Last week the United States Treasury Department released its latest data related to foreign buying of United States debt. It was a shocker.

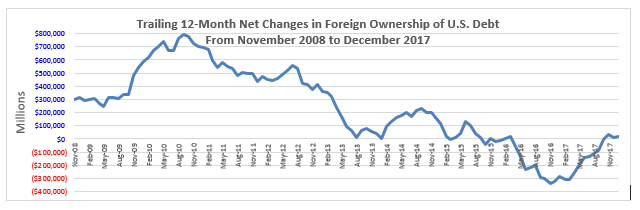

It showed that in the 12 months leading up to November 2016, the month that Donald Trump was elected president, foreigners had been net sellers of $339 billion in U.S. Treasurys. In the 12 months leading up to December 2017, they had shifted to being net buyers of $20 billion.

Contrast this to the prior administration’s record. In November 2008, when Barack Obama was elected president, the trailing 12-month figures showed that foreigners had been net buyers of $301 billion in Treasurys. This dropped to the $339 billion outflow figure in November 2016, just noted, when he lost power.

Putting the two sets of numbers together one sees that foreigners swinging $640 billion to the negative during the Obama presidency. During the Trump presidency to date, foreigners swung positive by $359 billion. Wow!!

It appears that foreign U.S. debt buyers are as enthused by the Trump agenda as much as domestic equity buyers are. Or, that the faith in the U.S. economic recovery is global in nature.

The largest foreign holding of U.S. debt would be the combined portfolio of China and Hong Kong. It is about 6 percent of outstanding Treasury debt. This portfolio, if looked at year-over-year numbers, was up 1.5 percent in August, 2.1 percent in September, 6.1 percent in October, 11.1 percent in November and 10.4 percent in December. Overall, it grew by $145 billion.

Other big buyers year over year were Saudi Arabia (up $47.1 billion), the United Kingdom (up $34.2 billion), Singapore (up $28.1 billion), India (up $26 billion), Switzerland (up $19.3 billion), Russia (up $15.6 billion) Korea (up $11.2 billion) and France (up $10.1 billion). The biggest sellers were Japan (down $47.1 billion) and Germany (down $14.7 billion). Finally, of note, Ireland’s holdings jumped $51.3 billion possibly due to Brexit.

The importance of these numbers cannot be understated. If one segregates the buyers of U.S. debt into its four main categories foreign buying is most important. Presently, it is believed that foreigners own 31.2 percent of outstanding U.S. debt. American households and businesses own 29.1 percent; Social Security and other government pension funds own 27.5 percent; and the Federal Reserve holds 14.2 percent. There is 2 percent double counting in the figures mainly in the amount held by Americans.

This fiscal year due to the tax cut, higher interest rates and possibly other new fiscal programs, it is expected that the government must raise possibly another trillion dollars along with refinancing a portion of the $20 trillion already owed.

The Federal Reserve does not want to contribute. The Social Security funds may not have much in incremental dollars to contribute. Americans want higher interest rates to contribute. So the expectation is that foreigners will not only not sell the U.S. debt that they have but they will add more.

Thus, the Treasury Department’s new figures are very encouraging and more than a little surprising. Cutting through the rhetoric, if foreigners believe in the Trump economic program and are willing to contribute to make it work, interest rates at the long end of the curve may not move as high as is now currently projected by many.

If the foreigners do not step up, then there will be problems. Someone has got to buy the increased debt. The federal government does accept voluntary contributions.

— Richard X. Bove is an equity research analyst at Vertical Group and the author of “Guardians of Prosperity: Why America Needs Big Banks” (2013).

Link to the source of information: www.cnbc.com

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals