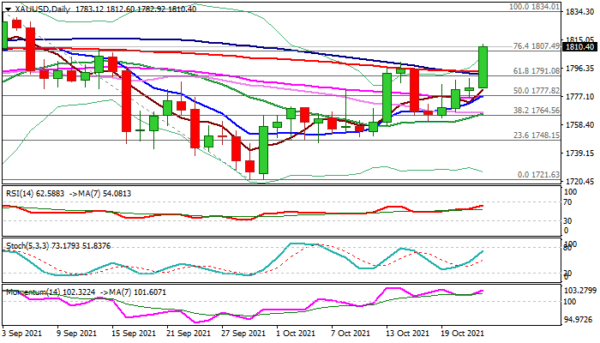

XAU/USD Outlook: Gold Surges above $1800 on Weaker Dollar and Rising Inflation Expectations

Spot gold surged to the highest levels in 1 –1/2 months on Friday, lifted by a weaker dollar and a pick-up in inflation expectations, while the rally accelerated after taking out barriers at $1791/93 (Fibo 61.8% of $1834/$1721/200DMA) and psychological...

CAD/CHF Could Edge Lower

The Canadian Dollar has surged by 1.81% against the Swiss Franc since October 8. The currency pair tested the resistance level at 0.7492 during this week’s trading sessions. Technical indicators suggest selling signals on the 4H time-frame chart. Most likely,...

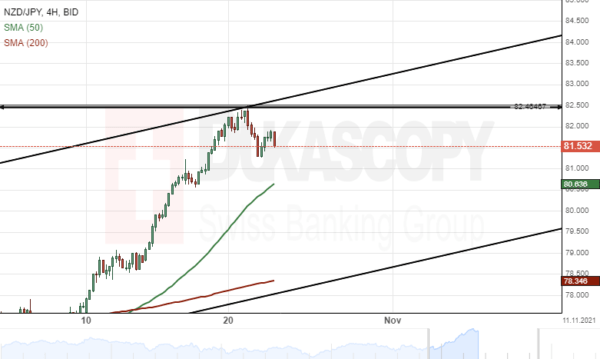

NZD/JPY Likely To Make A Pullback

Upside risks have been dominating the NZD/JPY currency pair since the beginning of October. The New Zealand Dollar has edged higher by 7.23% against the Japanese Yen during this period. All things being equal, the exchange rate is likely to...

EUR/USD Finds Support In 1.1620

The support zone of the last week’s high and this week low levels kept the EUR/USD from declining. Namely, on Thursday, the rate found support in 1.1620 and started a recovery. By the middle of the day’s European trading hours,...

GBP/USD Breaks Triangle Pattern

As explained on Thursday, all triangle patterns are eventually broken. The ascending triangle of the GBP/USD was broken to the downside. However, the sharp break out was stopped by the 100-hour simple moving average at the 1.3780 level. Afterwards, the...

WTI Oil Outlook: Bulls Are Taking A Breather Under New 7-Year High

The WTI oil is consolidating under new seven-year high, as bulls slowed on cooling demand over easing gas and coal prices and a forecast for mild winter in the US but is on track for the seventh consecutive bullish weekly...

Gold Inverted Head And Shoulders – As The Market Is Pushing Higher

The price is bullish. Last week we witnessed buying the dips scenario. Bulls are trying to push the price further up and so far they have been successful. The potential move is higher but the price needs to break above...

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals