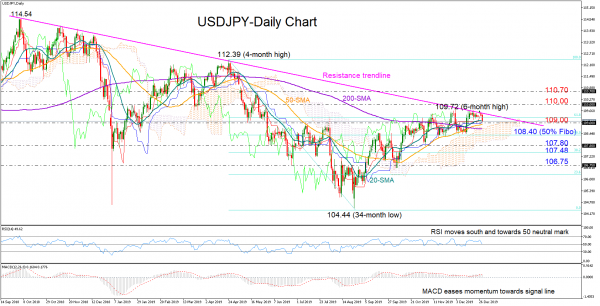

USDJPY pushed lower on Monday and back towards the 109.00 level as the strong descending trendline that joins all the lower highs since mid-September 2018 capped upside movements once again.

The slowing RSI, which heads towards its 50 neutral mark and the easing momentum in the MACD, which lies near its red signal line, are ruling out a meaningful rally in the short-term.

A decline below 109.00 could strengthen negative momentum probably towards the 108.40 support area, where the 50% Fibonacci retracement of the 112.39-104.44 bearish wave is located. Should the sellers pass that border, the uptrend off the 104.44 bottom would come under speculation, shifting the still positive medium-term picture to a neutral one. In this case, support could run into the 107.80-107.48 zone which encapsulates the 38.2% Fibonacci. Crawling lower, the price could next rest near 106.75.

On the upside, the bulls should close decisively above the resistance trendline and more importantly above the 6-month high of 109.72 to spark buying interest into the market. If the price rallies above the 110.00 number, then 110.70 could be the next level to watch.

In brief, USDJPY may remain cautious in the short-term and as long as it holds below the descending trendline. In the medium-term picture, the positive outlook is still intact and only a closing price below 108.40 would turn it fragile.

Signal2forex.com - robot Best Forex jeung sinyal

Signal2forex.com - robot Best Forex jeung sinyal