Two of the biggest cryptocurrency exchanges are aiming to make bitcoin transactions faster and cheaper with a new software update announced this week.

Both Coinbase and Bitfinex said they are adopting a software called SegWit, which bitcoin bulls and one exchange say should lower fees by as much as 20 percent while speeding up transactions.

“The most noticeable changes in the short term should be more efficiency when transacting,” said Alex Sunnarborg, founding partner at crypto hedge fund Tetras Capital. “SegWit adoption is undoubtedly positive for bitcoin as it greatly impacts transaction fees, speed, and future tech possibilities, all areas in which alternative crypto assets like Bitcoin Cash and Ethereum compete with and often criticize bitcoin on.”

Bitcoin enthusiasts have split over the best way to improve the cryptocurrency network’s efficiency. An upgrade called SegWit2x was called off in the fall after it lost widespread support.

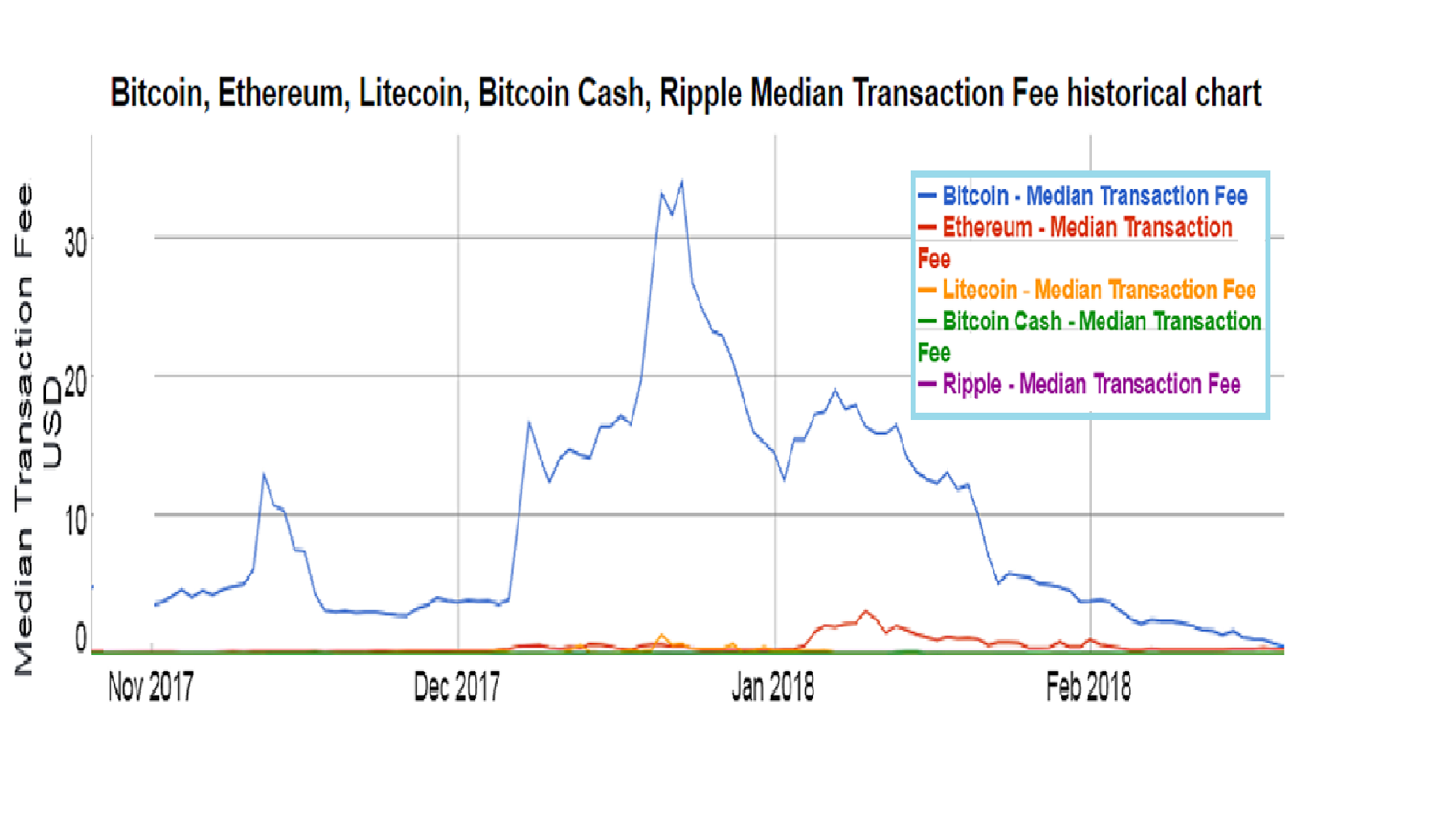

Meanwhile, bitcoin transaction fees soared well above $20 in the last few months and confirmation times could take longer than a day. Some users were so frustrated with fees, and unable to compromise on blockchain size increases, that they “forked” bitcoin, and created bitcoin cash this summer.

Source: BitinfoCharts

The software Segregated Witness, or SegWit, slightly increases the block size. As the number of transactions that fit into each block goes up, transactions get faster. SegWit went live in August as Bitcoin’s skyrocketing popularity led to some slowdowns on the network.

Bitfinex, which facilitates about 38 percent of all U.S. dollar-bitcoin trading volume according to CryptoCompare, announced the software roll-out on Tuesday.

“We are delighted that through this implementation we can provide our customers with bitcoin withdrawal fees that are up to 20 percent lower, as well as faster-than-ever transaction speeds,” Bitfinex Chief Technology Officer Paolo Ardoino said in a statement.

Tweet

San Francisco-based exchange Coinbase, which does 17 percent of all U.S. dollar bitcoin trading volume according to CryptoCompare, also tweeted the software update this week. The first phase will kick off this week, and should be fully available by the middle of next week, the company tweeted Tuesday.

Tweet

Bitcoin prices shrugged off the news, and fell 7 percent Wednesday, trading near $10,500. The cryptocurrency is down more than 40 percent year to date. Ethereum dropped more than 4 percent, trading near $832, and is down 37 percent year to date.

The software news could mean more for long-term sentiment than short-term prices, said Brian Kelly, CNBC contributor and CEO of BKCM.

“It’s very good for the ecosystem,” Kelly said. “We’re making progress on the technology front, that takes the criticism that fees are too high out of picture.”

Ethereum bull Benjamin Roberts agreed that the software update is a positive long-term sign for bitcoin, adding that more people may be open to the cryptocurrency if transaction fees fell. But it still remains to be seen if the update alone is “enough,” he said.

“It’s an incremental improvement,” said Roberts, founder and CEO of Citizen Hex. “It’s good that different players are adopting the changes but it’s a very small step on the way to what needs to be a significant improvement.”

Link to the source of information: www.cnbc.com

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals