Sterling plunges sharply today as markets are seeing increasing change of a no-deal Brexit. Adding that, GBP/USD’s break of 1.2956 earlier this week and EUR/GBP’s break of 0.8957 resistance yesterday also adds to broad based pressure on the Pound. Australian Dollar follows as the second weakest at this point. Market sentiments were weighed down generally by escalation in US-China trade war. Following US announcement of the effective date on 25% tariffs on Chinese imports, China MOFCOM announced retaliation data in parallel. Yen is so far trading as the strongest one, followed by Dollar which usually benefits from trade war. Euro pares some of this week’s gain but remains resilient.

In other markets, sentiments are mixed only, not too day. FTSE is trading up 0.74% at the time of writing, once again thanks to Pound’s depreciation. DAX is reversing earlier loss and is up 0.16%. CAC is down -0.1%. Earlier in Asia, China Shanghai SSE lost -1.27%. But Hong Kong HSI gained 0.39%. Nikkei closed down -0.08% while Singapore Strait Times lost -0.4%. WTI crude oil is back below 69 as recent sideway trading continues. There is no strength whatsoever for regaining 70 handle. Gold is hovering around 1210 as sideway trading extends. It’s just a matter of time for Gold to break through 1200 decisively.

Technically, GBP/JPY’s break of 143.18 confirms resumption of medium term fall from 156.69. Next target is 139.29 key cluster support. EUR/GBP is heading to 0.9043 fibonacci level. But based on current momentum, it’s possibly having 0.9305 (2017 high) in sight. GBP/USD also breaks a key medium term fibonacci level at 1.2874. Now it’s the time to monitor the momentum to gauge the chance of hitting 2016 low at 1.1946.

No-deal Brexit seems increasingly possible

Now, it seems a no-deal Brexit is an acceptable fact. It started last week when BoE Governor Mark Carney said risk of no-deal Brexit is “uncomfortably high”. Then Trade Minister Liam Fox assigned a 60-40 chance of it. Scotland’s First Minister Nicola Sturgeon also jumps in, blasting Prime Minister Theresa May’s handling of Brexit negotiation. Sturgeon said that “with every day that passes, the prospect of a no deal Brexit or a Brexit with very, very little information about the future relationship seems to become more and more likely.” She added that “both of those outcomes would be completely unacceptable, absolutely disastrous for our economy, so I hope she (Theresa May) can reassure me that neither of those things are going to happen.” “But if she can’t, then I hope she will outline her plan B, because we cannot simply take a step off that Brexit cliff-edge next March without knowing what comes next.”

ECB policy contributed considerably to private consumption growth

ECB released a bulletin article “Private consumption and its drivers in the current economic expansion” today. It argues that private consumption has been a main driver of growth in the current cycle that started back in 2013. And this has been “largely driven by the recovery in the labour market”. And, as labor markets continue to improve, “consumer confidence should remain elevated and private consumption should rise further”

At the same time, the article said that ECB’s accommodative monetary policy has “contributed considerably to the expansion of private consumption”. At the same time, the policies have also “directly decreased income and wealth inequality”. There is little evidence that low interest rates have led to generalized increases in household indebtedness. And therefore, the overall economic expansion is “sustainable”.

Italy Tria revised down 2018 and 2019 growth forecasts

Italian Economy Minister Giovanni Tria told the parliament said the government have downgraded growth forecast for both this year and next. 2018 GDP growth is projected to be 1.2%, down from prior forecast of 1.5%. 2019 GDP growth is projected to be at 1-1.1%, down from prior forecast of 1.4%.

Tria added that the slowdown would bring deficit to 1.2% in 2019, higher than deficit target of 0.8% of GDP, drawn up by prior administration. A more clearer estimate of the deficit will be available later in September. The figures will depend on the cost of servicing the debts and spending cuts. While the plan appears to be at odds with EU rules, Tria emphasized that it’s still “compatible” with Italy’s commitment to EU on its public finances.

China MOFCOM to start retaliatory tariffs on $16B US imports on Aug 23

China Ministry of Commerce announced to start to impose 25% retaliatory tariffs on USD 16B in US goods starting August 23, “in parallel with the US. The MOFCOM condemned that the US “once again overrides international law: as a very unreasonable practice. And Chin’s countermeasures were to safeguard its own “legitimate rights and interest and global multilateral trading system”.

USTR: 25% tariffs on $16B of Chinese goods to start on Aug 23

Yesterday, the US Trade Representative announced to start to collect 25% tariffs on USD 16B of Chinese imports starting August 23. The announced lists contains 279 of the original 284 tariff lines that were proposed back on June 15. This is the second tranche of tariffs as part of the Section 301 intellectual property investigations. The first tranche of 25% tariffs on USD 34B of Chinese goods already took effect on July 6. The upcoming 25% tariffs on USD 200B in Chinese goods are work in progress.

China’s import from EU jumped 20.5% mom, trade surplus shrank -31.0% mom, as US-China trade war starts

China’s July trade data revealed some interesting findings as US-China trade war formally started. Import from the EU jumped as massive 20.5% mom, 19.7% yoy. Trade surplus with EU dropped -31.0% mom, -7.9% yoy. On the other hand, trade surplus with US dropped a mere -3.0%, with -2.5% decline in export and -1.5% mom fall in imports. Looks like the EU could have the last laugh over Trump’s trade policy. More in the comments here.

BoJ: Allowing long-term yields to rise may contribute to sluggish prices

BoJ released the Summary of Opinions at the July 30/31 monetary policy meeting today. There the central bank noted that it’s “extremely important” to introducing forward guidance as a new measure. And, that would strengthen its commitment to achieving the price stability target, in order to ensure public confidence in its strong stance toward achieving the target.”

Also, the summary noted that “controlling the long-term yields in a flexible manner is likely to contribute to maintaining and improving market functioning.” it can be considered appropriate for interest rate control in Japan to allow the yields to move upward and downward by around 0.25 percent.” Though, most member agreed that it should be “made clear at the press conference” that currently yield may move between -0.1% to 0.1%.

But it’s also noted that “when medium- to long-term inflation expectations are weak, making policy adjustments that could allow the long-term yields to rise may lead to an increase in real interest rates and thereby contribute to sluggish prices.”

RBA Lowe reiterated next move is up not down

RBA Governor Philip Lowe delivered a speech titled “Demographic Change and Recent Monetary Policy” today. There he reiterated that “the next move in interest rates to be up, not down”. But the timing will depends upon the “speed of the progress” in “reducing the unemployment rate and having inflation return to around the midpoint of the target range on a sustained basis.” And in the Q&A, Low also noted that there is no strong case for a near term move.

RBNZ to stand pat with slightly dovish statement

RBNZ is widely expected to leave the OCR unchanged at 1.75% in the upcoming Asian session. The central bank might deliver a neutral to slightly dovish policy statement. We expect policymakers to look through the improvement in inflation data and maintain accommodative monetary policy at least until late 2019. The central bank will likely reiterate that the next move in the OCR could be “up or down”. On the updated economic forecasts, we expect the central bank to downgrade the GDP growth projection in light of recent slowdown.

More on RBNZ:

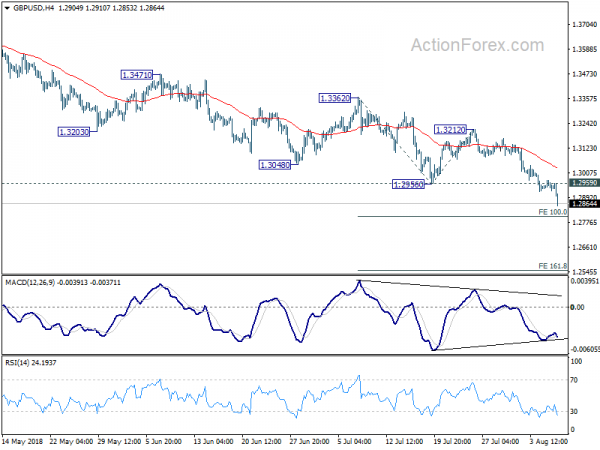

GBP/USD Mid-Day Outlook

Daily Pivots: (S1) 1.2917; (P) 1.2945; (R1) 1.2968; More…

GBP/USD drops to as low as 1.2853 so far today and breaks 1.2874 fibonacci level already. There is no sign of bottoming but only sign of downside acceleration. Intraday bias remains on the downside for 100% projection of 1.3362 to 1.2956 from 1.3212 at 1.2806 first. Break will target 161.8% projection at 1.2555 next. On the upside, above 1.2959 minor resistance will turn bias neutral and bring consolidation. But upside should be limited below 1.3212 resistance to bring fall resumption.

In the bigger picture, whole medium term rebound from 1.1946 (2016 low) should have completed at 1.4376 already, after rejection from 55 month EMA (now at 1.4141). Fall from 1.4376 should extend to 61.8% retracement of 1.1946 (2016 low) to 1.4376 at 1.2874 next. Decisive break of 1.2874 will raise the chance of long term down trend resumption through 1.1946 low. On the upside, break of 1.3212 resistance is needed to be the first indication of medium term bottoming. Otherwise, outlook will remain bearish even in case of strong rebound.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | BOJ Summary of Opinions Jul | ||||

| 23:50 | JPY | Current Account (JPY) Jun | 1.76T | 1.84T | 1.85T | |

| 23:50 | JPY | Bank Lending incl Trusts Y/Y Jul | 2.00% | 2.30% | 2.20% | |

| 1:30 | AUD | Home Loans M/M Jun | -1.10% | 0.10% | 1.10% | 1.00% |

| 3:05 | CNY | Trade Balance (USD) Jul | 28.1B | 39.1B | 41.6B | |

| 3:05 | CNY | Trade Balance (CNY) Jul | 177B | 255B | 262B | |

| 5:00 | JPY | Eco Watchers Survey Current Jul | 46.6 | 47.8 | 48.1 | |

| 12:30 | CAD | Building Permits M/M Jun | -2.30% | -2.70% | 4.70% | |

| 14:30 | USD | Crude Oil Inventories | 3.8M | |||

| 21:00 | NZD | RBNZ Rate Decision | 1.75% | 1.75% |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals