A Guide to GDP and Forex Trading

GDP (Gross Domestic Product) economic data is deemed highly significant in the forex market. GDP figures are used as an indicator by fundamentalists to gauge the overall healthand potential growth of a country.Consequently, greater volatility in the forex market is...

How to Combine Fundamental and Technical Analysis

Fundamental and technical analysis can complement one another Fundamental and technical analysis can be combined to provide a holistic trading strategy. Traders often compare the differences between fundamental and technical analysis, however blending the two can have positive benefits. Although...

Trading the 24-Hour Forex Market

The 24-hour forex market: Main talking points The Forex Market trades 24 hours a day, five days a week. The greatest amount of volatility happens during market open overlap. Forex traders can enter and exit trades at any time during...

Trading the Tokyo Session: A Guide for Forex Traders

The Asian trading session is one of the best time of day to trade forex, as explained in the DailyFX Traits of Successful Traders series. Also known as the Tokyo session, the Asian trading session is often overlooked as it...

Intermarket Analysis with All Star Charts Founder JC Parets | Podcast

Key points covered in this podcast – Simplifying your approach and removing less useful indicators – Why there are really only four outcomes of a trade – The power of intermarket analysis JC Parets is an accomplished and highly respected...

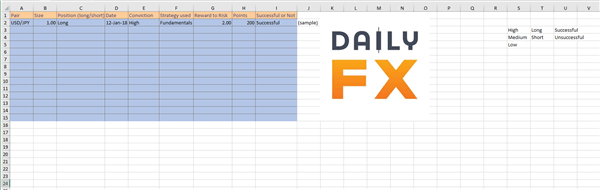

Forex Trading Journals: A How-To and other Forex Trading Tips

A forex trading journal is a log of your trades that can help you refine your strategies based on learning from previous experiences. Just as a business owner tracks inventory, a trader should also keep up with their closed positions....

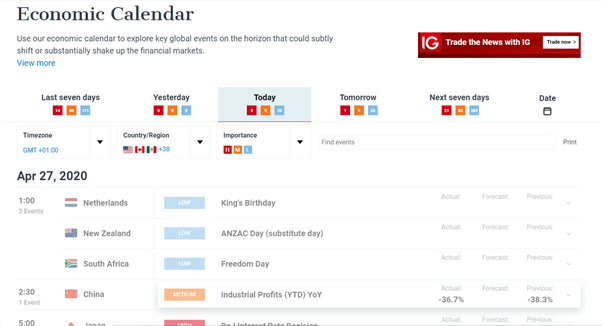

How to Read a Forex Economic Calendar

A forex economic calendar is useful for traders to learn about upcoming news events that can shape their fundamental analysis. This piece will explore the economic calendar in depth, offering tips on how to read a forex economic calendar to plan...

The CPI and Forex: How CPI Data Affects Currency Prices

In this article, we’ll explore CPI and forex trading, looking at what traders should know about the Consumer Price Index to make informed decisions. We’ll cover what CPI is as a concept, the CPI release dates, how to interpret CPI,...

How to use the PPI in Forex Trading

Using PPI to trade forex: Talking points PPI stands for the Producer Price Index, which is an important piece of economic data PPI data is released during the second week of each month. Forex traders can use PPI as a...

Trading the London Session: Guide for Forex Traders

The London trading session accounts for around 35% of total average forex turnover*, the largest amount relative to its peers. The London forex session also overlaps with the New York session throughout the year. Key talking points in this article:...

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals