Movements in the forex markets are not too decisive for the moment. Sterling made a bull run yesterday but there was no follow through buying. GBP/JPY is staying below 1.3929 near term resistance despite the rally attempt. GBP/JP’s recovery since last week’s low at 144.97 is also looking corrective. While Dollar is weak this week, Euro is not much better. EUR/USD’s recovery ahead of 1.2268 minor support has been very weak so far. Aussie and Kiwi are the better performing ones. But while AUD/UD does managed to extend the near term rebound, it’s starting to feel heavy ahead of 0.7892 resistance. Markets will look into US CPI today for more inspiration.

CPI unlikely to change Fed’s path

Markets are expecting US CPI to accelerate from 2.1% yoy to 2.2% yoy in February. Core CPI is expected to be unchanged at 1.8% yoy. So far, barring any disaster, a Fed hike in March is like a done deal even though Chicago Fed President Charles Evans might dissent. The overall impression is that consensus among Fed policy makers is three hikes this year. Weak (or the lack of) inflationary pressure provides little reaction for Fed to hike a fourth time. The picture could change if the impact of the government’s tax cut is passed through the economy later. But for now, a month of data is unlikely to alter Fed’s path in March and even June.

Australia NAB business confidence jumped to record

Australia NAB business condition jumped 3 pts to 21 in February, hitting a record high. However, business confidence dropped 3 pts to 9. NAB noted in the release that “business activity in Australia is robust” and “strength in conditions is broad based across industry groups.” The fall in confidence was seen as reactions to global market “turbulence” back in early February only. But the impact of those turbulence was “relatively limited”.

Overall, NAB maintained that view that RBA will hike by late 2018, but may delay till early 2019. It noted that “we expect by late 2018 the RBA will feel relaxed enough about the domestic fundamentals to cautiously start withdrawing the stimulatory policy stance it is currently running. However, it will depend heavily on the data flow and the risk is that the RBA will delay rate rises until early 2019”.

Also fro Australia, home loans dropped -1.1% mom in January.

RBNZ Spencer hailed macroprudential policy

RBNZ Governor Grant Spencer hailed the success of macroprudential tools in a speech to finance industry professional today. The policy infrastructure including the LVRs (loan to value restrictions). helped limit the risks of surge hour prices. It also helped keep interest low to boost inflation. And, after adopting the policy for five years, Spencer suggested a review would be run with the Treasury to consider ways to expand it. He also suggested to introduce a new committee on macroprudential policy alongside the monetary policy committee.

Canada PM Trudeau: No link between NAFTA and tariff exemptions

Canadian Prime Minister Justin Trudeau said that the exemptions on Trump’s steel and aluminum tariffs were not a “magical favor being done”. He pointed out that

“millions of jobs on both sides of the border depend on continued smooth flow of trades.” And the tariffs would hurt both sides. He also expressed the willingness to work with the on NAFTA. But, he also emphasized that “we don’t link together the tariffs and the negotiations for NAFTA.”

Looking ahead

The economic calendar is not too busy today. UK annual budget release will be a major focus. US CPI will be another. BoC Governor Stephen Poloz’s speech will also be watched.

GBP/USD Daily Outlook

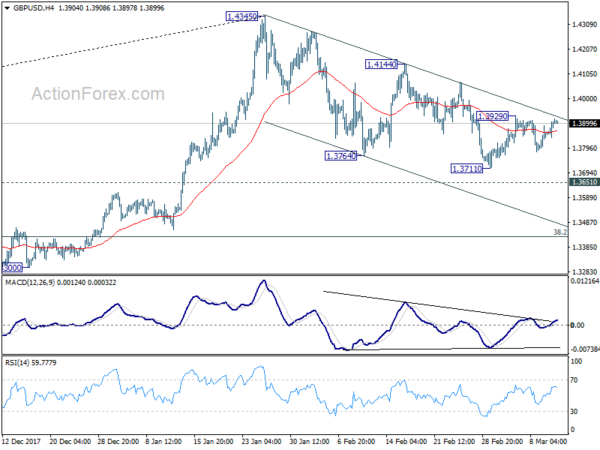

Daily Pivots: (S1) 1.3858; (P) 1.3887; (R1) 1.3935; More….

At this point, GBP/USD is still limited below 1.3929 minor resistance, and bounded below near term falling trend line. Intraday bias remains neutral first. On the upside, firm break of 1.3929 will be the first sign of reversal. That is, the choppy pull back from 1.4345 could have completed at 1.3711 already. In this case, intraday bias will be turned back to the upside for 1.4144 resistance for confirming this bullish view. On the downside, break of 1.3711 will resume the decline from 1.4345 through 1.3651 resistance turned support. At this point, we’ll look for strong support from 38.2% retracement of 1.1946 to 1.4345 at 1.3429 to contain downside and bring rebound.

In the bigger picture, as long as 1.3038 support holds, medium term outlook in GBP/USD will remains bullish. Rise from 1.1946 is at least correcting the long term down from 2007 high at 2.1161. Further rally would be seen back to 38.2% retracement of 2.1161 (2007 high) to 1.1946 (2016 low) at 1.5466. However, GBP/USD fails to sustain above 55 month EMA (now at 1.4259) so far. Break of 1.3038 support, will suggest that rise from 1.1946 has completed and will turn outlook bearish for retesting this low.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Domestic CGPI Y/Y Feb | 2.50% | 2.50% | 2.70% | |

| 0:30 | AUD | Home Loans M/M Jan | -1.10% | -0.20% | -2.30% | |

| 0:30 | AUD | NAB Business Conditions Feb | 21 | 18 | ||

| 0:30 | AUD | NAB Business Confidence Feb | 9 | 12 | ||

| 4:30 | JPY | Tertiary Industry Index M/M Jan | -0.30% | -0.20% | ||

| 12:30 | USD | CPI M/M Feb | 0.20% | 0.50% | ||

| 12:30 | USD | CPI Y/Y Feb | 2.20% | 2.10% | ||

| 12:30 | USD | CPI Core M/M Feb | 0.20% | 0.30% | ||

| 12:30 | USD | CPI Core Y/Y Feb | 1.80% | 1.80% |

Link to the source of information: www.actionforex.com

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals