The forex markets are rather quiet today with major pairs and crosses bounded in Friday’s range. It’s back to business as usual for a Monday, without any surprise. For now, Swiss Franc is trading as the strongest, followed by Dollar. New Zealand Dollar, Euro and Australian Dollar are the weakest ones but the picture will more likely change than not as the day goes. In other markets, Nikkei closed down -71.38 pts or -0.32% at 22199.00. But other major Asian indices are in black, with HK HSI up 1.01%, China Shanghai SSE up 0.45% and Singapore Strait Times up 0.08%. Gold is back above 1180 but struggles to extend gain.

The meeting between low level US and China officials on trade this week is something that might catch attention. But just like many other market participants, we have very low expectations on it. There are speculations that the talks could set the stage for a summit between US president Donald Trump and Chinese President Xi Jinping in November. But it’s too early to tell, in particular due to the erratic nature of Trump.

German-Italian yields spread is another development to watch. Currently at 3.114, Italian 10 year yield is now significantly higher than July’s close at 2.734. German 10 year bund yield, on the other hand, is now at 0.305, comparing to July’s close at 0.446. Greece’s marathon bailout program completes today, marking the end of the Eurozone debt crisis. But there are talks of crisis revival, starting from Italy. Worries could deeper should German-Italian spread jumps above 300 again, which it did earlier this year.

UK to publish technical notices on no-deal Brexit preparations

UK Brexit Minister Dominic Raab will meet EU chief Brexit negotiator Michel Barnier in Brussels on Tuesday. Prime Minister Theresa May’s spokesman said that “on the agenda will be resolving the few remaining withdrawal issues related to the UK leaving the EU and pressing ahead with discussions on the future relationship.”

Raab said that securing a Brexit deal was still “the most likely outcome”. But at the same time, the government scheduled to push a series of technical notices for no-deal preparation. Raab added that the government would wanted to “clearly set out the steps that people, businesses and public services need to take in the unlikely event that we don’t reach an agreement” with the EU.

The no-deal advice will be due on Thursday and are “sensible, proportionate, and part of a common sense approach to ensure stability, whatever the outcome of talks”, according to Raab.

Economists project two BoE hikes next year, we disagree

According to a Bloomberg survey, majority of the 31 economists surveyed expected BoE Bank rate to reach 1.25% by the end of 2019. That is, they expected two 25bps rate hikes next year. The first move is expected to come in Q2. It’s cited that Brexit is a concern that slows BoE’s tightening path. But by the time of Q2 next year, such concerned should be cleared. Meanwhile, falling inflation could only give BoE a reason to keep rates on hold until May. With Brexit cleared, and unfolded smoothly, path will be clear for another hike in November. Some analysts also saw BoE’s unanimous votes as sign that policymakers are confident enough to act twice next year. The Bank Rate currently stands at 0.75%.

But it should noted that BoE has revised down the rate path in August Inflation Report released less than three weeks ago. The central bank forecast Bank Rate to hit 0.9% in Q3 2019, revised down from 1.0%. Bank Rate is forecast to be at 1.0% in Q3 2020, revised down from 1.2%. Looking into the details, the conditioning path that BoE used didn’t price in a 25bps hike fully until 2020. And basically there would be no more hike within the forecast horizon. And based on such conditioning path, CPI is forecast to slow to 2.2% in Q3 2019, 2.1% in 2020. July’s pick up in CPI to 2.5% was in line with BoE’s expectations.

So, to us, a hike in H2 of 2019 is possible based on the current projections and developments. But a hike in Q2 2019 looks a bit stretched. And two hikes in 2019 is rather far-fetched. Moreover, the unanimous vote was seen to us as a compromise between hawks and doves. That is, BoE was going to hike once this year anyway as Q1 slowdown was proven to be temporary. Let’s do it and settle, but to stay gradual and cautious going forward.

German Finance Ministry: Turkish crisis adds to risks of Brexit and trade war

In its monthly report, the German Finance Ministry the “economic developments in Turkey present a new, external economic risk” to the economy. Germany is the second largest foreign investor in Turkey.

That adds on top of Brexit as “risks remain particularly with regards to uncertainty over how Brexit is going to pan out”.

US trade policy is another main risk as “the persistent debate about tariffs and the threat of a trade war are choking trade activity.”

Nonetheless, despite the risks, the Ministry said the economy remains supported by state spending, private consumption, low interest rates, a robust labor market and rising real wages.

RBA, FOMC and ECB minutes to highlight the week

Looking ahead, meeting minutes of RBA, FOMC and ECB will be the major focuses of the week. Meanwhile, the annual Jackson Hole symposium of central bankers will also catch a lot of attentions. Central banks have stepped up their use of communications and forward guidances rather well in recent years. The policy paths are rather clear to the public. And we’re not expecting any significant surprises from the minutes nor the symposium this week.

On the data front, though, there are some important ones to digest. Canada retail sales may provide more hints on whether BoC will hike again in September or October. We lean towards the latter. Eurozone PMIs and US durables goods orders will be watched. New Zealand retail sales won’t alter RBNZ’s policy path, that is stay low for longer.

Here are some highlights for the week:

- Monday: UK Rightmove house price; German PPI

- Tuesday: RBA minutes; Swiss trade balance; UK public sector net borrowing, CBI orders expectations; Canada wholesale sales

- Wednesday: News Zealand retail sales; Australia construction work done; Japan all industries index; Canada retail sales; US existing home sales, FOMC minutes

- Thursday: Eurozone PMIs, ECB monetary policy meeting accounts; UK CBI realized sales; US jobless claims, house price index, PMIs, new home sales

- Friday: New Zealand tarde balance; Japan national CPI, SPPI; German GDP final; US durable goods orders

EUR/USD Daily Outlook

Daily Pivots: (S1) 1.1387; (P) 1.1417 (R1) 1.1467; More…..

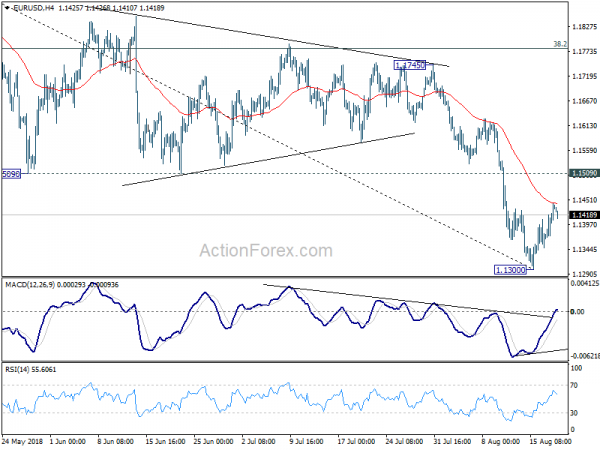

EUR/USD faces some resistance from 4 hour 55 EMA (now at 1.1442) and retreats mildly. But for now, recovery from 1.1300 short term bottom is still in favor to extend higher for 1.1509 support turned resistance. However, we’d expect upside to be limited below 1.1745 resistance to bring down trend resumption. On the downside, break of 1.1300 support is now needed to confirm down trend resumption. Otherwise, near term outlook is neutral for more consolidation first.

In the bigger picture, the down trend from 1.2555 medium term is in progress for 61.8% retracement of 1.0339 to 1.2555 at 1.1186. Note again that EUR/USD was rejected by 38.2% retracement of 1.6039 (2008 high) to 1.0339 (2017 low) at 1.2516. That carries some long term bearish implications. Sustained break of 1.1186 could pave the way back to retest 1.0339 low. For now, outlook will remain bearish as long as 38.2% retracement of 1.2555 to 1.1300 at 1.1779 holds, even in case of strong rebound.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:01 | GBP | Rightmove House Prices Y/Y Aug | 1.10% | 1.40% | ||

| 6:00 | EUR | German PPI M/M Jul | 0.20% | 0.40% | 0.30% | |

| 6:00 | EUR | German PPI Y/Y Jul | 3.00% | 3.00% |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals