As the leaders of the EU gather in Austria today, British PM May hopes to convince them of the merits of her Chequers plan, in an attempt to lay the groundwork for a breakthrough in the Brexit negotiations. While no formal announcements will be delivered, sterling could still prove sensitive to any relevant remarks. Going forward, a realistic proposal that solves the Irish border issue may be needed for the currency to extend its recent gains.

The heads of state of the EU27 will meet for an informal two-day summit in Austria today, the first time these leaders will share the same roof since the UK government publicized its Chequers plan for Brexit back in July. During dinner tonight, British PM Theresa May will be allowed 10 minutes to “pitch” her withdrawal proposals, before the 27 officials discuss Brexit in May’s absence on Thursday.

Note that no negotiations will actually take place between them. The EU chiefs will simply listen to May, respecting the authority of Michel Barnier to conduct all negotiations on their behalf. Moreover, since this is an informal gathering, there will be no official EU statement on Brexit. Hence, any market reaction to this event will probably come from potential comments by the relevant EU leaders – if at all.

The EU has adopted a more conciliatory tone lately. Key EU officials including Barnier have gone out of their way to stress the Union wants a deal, even noting Europe is ready to improve its proposals on what is likely the biggest obstacle left; the Irish border. Naturally, sterling regained a lot of lost ground in the midst of this, as traders became less pessimistic and positioned for the possibility of an agreement.

Yet, filtering out much of the noise, the bigger picture hasn’t changed. For all the optimistic remarks out of Brussels, there’s been no fundamental shift by either side on the Irish border question. Both want a frictionless border between the two Irelands but cannot reach common ground on the mechanics that would govern it, each rejecting the other’s proposals as unworkable. The UK believes it has compromised enough to reach the controversial Chequers plan, over which two UK ministers resigned, and that it’s now the EU’s turn to soften its stance. While that is certainly possible, it may also be a case of wishful thinking on the UK’s part, as the EU has long been adamant that it won’t put the integrity of the single market at stake to strike a deal with Britain. Similarly, May has stressed that she won’t put the UK’s constitutional integrity at risk by drawing a regulatory border across the Irish Sea as proposed by the EU.

Although this event may prove out to be a “dud”, in the sense it’s unlikely to deliver any concrete announcements, sterling has displayed a tendency to move sharply even on the tiniest bit of news. Hence, the tone of any remarks by EU leaders may prove crucial for the currency’s near-term direction – even in the absence of real substance.

Looking ahead however, sterling’s performance may hinge primarily on whether some realistic and workable proposal for the Irish border is submitted, and whether there is tangible progress in the negotiations beyond merely appeasing remarks. If so, the pound could explode higher as the prospect of a no-deal exit fades into the rear-view mirror.

On the contrary, a lack of meaningful progress before the next formal EU summit on October 18, could spell bad news for sterling as speculation for a no-deal exit regains steam. Expectations are currently riding high that an accord may be finalized ahead of this summit, and if not, that the EU will announce a special Brexit summit for November as a last-ditch attempt to reach an agreement.

In the meantime, the Conservative Party conference commencing on September 30 is also worth watching, as Theresa May could have a mutiny on her hands. Hardline Brexiteers in her party like Boris Johnson – who are unhappy with her softening Brexit stance – might mount a leadership challenge. This presents a downside risk for sterling, as such an internal fight would raise political uncertainty at a time when the government’s full efforts should be focused elsewhere.

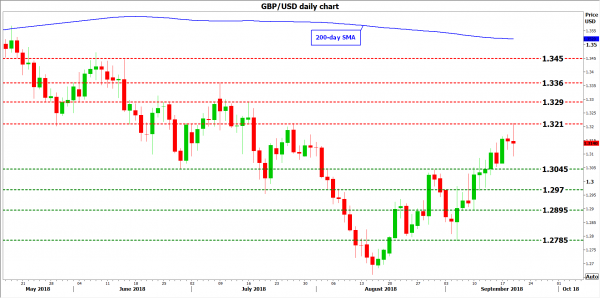

Technically, looking at sterling/dollar, further advances could encounter resistance near 1.3210, the high of July 26. An upside break may pave the way for a test of 1.3290, this being the peak of July 16, before the July 9 top of 1.3360 comes into view. Conversely, in case of declines, support may be found around 1.3045, the high of August 30. If the bears pierce below it, the September 11 low of 1.2970 would be eyed next, ahead of the September 10 trough at 1.2895.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals