As the week is heading towards the close, Dollar is trying to pare back some of the losses over the few days. Mixed economic from the US are ignored by the markets. Nonetheless, the greenback is outshone slightly by the Swiss Franc, which is so far to strongest for today. On the other hand, Australian and Canadian Dollar weakens generally. Over the week, Sterling is the strongest one, followed by Canadian Dollar. Yen is the worst performing one, followed by Dollar.

In other markets, major European stock indices are trading up slightly today. FTSE is up 0.22% at the time of writing, DAX up 0.34% and CAC also up 0.34%. German 10 year bund yield display some sustainable strength and is up 0.33% 0.458. Two weeks ago on August 31, 10 year bund yield was at 0.330. Earlier in Asia, Nikkei closed up 1.2%, Hong Kong HSI up 1.01%, Singapore Strait Times up 0.95%. But China Shanghai SSE dropped -0.18%.

Released from the US, headline retail sales rose 0.1% mom in August, below expectation of 0.4% mom. Ex-auto sales rose 0.3% mom, below expectation of 0.5% mom. Import price index dropped -0.6% mom versus expectation of -0.2% mom. Industrial production rose 0.4% mom in August, above expectation of 0.3% mom. Capacity utilization rose to 78.1%.

UK Raab: Substantive differences remain with EU and Brexit agreement

UK Brexit Minister Dominic Raab held a phone call with EU chief negotiator Michel Barnier. After that, Raab said “while there remain some substantive differences we need to resolve, it is clear our teams are closing in on workable solutions to the outstanding issues in the Withdrawal Agreement, and are having productive discussions in the right spirit on the future relationship.”

Raab added that “we agreed to review the state of play in the negotiations following the informal meeting of heads of state or government of the European Union in Salzburg next Thursday, and we reiterated our willingness to devote the necessary time and energy to bring these negotiations to a successful conclusion.”

BoE Carney on Brexit: Hope for the best but plan for the worst

In a speech at the Irish central bank, BoE Governor Mark Carney emphasized that BoE is ” well-prepared for whatever path the economy takes, including a wide range of potential Brexit outcomes.” And, “we have used our stress test to ensure that the largest UK banks can continue to meet the needs of UK households and businesses even through a disorderly Brexit, however unlikely that may be.” He emphasized that “our job, after all, is not to hope for the best but to plan for the worst.”

It’s reported that Carney told Prime Minister Theresa May’s cabinet a no-deal Brexit could trigger 25-35% fall in UK house prices over three years. He said today that this is not a prediction but something that the central bank needs to be prepared for.

ECB Smets: Gradual policy normalization support reflationary process

ECB Governing Council member Jan Smets reiterated the central bank’s forward guidance and the implication that policy normalization will be slow and gradual. He said in a conference that “we reiterated the forward guidance on the reinvestment and on policy rates, implying that we do foresee a very gradual process of policy normalization.” And, “that will allow financing conditions to remain very favorable and to support both the economy and the associated reflationary process we are aiming for.”

Released fro Eurozone, trade surplus narrowed to EUR 12.8B in July.

Japan PM Abe would like BoJ to end ultra-loose policy in his next term

Japan Prime Minister Shinzo Abe said BoJ’s ultra loose monetary policy should not last “forever”. Now, he said that “wages are finally picking up … We’re starting to see consumption and capital expenditure boost growth.” And he’d like to end the ultra-loose policy “during my next term”.

But “when to modify the easy policy is up to (BOJ Governor Haruhiko) Kuroda. I’ve left that decision to him.” He added that “the BOJ’s price target is one measurement in guiding policy but the real goal is to boost growth and employment.” “We’ve seen a significant improvement in job growth.”

Elsewhere, New Zealand Business NZ manufacturing PMI rose to 52 in August up from 51.2. China retail sales grew 9.0% yoy in August, beat expectation of 8.8%. However, industrial production grew 6.1% yoy, below expectation of 6.2% yoy. Fixed assets investment few 5.3% yoy, below expectation of 5.7% yoy.

EUR/USD Mid-Day Outlook

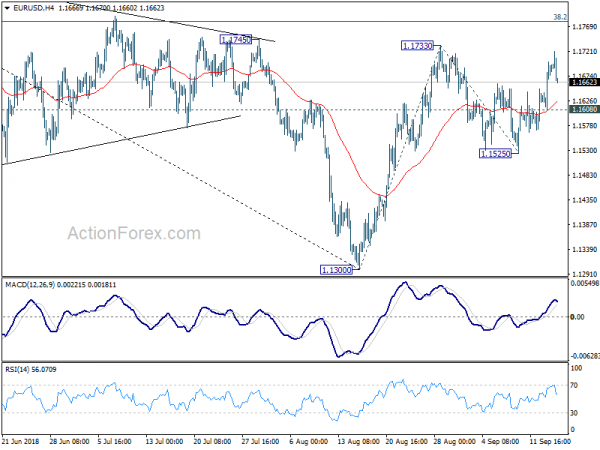

Daily Pivots: (S1) 1.1632; (P) 1.1667; (R1) 1.1725; More…..

EUR/USD failed to break through 1.1733 resistance and retreats notably in early US session. Intraday bias is turned neutral first. Further rise cannot be ruled out as long as 1.1608 minor support holds. However, we’d still expect strong resistance from 38.2% retracement of 1.2555 to 1.1300 at 1.1779 to limit upside. On the downside, break of 1.1608 minor support will turn bias to the downside for 1.1525 support. Break will indicate completion of whole rebound from 1.1300. However, firm break of 1.1779 will extend the rise to 100% projection of 1.1300 to 1.1733 from 1.1525 at 1.1958.

In the bigger picture, a medium term bottom should be in place at 1.1300, on bullish convergence condition in daily MACD and some consolidations would be seen. But still, note that EUR/USD was rejected by 38.2% retracement of 1.6039 (2008 high) to 1.0339 (2017 low) at 1.2516. That carries some long term bearish implications. Thus, we’d expect fall from 1.2555 high to resume after consolidation completes. Below 1.1300 should send EUR/USD through 61.8% retracement of 1.0339 to 1.2555 at 1.1186. And, in that case, EUR/USD would head to retest 1.0339 (2017 low).

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:30 | NZD | BusinessNZ Manufacturing PMI Aug | 52 | 51.2 | ||

| 02:00 | CNY | Retail Sales Y/Y Aug | 9.00% | 8.80% | 8.80% | |

| 02:00 | CNY | Industrial Production Y/Y Aug | 6.10% | 6.20% | 6.00% | |

| 02:00 | CNY | Fixed Assets Ex Rural YTD Y/Y Aug | 5.30% | 5.70% | 5.50% | |

| 04:30 | JPY | Industrial Production M/M Jul F | -0.20% | -0.10% | -0.10% | |

| 09:00 | EUR | Eurozone Trade Balance (EUR) Jul | 12.8B | 16.3B | 16.7B | |

| 12:30 | USD | Retail Sales Advance M/M Aug | 0.10% | 0.40% | 0.50% | 0.70% |

| 12:30 | USD | Retail Sales Ex Auto M/M Aug | 0.30% | 0.50% | 0.60% | 0.90% |

| 12:30 | USD | Import Price Index M/M Aug | -0.60% | -0.20% | 0.00% | -0.10% |

| 13:15 | USD | Industrial Production M/M Aug | 0.40% | 0.30% | 0.10% | 0.40% |

| 13:15 | USD | Capacity Utilization Aug | 78.10% | 78.40% | 78.10% | 77.90% |

| 14:00 | USD | Business Inventories Jul | 0.50% | 0.10% | ||

| 14:00 | USD | U. of Mich. Sentiment Sep P | 96.9 | 96.2 |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals