Guppy Indicator Talking Points:

- How I learned to love the Guppy Multiple Moving Average indicator (GMMA or Guppy)

- Guppy helps traders easily identify and capture trending markets

- Guppy can identify shifting market sentiment

As an investor/trader, we always want to trade in the direction of the ‘trend.’ If you’re a day-trader or a long-term investor, knowing the general trend does a lot of the analytical weight lifting for you. I used to struggle in finding the overall trend of the market until I learned about the Guppy Multiple Moving Average indicator (GMMA or Guppy).

Meet The Guppy

Most people suggest using price action to determine overall trends, but price action can be subjective. Guppy is an easy indicator that will allow anyone to determine the overall trend of the market quickly and without personal bias. Once you know the general direction of a trending market, the odds of a successful trade increase.

Guppy Helps With Timing Trades

Another area I struggled with was timing an exit. Guppy also offers insight into potential reversals or periods of consolidation by signaling changes in market sentiment. Although Guppy is a standalone trading strategy, I have found great results combining Guppy with price action and Heikin Ashicharts.

The Origins of the Guppy

First mentioned in Daryl Guppy’s book “Trend Trading,” the Guppy Multiple Moving Average indicator, or GMMA, helps traders identify and trade a trending market. Guppy works by grouping exponential moving averages into two categories, short and long-term.

In an ideal world, a trader is holding positions in the direction of the long-term trend, and entering either when a cross-over appears or adding to a long-term trend-favoring position when the short-term trend shows a favorable entry. I’ve found that the Guppy helps visualize both events of either a broad reversal and or a continuation well.

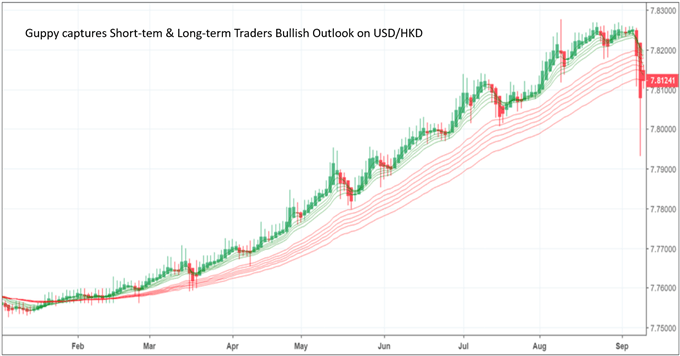

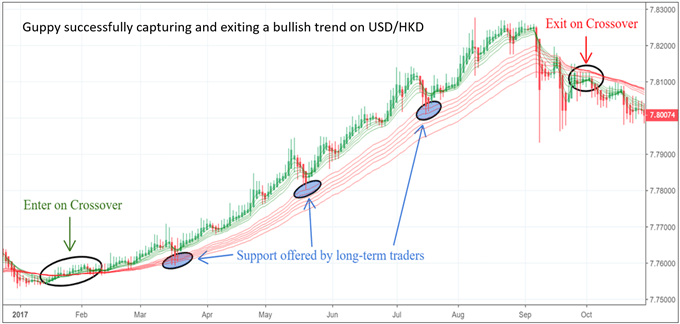

Guppy Captures a USD/HKD bullish trend

Chart Source: TradingView

The green moving averages represent short-term traders and red represents long-term traders. When both the red and green lines are moving in agreement (both trending up or down), we are given a confirmation of market sentiment and trend.

The moving averages may also act as support and/or resistance. When price finds support at these levels, it might be a good time to add positions if you see further upside potential or have spare risk capital available.

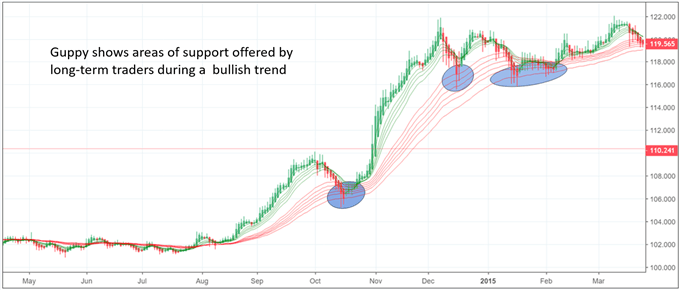

Long-term traders supporting a bullish trend on USD/JPY

Chart Source: TradingView

When price tests the red moving average zone, long-term traders will look to buy more of the pair given their outlook is still bullish. The strength of the trend is determined by the distance between the red and green moving average clusters.

The further the distance, the greater the trend. Another way to evaluate the strength of a trend is to evaluate the spread between each moving average cluster. If the long-term red averages are spread out nicely, this indicates that the support/resistance level is broad and strong.

If the lines within a cluster are narrowing, this indicates momentum is declining, and a reversal or consolidation could follow.

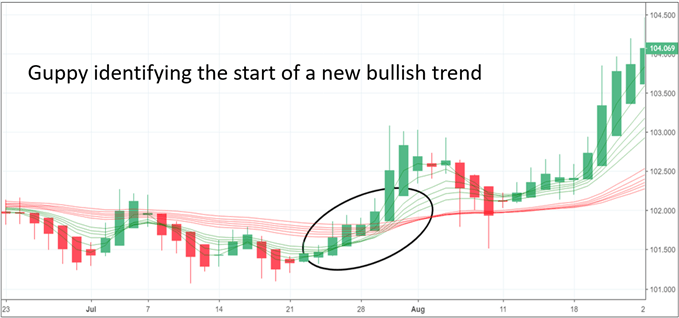

Just like Simple Moving Averages, we can use crossovers as entry and exit signals. When the short-term moving average cluster crosses over the long-term, this signals a change in market sentiment and suggest that short-term traders are starting a new trend.

Guppy suggesting a bullish trend starting on USD/JPY

Chart Source: TradingView

For instance, this Guppy crossover indicates that short-term traders have become optimistic about this pair and could potentially start a new bullish trend. The strength of the trend is determined by the distance between the red and green moving average clusters. The further the distance, the greater the trend.

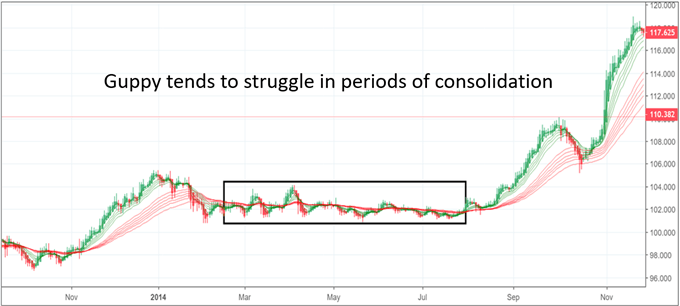

Sense GMMA was designed for trending assets; the indicator runs into problems when price consolidates. The indicator shows consolidation and potential reversals when the short and long-term moving averages condense.

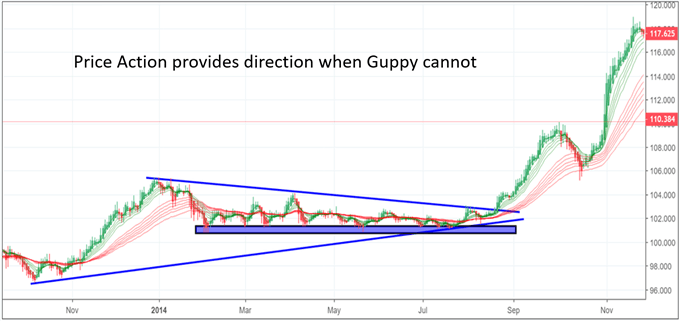

Guppy moving averages condensing during a consolidation period on USD/JPY

Chart Source: TradingView

In times of consolidation, I find it useful to combine Price Action with GMMA. The reason Guppy struggles in trendless markets is due to the output being delayed. This fundamental problem is caused by how moving averages are calculated. Price action is a pure analysis of, you guessed it, price. This means there are no data lags due to equations. Below I overlay a Symmetrical Triangle with a Support Zone.

Price Action and Guppy capturing a bullish trend

Chart Source: TradingView

When price starts to breakout, the GMMA is used to confirm the trend. I use Heikin Ashicharts, to filter out ‘noise’ from my charts. The combination of GMMA, Price Action, and Heikin Ashi will benefit anyone looking to catch momentum and trends.

Using Guppy to capture a bullish swing on USD/HKD

Chart Source: TradingView

Bottom Line on Trading with Guppy:

Although a simple indicator, Guppy can offer valuable insight to any momentum or swing trader. Guppy is a standalone trading strategy; however, I have found the greatest returns when combining Guppy with price action and heikin ashi charts.

Price action addresses periods of consolidation, where Guppy tends to underperform. Heikin ashi removes a lot of the ‘noise’ created by candlesticks so a trader can focus on the overall trend instead of small movements. Together Guppy, price action, and heikin ashi charts can help traders identify and capture trending markets.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals