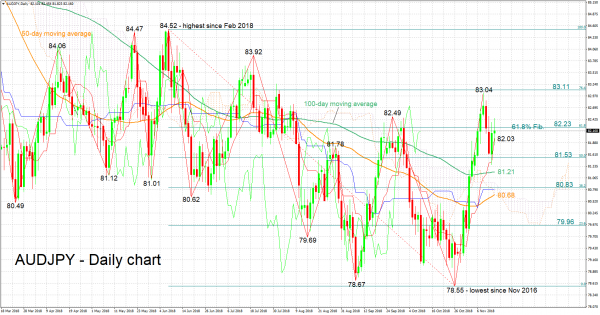

AUDJPY’s remarkable recovery after hitting a two-year nadir of 78.55 in late October lost some steam when the pair touched a near three-and-a-half-month high of 83.04 last week.

The Tenkan- and Kijun-sen lines remain positively aligned in support of a bullish bias in the short-term, though the fact that the Kijun-sen has flatlined is an indication of weakening positive momentum.

Immediate resistance to gains may come around 82.23, the 61.8% Fibonacci retracement level of the downleg from 84.52 to 78.55; the zone around this also captures the late September top of 82.49. Higher still, a barrier could be met around the 76.4% Fibonacci mark at 83.11, with the area around it also encapsulating last week’s peak of 83.04. More bullish movement would turn the attention to the 83.92 high.

A move down could meet a first line of support around 82.03, this being the current level of the Tenkan-sen; a previous top at 81.78 lies close to this point. A downside violation would eye the 50% Fibonacci level at 81.53 and then the 100-day moving average at 81.21. Steeper losses would bring the region around the 38.2% Fibonacci at 80.83 within scope; the area around this point also includes the Ichimoku cloud top (80.96) and bottom (80.66), the Kijun-sen (80.79), and the 50-day MA (80.68).

The medium-term picture is looking mostly bullish, with trading activity taking place above the 50- and 100-day moving average lines, as well as above the Ichimoku cloud.

To conclude, both the short- and medium-term outlooks look predominantly bullish at the moment, though there are signs of weakening momentum in the near term.

Signal2forex.com - robot Best Forex jeung sinyal

Signal2forex.com - robot Best Forex jeung sinyal