Washington’s increased scrutiny of technology giants could spell trouble for their stocks, if history is any guide.

Technology is the least regulated industry sector, with just 27,000 regulations versus 215,000 for manufacturing and 128,000 for the financial sector, according to Bank of America Merrill Lynch. That light touch could change in the wake of Facebook’s consumer data scandal, likely leading to significant pressure on the best-performing S&P 500 industry sector.

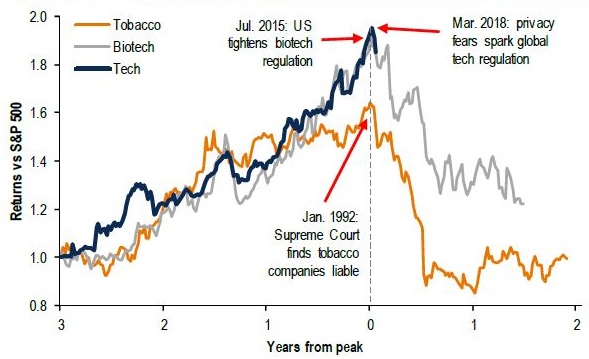

“Tobacco (1992), financial (2010), biotech (2015) industries illustrate how waves of regulation can lead to investment underperformance,” Michael Hartnett, chief investment strategist at BofAML, said in a Sunday report. The statement is his 10th and last in a list of reasons to reduce holdings of technology stocks this year.

Equity bubbles popped by regulation

Source: BofAML Global Investment Strategy

Pending U.S. and EU regulations, such as increased online sales tax collection, could threaten 4 percent of tech revenue, the report said.

In 1992, the Supreme Court ruled that tobacco companies are liable for their products and health risks, Hartnett pointed out. He added that restrictive laws such as the Dodd-Frank Act imposed in the wake of the financial crisis made it difficult for banks and other companies in the financial industry to recover, while the peak in biotech stocks came as the Obama administration ordered tighter regulation.

Information technology is up 25 percent over the last 12 months, by far the best performer in the S&P 500. But its fourth-largest constituent, Facebook, plunged into bear market territory, or more than 20 percent from its record high hit Feb. 1, after revealing a consumer data scandal affected 87 million accounts. The shares have recovered slightly, but remain about 19 percent below that high.

Facebook CEO Mark Zuckerberg is set to testify before congressional committees Tuesday and Wednesday.

U.S. federal regulations by sector

Source: BofAML Global Investment Strategy

Other reasons Hartnett listed for why investors should reduce their tech holdings include:

- Tech has benefited from an era of easy monetary policy that is changing. Without tech, the S&P 500 would be 600 points lower at 2,000.

- U.S. internet commerce stocks have surged 624 percent in seven years, marking the third-largest stock bubble of the past 40 years.

- The market capitalization of U.S. technology stocks is $6.4 trillion, more than the euro zone’s $5 trillion.

- “Earnings hubris.” Tech and e-commerce companies account for nearly a quarter of U.S. earnings per share, a level “that is rarely exceeded, and often associated with bubble peaks.”

- Out of all U.S. sectors, technology stocks have the greatest percentage of foreign revenue, making them more sensitive to increasing trade tensions.

Link to the source of information: www.cnbc.com

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals