There’s a deeper hawkish tilt to the Federal Reserve’s outlook for interest rates that could be worrisome for markets.

Federal Reserve officials, in their first meeting chaired by Jerome Powell, raised their median forecast for the funds rate for 2019 to 2.9 percent from 2.7 percent, and for 2020 to 3.4 percent from 3.1 percent. Those are aggressive forecasts relative to market expectations.

Still, they total only about an extra 30 basis points of tightening over the next two years.

The more concerning take comes by looking closely at just how many Fed officials are more hawkish than the median. It suggests the risk to the market is definitely for a more hawkish Fed over the next several years.

To be sure, that could change if the economic data come in weaker than expected, especially if inflation doesn’t rise towards the Fed’s 2 percent goal. But if the economy follows the current forecast, it wouldn’t take much for the Fed to end up being more hawkish than its current stance.

At his first press conference as Fed chairman, Powell was peppered with questions about the forecasts, but he downplayed their significance. “The summary of economic projections is a compilation of the individual rate forecasts,” Powell said. “The committee made one decision at this meeting and that was to raise the federal funds rate by 25 basis points. The summary of economic projections is individual forecasts compiled and written down.”

That is, forecasts are not policy, but they can suggest where the risks lie.

The Fed’s projections for this year show a median forecast of 2.1 percent for the funds rate, but eight officials are above the median (more than half of the committee). Their forecasts average out to a funds rate of 2.4 percent, that is, one more hike than the median — for a total of four this year.

By contrast, just two officials forecast a funds rate below the median, suggesting the tail risk for markets is for higher, not lower, rates.

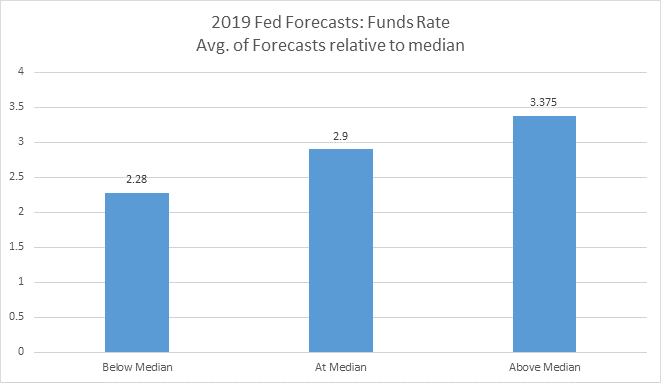

That problem continues into 2019. Five officials have a forecast at the median 2.9 percent. Four officials are below the median, but six officials are above it. The average forecast for these six officials is a much more hawkish 3.4 percent. One forecast is as high as 3.9, or 2.28 percentage points above the current rate.

Put another way, 40 percent of the committee is more hawkish than the median for 2019 while just 27 percent is more dovish. And the forecasts of the doves are just barely below the median.

The risks balance out somewhat for 2020, but at a higher level. The median forecast is 3.4 percent, with five officials at the median, five below and five above. But again, the averages suggests a hawkish tilt.

The average rate of those below the median is 2.65 percent. The average forecast of those above: 3.95 percent, or 55 basis point above the median, with one official at 4.9 percent.

All of this raises questions about support for a critical line in the Fed’s statement where it says: “The federal funds rate is likely to remain, for some time, below levels that are expected to prevail in the longer run.” It seems as if a considerable portion of the committee is less on board with “below normal” rates than perhaps they had been.

Link to the source of information: www.cnbc.com

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals