Market Morning Briefing: Pound Has Bounced From 1.3640

STOCKS Short selling continues in the equities globally as most indices break immediate supports and look bearish for the next few sessions. Dow and Dax have broken below 34000 and 15400 respectively and can head towards 33500-33000 and 15000-14800. Nikkei...

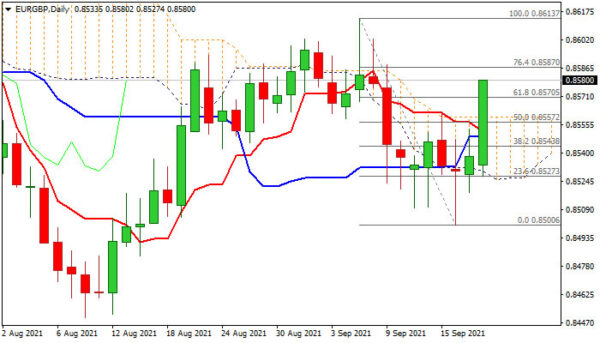

EURGBP – Strong Bullish Signal is Developing Following a Break Above Daily Cloud

The cross rose over 0.5% on Monday and hit 8-day high, on a biggest one-day rally in one month. Sterling, as more risk-sensitive currency than the euro, reacted negatively on strong risk aversion that pushed global equities sharply lower. Today’s...

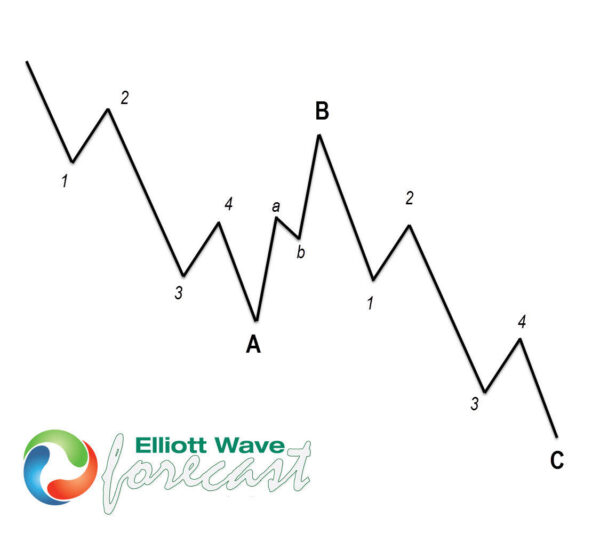

USD/CHF Elliott Wave Analysis – Seems Bullish above 0.9240

USDCHF is breaking sharply higher after it found a support at 0.9163, the second higher swing low that makes a rising trendline connected from end of wave B. As such, we are observing now motive structure for wave C which...

Market Morning Briefing: Aussie Has Fallen Too And Can Test 0.72

STOCKS There seems to be short selling on the equities ahead of the FOMC due this week. Need to be careful on the equities breaking below immediate supports. Dow and Dax have crucial support near 34500 and 15400 which needs...

Gold Price Is Bearish As Short Traders Break Below 1765 Support

GOLD has made a breakout of 1765 lows. We should see a move lower on a1765 zone retest. The 1765-70 zone could be good for new short trades. The bearish momentum in the market persists as the price is getting...

GBPJPY Flickers Green In A Directionless Market

GBPJPY is mostly edging sideways and has recently found some footing off the 150.96 level, this being the 23.6% Fibonacci retracement of the up leg from 134.39 to 156.06. The flattening out of the 50- and 100-day simple moving averages...

GBP/AUD Found Buyers After Elliott Wave Zig Zag

Hello fellow traders. In this technical blog we’re going to take a quick look at the Elliott Wave charts of GBPAUD, published in members area of the website. As our members know, we’ve been calling rally in the Forex Pair. The pair made pull...

Swiss Market Index (SMI) Developing A Motive Wave From March 2020

The Swiss Market Index (SMI) is one of the other Capital Markets worldwide that is building motive wave from the lows of March 2020. We can clearly see that it has already completed 3 waves to the upside and we...

EUR/USD Pair Is Now Attempting A Recovery From The 1.1750 Low

The Euro started a fresh decline from well above 1.1820 against the US Dollar. The EUR/USD pair traded below the 1.1800 and 1.1780 support levels. The pair even declined below the 1.1765 zone and settled below the 50 hourly simple...

USDCAD Fails To Gain Optimism For Bullish Bias In Short-Term

USDCAD has been trading back and forth the 20-day simple moving average (SMA) over the last month, failing to improve the bullish view in the short-term. The pair rebounded off the six-year low of 1.2012 and is creating higher highs...

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals