Global stock markets are generally higher today, continuing to ride on trade optimism. White House economic adviser Kevin Hassett added to the positive mood and said US Trade Representative Robert Lighthizer has made a lot of progress with China. And the deal may be finished some time soon. Also, WSJ reported that a signing summit could be held on March 27. On the other hand, EU-US trade negotiations will also start this week.

The currency markets are relatively quiet though. Euro is trading as the weakest one today despite better than expected investor confidence data. Pull back in German yield could be a factor weighing on the common currency. Swiss Franc is follows as the second weakest and then Canadian. New Zealand and Australian Dollars are the strongest one for today so far. But gains are limited as traders guard against any dovish twist in RBA statement tomorrow. Nomura follows Westpac and forecasts RBA to cut interest rate by 50bps this year.

In other markets, FTSE is currently up 0.66%. DAX is up 0.24%. CAC is up 0.76%. German 10-year yield is down -0.0156 at 0.171. Earlier in Asia, Nikkei rose 1.02%. Hong Kong HSI rose 0.51%. China Shanghai SSE rose 1.12%. Singapore Strait Times rose 0.95%. Japan 10-year JGB yield rose 0.0103 to 0.002, turned positive.

EU Malmstrom and USTR Lighthizer to meet on March 6 on trade negotiations and tariffs

EU Trade Commissioner Cecilia Malmstrom is scheduled meet U.S. Trade Representative Robert Lighthizer on March 6 in Washington to resume trade negotiations. On the following day, Secretary-General of the European Commission, Martin Selmayr, will meet US National Economic Council Director Larry Kudlow.

European Commission spokesman Margaritis Schinas said ‘the discussions will focus on the next steps toward the implementation of the July 2018 Joint Statement and on the EU-US cooperation on World Trade Organization reform and level playing field issues”. He added that “the Commission will update the U.S. side on the state of play of the adoption of the negotiating mandates for EU-U.S. trade agreements on industrial goods and on conformity assessment.”

Also, Schinas said “the Commission will also raise the EU’s concerns on the tariffs imposed by the U.S. on steel and aluminum products and on the possible consequences of the recently concluded investigation on whether automobile imports represent a threat to the US’ national security”.

Eurozone Sentix shows signs on stabilization, Asia ex-Japan on the rise

Eurozone Sentix Investor Confidence improved to -2.2 in March, up from -3.7 and beat expectation of -3.1. Current Situation index dropped from 10.8 to to 6.3, lowest since September 2016 and the seventh monthly decline. Expectations Index improved to -10.3, up from -17.3. Sentix noted that the indexes are “sending signs of stablisation” and “fueling hopes that there will be no recession. However, “it is too early to give the all-clear”.

And, thematically “investors expect slight support from monetary policy in the coming months from a pause in the interest rate cycle. Nevertheless, the central bank policy barometer does not give the impression that a sustained easing of monetary policy is to be expected. On the one hand, a rapid comeback of the economy would also surprise the central bank and, on the other, investors expect inflationary pressures to rise again.

On development to now in the strong improvement in Asia ex-Japan. Overall Investor Confidence index rose 9.9 to 15.3, highest since August 2018. Current Situation index rose from 22.3 to 24.5. Expectations index rose from -1.8 to 6.5, highest since March 2018. Sentix noted that the Chinese “government’s measures to stimulate economic growth both in fiscal and monetary terms are well received by the investors surveyed by Sentix.

Also from Eurozone, PPI rose 0.4% mom, 3.0% yoy in January versus expectation of 0.3% mom, 2.9% yoy.

UK PMI construction dropped to 49.5, Brexit anxiety intensified

UK PMI construction dropped to 49.5 in February, down from 50.6, missed expectation of 50.5. That’s also the first contraction in eleven months. Markit noted there was slight fall in construction output, led by commercial and civil engineering work. And, housing was the only category to register growth. And there was sharp deterioration in supplier performance.

Tim Moore, Economics Associate Director at IHS Markit, noted “construction sector moved into decline during February as Brexit anxiety intensified and clients opted to delay decision-making on building projects.” And, “risk aversion in the commercial sub-category has exerted a downward influence on workloads throughout the year so far.”

UK Cox given up Irish backstop time limit or unilateral exit

UK Brexit Minister Stephen Barclay and Attorney General General Geoffrey Cox will travel to Brussels again tomorrow to meet EU Brexit negotiator Michel Barnier. Ahead of that, the Telegraph reported that Cox has given up the request on a time-limit on the Irish backstop or unilateral exit mechanism. Cox wanted to push for an independent arbitration mechanism which both UK and EU could give formal notice to end the backstop. But such independent arbitration would be outside the jurisdiction of the European Court of Justice. That is seen as totally unacceptable by the EU.

Separately, Trade Minister Liam Fox said he would be “shocked” if EU would insist on a delay of 21 months or two years extension of Article 50, if requested. He said “the European Union does not want Britain to fight the European elections.” Fox added it’s still “entirely possible” for leave EU on March 29. But a short extension to Article 50 may be needed to deliver a smoother exit.

BoJ Kuroda: Will debate exit strategy when appropriate time comes

BoJ Governor Haruhiko Kuroda said there is no specific stimulus exit strategy yet as it would take “significant time” to achieve the 2% inflation target. For now, BoJ will “patiently” maintain current monetary easing while “the economy is sustaining momentum for achieving the BOJ’s price target.”

Though, he acknowledged that “to ensure markets remain stable, it’s important to come up with a strategy and guidance at an appropriate timing on how to proceed with an exit”. And, “when the appropriate time comes, we will debate at our policy meetings an exit strategy and guidance, and communicate them appropriately.”

On the side effect of monetary easing, Kuroda said “there’s a concern low-rate environment and competition will prolong downward pressure on financial institutions’ profits. As a result I’m aware of risks that financial intermediation could stagnate and financial system could become unstable”. But he added “I don’t think such risks are large at the moment given that financial institutions are equipped with ample capital base.”

Eur / USD Mid-Day Outlook

Pivots poean: (S1) 1.1343; (P) 1.1375; (R1) 1.1398; Tambih deui…..

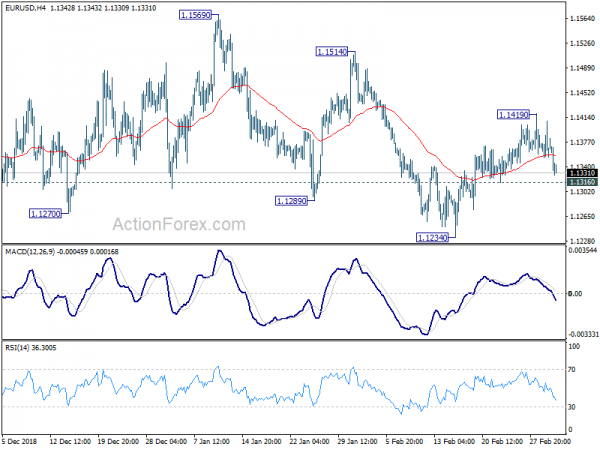

EUR/USD drops notably today and focus is back on 1.1316 minor support. Firm break there will indicate completion of rebound from 1.1234. In such case, intraday bias will be turned back to the downside for retesting 1.1215 low. On the upside, break of 1.1410 resistance will extend the rebound from 1.1234, which is a leg in the consolidation pattern from 1.1215, to 1.1514 resistance next.

Dina gambar badag, salami lalawanan 1.1814 nahan, trend handap trend handap ti 1.2555 luhur istilah sedeng masih lumangsung sarta kudu sasaran 61.8% retracement of 1.0339 (2017 low) kana 1.2555 di 1.1186 salajengna. Sustained putus aya bakal rarata jalan pikeun retest 1.0339. Sanajan kitu, putus tina 1.1814 bakal mastikeun parantosan trend handap misalna jeung ngahurungkeun outlook istilah sedeng bullish.

Ékonomi Indikator Update

| GMT | Ccy | kajadian | saleresna | ramalan | saméméhna | dirévisi |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Monetary Base Y/Y Feb | 4.60% | 4.50% | 4.70% | |

| 0:00 | AUD | TD Securities Inflation M/M Feb | 0.10% | -0.10% | ||

| 0:30 | AUD | Company Operating Profit Q/Q Q4 | 0.80% | 3.00% | 1.90% | 1.20% |

| 0:30 | AUD | Building Approvals M/M Jan | 2.50% | 1.50% | -8.40% | -8.10% |

| 9:30 | eur | Eurozone Sentix Investor Confidence Mar | -2.2 | -3.1 | -3.7 | |

| 9:30 | GBP | Construction PMI Feb | 49.5 | 50.5 | 50.6 | |

| 10:00 | eur | Eurozone PPI M/M Jan | 0.40% | 0.30% | -0.80% | |

| 10:00 | eur | Eurozone PPI Y/Y Jan | 3.00% | 2.90% | 3.00% | |

| 15:00 | USD | Construction Spending M/M Dec | 0.20% | 0.80% |

Signal2forex.com - robot Best Forex jeung sinyal

Signal2forex.com - robot Best Forex jeung sinyal