Becoming a Better Trader – Maximizing Breakout and Pullback Strategies

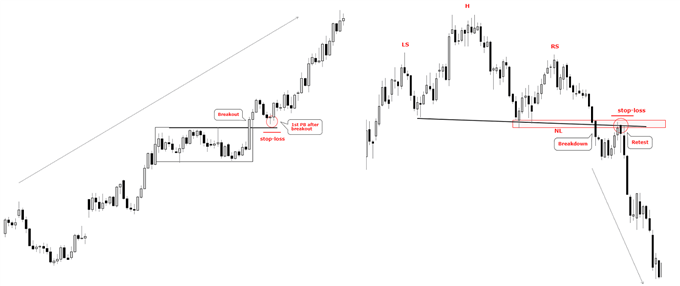

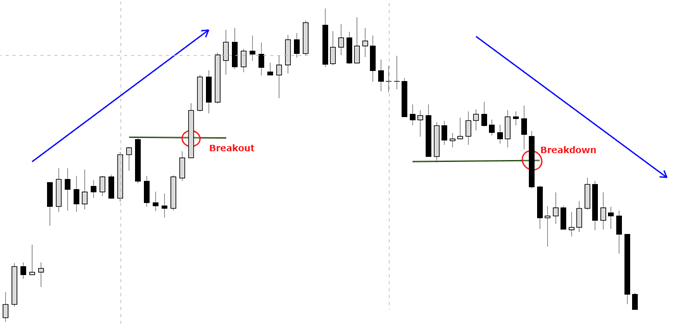

Today, we discussed how to combine breakout and pullback entries to take advantage of a chart set-up and maximize your risk/reward profile for increased robustness. There are times when an initial set-up will present an opportunity to trade along the...

Becoming a Better Trader – Trading Breakouts and Pullbacks, Part II

Today, we discussed several types of pullback scenarios, with three main categories – post-breakout, mid-trend, and after a trend reversal for a counter-trend trade. We covered the various aspects to identifying the highest probability set-ups and took a look at...

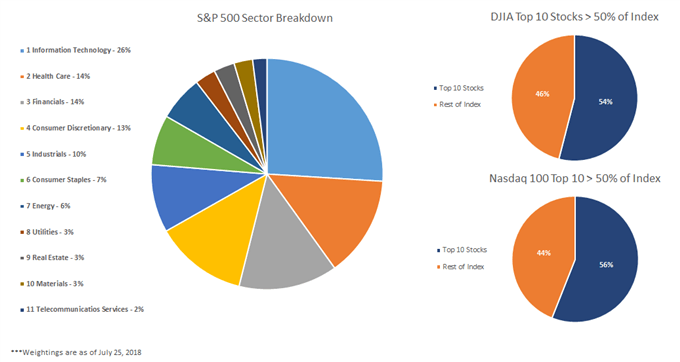

Difference Between Dow, Nasdaq, and S&P 500: Major Facts & Opportunities

In the U.S., market participants focus the majority of their attention on three indices – S&P 500, Dow Jones Industrial Average, and Nasdaq 100. These indices are of course highly correlated to one another as they track companies impacted by...

Becoming a Better Trader – Trading Breakouts and Pullbacks, Part I

Today, we discussed two general types of breakouts – simple price level breakouts (support/resistance) and those involving various types of chart patterns. Not all set-ups are created equally, with some presenting more attractive risk/reward opportunities. We also discussed a few...

How to Trade Gold: Top Gold Trading Strategies and Tips

Gold trading strategy: – Trading gold is much like trading forex if you use a spread-betting platform. – A gold trading strategy can include a mix of fundamental, sentiment, or technical analysis. – Advanced gold traders recognize that the yellow...

Day Trading the Dow Jones: Strategies, Tips & Trading Signals

Day Trading the Dow Jones Main Points: The Dow Jones Industrial Average is one of the oldest US stock indices, containing 30 of the largest US-based stocks traded on the New York Stock Exchange and the Nasdaq. The Dow is...

Becoming a Better Trader – How to Handle a Drawdown

In this webinar, we discussed the inevitable drawdown (in fact, your account spends a large swath of time underwater), and how to handle both the ‘normal’ variety which occur regularly, and more importantly, the ones which fall under the ‘problematic’...

Becoming a Better Trader – Identifying Trade Set-ups

In this webinar, we delved into the trading process and a few favorite trade set-ups. We looked at several fairly recent examples of trades utilizing trend and market conditions, support & resistance, candlesticks, and chart patterns. We understand the difficulties...

ETH vs BTC – Ether and Bitcoin Spread; De-Risking Crypto Trading?

Cryptocurrency Spread Trade – Trading Ether and Bitcoin against each helps remove general cryptocurrency market risk. – Ether continues to out-perform Bitcoin. If you are new to trading cryptocurrencies, or are just looking to refresh your trading knowledge, please see...

Patience in Trading: Why It Pays Not To Be Too Greedy In FX

Why it pays to have patience in trading: – When planning to enter a trade, it’s best to wait to be sure that a trend is in place. – And when exiting the trade, don’t try to squeeze the last...

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals