WTI Futures Plunge But Broader Upside Risks Still In Force

WTI oil futures are trying to create a foothold at the Ichimoku cloud’s lower surface around 67.52. The aggressive loss of ground from the 74.00 mark’s vicinity over the past three days, may be somewhat attributed to rising concerns that...

US Oil Heads Towards Daily Support

WTI crude fell as US inventory rose by 3.6M barrels last week. The bearish MA cross on the daily chart could be the start of consolidation for the days to come. The fall below 71.80 is an indication that sentiment...

German Bund Yields Fall Below -0.50; Highly Correlated with EUR/JPY in Short-Term

The current correlation coefficient between German Bund Yields and EUR/JPY on a 240-minute timeframe is +0.94! There has been a lot of talk lately about the drop in US 10-year yields, moving from 1.7742 on March 30th, down to today’s...

Bitcoin – Patience to Pay Off?

Or pullback a cause for concern? Should we be concerned that the bitcoin has stalled just as it appeared poised to take off? Bitcoin has pulled back in recent days, with the price falling from around $41,000 to roughly $37,500....

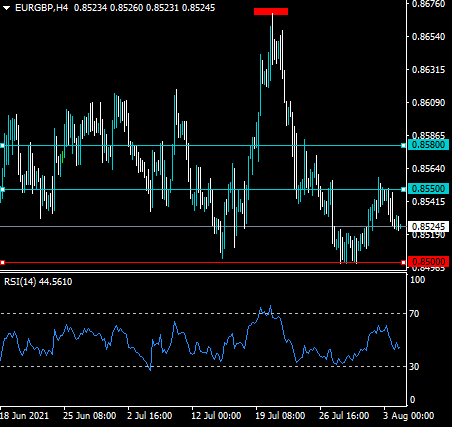

EURGBP Heavily Bearish

Technical analysis The EURGBP has formed a large head and shoulders pattern on the four-hour time frame, with the pair trading close to the neckline of the bearish price pattern. According to the RSI indicator the trend on the four-hour...

EURJPY Rebounds But Downside Risks Remain In Force

EURJPY is drifting across the 129.61 level, which happens to be the 50.0% Fibonacci retracement of the up leg from 125.08 until 134.12, after the bearish correction bounced off the 200-day simple moving average (SMA). The 200-day SMA is defending...

GBP/NZD Bearish Continuation Possible

The GBP/NZD is bearish and sellers are taking over. The angle of a drop and retracement is diverging, hinting at a bearish move. I am already short and have protected more than 350 pips. You can clearly see my shorting...

Market Morning Briefing: Pound Has Bounced A Bit From 1.3873

STOCKS Equities look mixed within their broad sideways range. As mentioned yesterday, a fresh trigger looks likely to be needed to see an upside breakout of the range that we have been expecting. Else a fall within the range is...

AUDUSD Consolidates Below 0.74 But Buyers Intensify

AUDUSD is currently pushing above the 50-period simple moving averages (SMAs) and the flattening Ichimoku lines at 0.7364. The falling 200- and 100-period SMAs are endorsing a negative price trajectory, while the slight uptick in the 50-period SMA is reflecting...

Euro Still Holds a Strong Position

The major currency pair is stable at the beginning of August, growing slightly. EURUSD is rising to 1.1870. The dollar is still coping with the negative influence of the comments by the Fed’s head Jerome Powell. Last week, he stated...

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals