USD/JPY: Dollar Edges Higher But Still Holding Within a Triangle

The USDJPY regained traction on Tuesday and resumed the upleg from Aug 11 trough (131.73). Fresh bullish acceleration broke through important Fibo barrier at 133.83 (38.2% of 139.39/130.39) and pressuring the triangle resistance trendline (134.37). Break of these obstacles would...

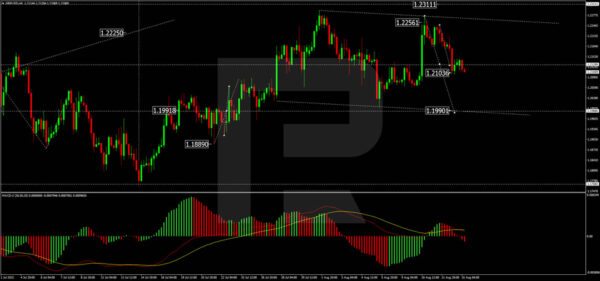

The Pound Is Losing Momentum

The Pound Sterling continues to fall against the USD on Monday; the instrument is mostly trading at 1.2117. First of all, the Pound got under significant pressure from the USD, which has pretty much improved recently. Secondly, statistics published by...

AUD/USD Pair Started a Steady Increase from $0.6920

The Aussie Dollar started a steady increase from the 0.6920 zone against the US Dollar. The AUD/USD pair was able to move above the 0.7000 resistance zone. It surged above the 0.7050 level and the 50 hourly simple moving average....

Natural Gas Futures Tick Higher as Bullish Forces Linger

Natural gas futures (September 2022 delivery) have drifted higher again after their recent downside correction faltered. Even though the latest spike seems to have encountered resistance at the upper Bollinger band, the commodity continues to retain a bullish near-term picture. The...

USDJPY Resumes Rebound but 50-day SMA Caps Advance

USDJPY has been gaining some ground in the short-term after its latest decline came to a halt at the 130.40 region. However, the recent price recovery has been repeatedly held down by the ascending 50-day simple moving average (SMA). The momentum...

NZDJPY Wave Analysis

NZDJPY broke resistance level 84.70 Likely to rise to resistance level 86.40 NZDJPY today broke the resistance level 84.70 (top of the earlier Shooting Star from the start of this month) intersecting with the 681% Fibonacci correction of the downward...

Technical Tuesday: Silver, Nasdaq and EUR/USD

Welcome to Technical Tuesday, a weekly report where we highlight some of the most interesting markets that will hopefully appease technical analysts and traders alike. In this week’s edition, we are getting technical on silver and the gold-silver ratio; Nasdaq...

Silver and Palladium Broke Up. Will Gold Follow?

The precious metals are recapturing critical levels one after another, claiming a reversal to the upside after a two-year bearish trend. Silver made quite a move up on Monday, gaining over 4%. Palladium closed the day up 5.3%, and at...

Brent is Stressed and Continues to Decline

The commodity market suffered another stress last week. On Monday, the situation reached stability, but it remains quite complicated; Brent is trading at $95.60. The asset closed last trading week near its 5-month lows. The key reason for these negative...

S&P500: Bear Market Rally or Return to Growth?

The S&P500 is at 4150, having returned to the rebound highs of late May. The direction of the breakout outside the 4100-4200 range will determine its future for the next days or weeks. In mid-June, the S&P500 halted its correction...

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals