Dollar is still trading as the strongest for today even though the rebound looks a bit unconvincing. In particular, the greenback is effectively just range bound against against European majors. And in fact, it’s taking turn to be the strongest with Swiss Franc. Meanwhile, Australian Dollar remains the weakest one, followed by New Zealand Dollar. The Aussie is weighed down by its own political turmoil. There is a high chance Prime Minister Malcolm Turnbull would be ousted as soon as tomorrow. And it’s uncertain who of Treasurer Scott Morrison, former Home Affairs Minister Peter Dutton, or Foreign Affairs Minister Julie Bishop would get enough vote for party leadership and the top job.

Released from US, initial jobless claims dropped -2k to 210k in the week ended August 18, below expectation of 215k. Four-week moving average of initial claims dropped -1.75k to 213.75k. Continuing claims dropped -2k to 1.727m in the week ended August 11. Four-week moving average of continuing claims dropped -5k to 1.7355m. The markets paid little attention to the data. Focuses are on the rising impeachment threat for Trump. And Trump himself even threatened the Americans that if he’s impeached, “the market would crash” and “everybody would be very poor”.

In other markets, European indices are trading nearly flat today, “flipping” between gains and losses in very tight range. China’s Shanghai SSE rose 0.37% to close at 2724.62 as new rounds of tariffs from US and China takes effect. Hong Kong HSI dropped -0.49%. Nikkei rose 0.22% and Singapore Strait Times rose 1.56%. Gold breached 1187.40 minor support earlier today but refuses to give in so far.

Technically, weakness of Australian Dollar will remain a main theme in the US session. EUR/AUD just took out 1.5888 resistance to resume the rally from June’s low at 1.5271. It’s heading to 1.6 handle and will very likely challenge 1.6189 resistance in near term. Meanwhile, 1.1493 minor support and EUR/USD and 1.2811 minor support in GBP/USD will be watched to confirm if Dollar is really completing this week’s pull back.

China’s retaliation tariffs start shortly after US tariffs took effect

A new round of US tariffs on Chinese imports has just started today. The US began collecting 25% tariffs on 279 lines of Chinese goods, totalling USD 16B in values. They add to the tariffs on USD 34B of Chinese imports which are already in effect. Shortly after US tariffs on USD 16B in Chinese goods came into effect, China’s equivalent retaliation tariffs also start.

In a brief statement, the Chinese Ministry of Commerce said “China resolutely opposes this, and will continue to take necessary countermeasures.” And, “at the same time, to safeguard free trade and multilateral systems, and defend its own lawful interests, China will file suit regarding these tariff measures under the WTO dispute resolution mechanism.”

ECB accounts: Risks broadly balanced notwithstanding protectionism and market volatility

In the accounts of July monetary policy meeting, ECB noted that “members considered that the risks surrounding the euro area growth outlook could still be assessed as broadly balanced”. Though, there are uncertainties related to global factors “notably the threat of protectionism.”. Also, “risk of persistent heightened financial market volatility also continued to warrant monitoring.”

On inflation, there was “broad agreement” on chief economist Peter Praet’s assessment. Annual HICP inflation rose to 2.0% in June. And, “on the basis of current futures prices for oil, annual rates of headline inflation were likely to hover around the current level for the remainder of the year”. Muted underlying inflation “had been increasing from earlier lows”. Also, there was “increasing support” for domestic cost pressures from “ongoing strengthening in wage growth”. Beside, “members broadly shared the view that uncertainties surrounding the inflation outlook had been receding.”

Regarding communications, “members widely expressed satisfaction that the communication of the June monetary policy decisions had been well understood by financial markets.” And, the “enhanced forward guidance on the future path of policy rates had been effective in aligning market views”. That is, ECB interest rates would remain at current levels “at least through the summer of 2019”. It “struck an appropriate balance” between precision and flexibility and “was remarked that the Governing Council’s expectation was probabilistic in nature.”

Full ECB meeting accounts here.

Bundesbank Weidmann: Get the normalization ball rolling without undue delay

Bundesbank President Jens Weidmann warned today that ECB must not delay monetary policy normalization. He said, it’s ” time to begin exiting the very expansionary monetary policy and the non-standard measures, especially considering their possible side effects.” And, such normalization process would “take place only gradually over the next few years.” That “exactly why it has been so important to actually get the ball rolling without undue delay.”

Weidmann added that ECB’s projection of 1.7% headline inflation for 2020 is “broadly consistent” with the mandate. And, domestic prices are ” likely to intensify as aggregate capacity utilization increases.” Therefore, “they will thus counteract waning impetus from other components of the inflation rate, such as energy prices.”

Eurozone PMIs, manufacturing looking the most susceptible to a trade-led slowdown in coming months

Eurozone PMI manufacturing dropped to 54.6 in August, down from 55.1 and missed expectation of 55.1. PMI services rose to 54.4, up from 54.2 and matched expectations. PMI composite rose to 54.4, up merely 0.1 from 54.3.

Chris Williamson, Chief Business Economist at IHS Markit said that the survey data indicated steady growth in August, and raised hopes that Q3 GDP could match Q2’s 0.4%. However, “warning lights are flashing” as “risks seem tilted to the downside”. He noted “escalating political worries, rising prices and a recent slowdown in order book growth have all contributed to the gloomiest outlook for almost two year”. And, “with manufacturing looking the most susceptible to a trade-led slowdown in coming months, hopes are pinned on a robust service sector helping to drive economic growth as we move into the autumn, yet even here optimism is down to its lowest for nearly two years.”

Also released, Germany PMI manufacturing dropped to 56.1 in August, down from 56.9 and missed expectation of 56.6. PMI services rose to 55.2, up from 54.1 and beat expectation of 54.4. PMI composite rose to 55.7, up from 55.0, hit a 6-month high.

France PMI manufacturing rose to 53.7 in August, up from 53.3 and beat expectation of 53.5. PMI services rose to 55.7, up from 54.9 and beat expectation of 55.1. PMI composite rose to 55.1, up from 54.4 and hit a 4-month high.

UK published documents on no-deal Brexit preparations

UK government published a collection of documents on “How to prepare if the UK leaves the EU with no deal“. Topics covered include applying for EU-funded programs, civil nuclear and nuclear research, farming, Importing and exporting, labelling products and making them safe, money and tax, regulating medicines and medical equipment, state aid, studying in the UK or EU, workplace rights.

Brexit minister Dominic Raab said he wanted to make sure Britain “goes from strength to strength, even in the unlikely event that we do not reach a negotiated deal with the European Union.” Nonetheless, Raab remained “confidence that a good deal is within out sights”.

Japan PMI manufacturing: Weaker international sales weighed on business confidence

Japan PMI manufacturing rose 0.2 to 52.5 in August, slightly above expectation of 52.4. Markit noted in the release that “input and output price inflation at multi-year highs.” While overall demand improves, “export orders fail to rise for a third straight month”.

Joe Hayes, Economist at IHS Markit, said that the growth cycle in Japan’s manufacturing sector extended to two years, “the longest uninterrupted stretch of expansion since the global financial crisis”. But declining export orders suggested the expansion was “underpinned by strength in the domestic market.”

Meanwhile, “weaker international sales weighed on business confidence, with panellists citing potential trade conflicts as a key risk to their outlook over the coming year.”

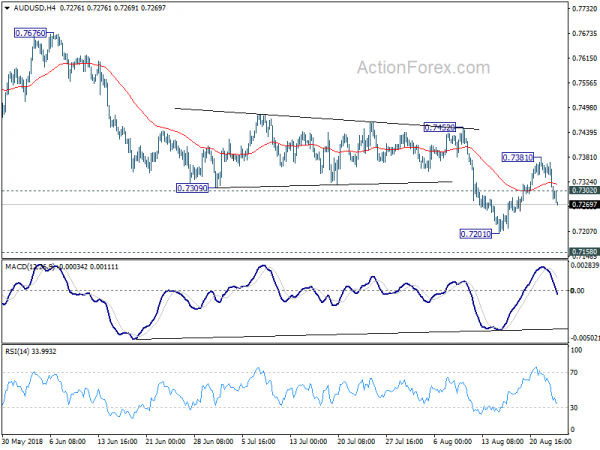

AUD/USD Mid-Day Outlook

Daily Pivots: (S1) 0.7335; (P) 0.7352; (R1) 0.7371; More…

AUD/USD’s decline from 0.7381 is still in progress and intraday bias stays on the downside for 0.7201 low. Firm break there will resume larger down trend fro 0.8135. In that case, 0.7158 medium term support will be the next target. On the upside, above 0.7302 minor resistance will turn intraday bias neutral first. And, even in case that correction from 0.7201 extends with another rise, we’d expect upside to be limited by 0.7425 resistance to bring larger down trend resumption eventually.

In the bigger picture, rebound from 0.6826 (2016 low) is seen as a corrective move that should be completed at 0.8135. Fall from there would extend to have a test on 0.6826. There is prospect of resuming long term down trend from 1.1079 (2011 high). But we’ll look at downside momentum to assess at a later stage. On the upside, break of 0.7452 resistance, however, will indicate medium term bottoming, on bullish convergence condition in daily MACD. In that case, a correction should be seen first, with stronger rebound would be seen to 38.2% retracement of 0.8135 to 0.7201 at 0.7558. The down trend from 0.8135 will resume after the correction completes.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 00:30 | JPY | PMI Manufacturing Aug P | 52.5 | 52.4 | 52.3 | |

| 07:15 | EUR | France Manufacturing PMI Aug P | 53.7 | 53.5 | 53.3 | |

| 07:15 | EUR | France Services PMI Aug P | 55.7 | 55.1 | 54.9 | |

| 07:30 | EUR | Germany Manufacturing PMI Aug P | 56.1 | 56.6 | 56.9 | |

| 07:30 | EUR | Germany Services PMI Aug P | 55.2 | 54.4 | 54.1 | |

| 08:00 | EUR | Eurozone Manufacturing PMI Aug P | 54.6 | 55.1 | 55.1 | |

| 08:00 | EUR | Eurozone Services PMI Aug P | 54.4 | 54.4 | 54.2 | |

| 10:00 | GBP | CBI Realized Sales Aug | 29 | 13 | 20 | |

| 11:30 | EUR | ECB Monetary Policy Meeting Accounts | ||||

| 12:30 | USD | Initial Jobless Claims (AUG 18) | 210K | 215K | 212K | |

| 13:00 | USD | House Price Index M/M Jun | 0.30% | 0.20% | ||

| 13:45 | USD | Manufacturing PMI Aug P | 55.1 | 55.3 | ||

| 13:45 | USD | Services PMI Aug P | 55.9 | 56 | ||

| 14:00 | USD | New Home Sales Jul | 651K | 631K | ||

| 14:00 | EUR | Eurozone Consumer Confidence Aug A | -1 | -1 | ||

| 14:30 | USD | Natural Gas Storage | 47B | 33B |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals