Italy is the center of focus in a rather quiet day. The highly anticipated response to EU on its budget is delivered. And there is little surprise that Italy insists on sticking with it’s budget deficit target of 2019. Euro’s rally attempt falters after that and turned mixed. Nonetheless, sterling is even weaker as Brexit uncertainty is neverending even though 95% of the withdrawal agreement is done. New Zealand and Australian Dollar continue to decouple from Chinese stock, which staged a strong rally today, and are trading as the next weakest. On other hand, Canadian Dollar, Dollar and Swiss Franc are the stronger ones today so far. (if you want to make money in the financial market use our forex robot)

In other markets, Italian 10 year yield hit as low as 3.318 earlier today but it’s now back at 3.474, down -1.08. The decline is more of a response to Moody’s downgrade of Italy with stable outlook on Friday. German 10 year yield is down -0.20 at 0.443. German-Italian spread is now at 303, still an alarming level. European stocks are firm, though, with FTSE up 0.82%, DAX up 0.53% and CAC up 0.27% at the time of writing.

Another major development today and the strong rally in Chinese stocks. Shanghai SSE closed up 4.09% at 2654.88. The two day strong rebound should confirm medium term bottoming at 2449.19 after climax selling on Friday. There is prospect of breaking through 2700 psychological level in near term. Other Asian markets followed higher, with Hong Kong HSI up 2.32%, Nikkei up 0.37% and Singapore Strait Times up 0.51%.

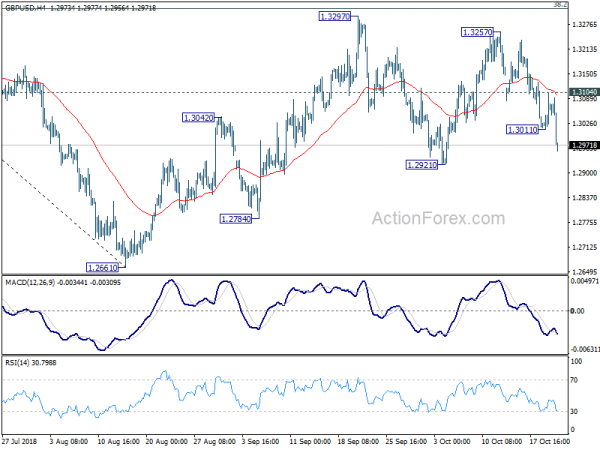

Technically, GBP/USD’s break of 1.3011 temporary low suggest decline resumption and focus is turned to 1.2921 support. At the same time, GBP/JPY is eyeing 145.67 key support level. Meanwhile, EUR/GBP’s break of 0.8847 resistance is seen as signal of bullish reversal. EUR/USD was rejected by 4 hour 55 EMA today while EUR/JPY was rejected by 130.29 minor resistance. Nonetheless both pairs are kept well above last week’s lows. Thus, EUR/USD and EUR/JPY are bias-neutral for now. (Read fundamental analysis…)

Italy tells EU it will stick to hard but necessary budget

In a formal response to the EU, Italian Economy Minister Giovanni Tria indicated the country will stick to its draft budget plan. That is, the deficit to GDP target for 2019 will be kept at 2.4%. Though, Tria expressed the eagerness to engage in conversation with EU. Prime Minister Giuseppe Conte also emphasized that 2.4% is the cap that “for sure we won’t exceed”.

Tria said the budget was a “hard, but necessary decision in light of Italy’s delay in catching up to pre-crisis levels of GDP and the desperate economic conditions in which the most disadvantaged citizens find themselves in”. And, “the government trusts that what it has explained is sufficient to clear up the setup of its budget and that the (fiscal) law will not put at risk the financial stability of Italy or other EU state members.”

Also, he said “while recognizing the divergence of the respective evaluations, the Italian government will remain in a constructive and fair dialogue.” And, “the government is confident it can get investment and GDP growth moving again and that the recent rise in the government bond yields will be reabsorbed as the investors learn about all the details of the measures in the budget law.”.

EU Moscovici doesn’t want crisis with Italy, Austria said must reject the budget

European Economic Affairs Commissioner Pierre Moscovici talked about Italy again in France Inter radio today. He emphasized that the European Commission does not want any crisis with Italy over it’s budget. However, questions are there and the Commission is awaiting Italy’s answers.

Moscovici said that “the European Commission does not want a crisis between Brussels and Rome.” And “my state of mind is that of constructive dialogue.” Though, he also reiterated that “when you are an EU member and a member of the single currency, of the euro zone, you must respect a number of joint rules.” Moscovici has been rather cautious in handling Italy. While last week’s letter to Italy regarding the budget was strongly worded, Moscovici later said he wanted to reduce tensions, and solve the budget issue through “constructive dialogue”.

On the other hand, Austria Chancellor Sebastian Kurz warned that “if it is not amended, the European Commission must reject the budget” of Italy. Kurz added that “Austria is not prepared to stand up for the debts of other states while these states knowingly contribute to uncertainty in financial markets”. And he urged the EU to “prove that it has learned from the Greece crisis.” (Use Keltner channel robot)

Bundesbank expects German economy to expand considerably again in Q4

Germany’s Bundesbank said today that the economy “may have come to a temporary halt” in Q3. The “booming” constructor sector have even “decelerated” after strong Q2. Also, retail sales were “relatively subdued”. However, the bank does not expect the pause in growth to be long-lived. And, business expectations the auto sector “rose significantly of late.”

Bundesbank expects “economic output to expand considerably again in the current three-month period.” The bank also noted “rather sharp fall” in unemployment, which could be attributable in part to “the expansion of labour market policy measures at the end of the summer holiday period.”

UK PM May rejects EU’s proposal on Irish backstop again

UK Prime Minister Theresa May is set to tell the Parliament that Brexit agrement is now 95% done. But she also repeated her rejection of EU’s proposal on Irish backstop.

In her prepared speech, May said “taking all of this together, 95 per cent of the Withdrawal Agreement and its protocols are now settled”, referring to what she has achieved. And, “the shape of the deal across the vast majority of the Withdrawal Agreement is now clear.”

However, on Irish border backstop, May said “As I set out last week, the original backstop proposal from the EU was one we could not accept, as it would mean creating a customs border down the Irish Sea and breaking up the integrity of the UK,” She reiterated that “I do not believe that any UK Prime Minister could ever accept this. And I certainly will not.”

So, the deadlock is still there and the deal is not finished yet. No matter how much May’s done, without that outstanding 5% completed, it’s still a no-deal Brexit.

NOTE: if you do not have time to search for strategies and study all the tools of the trade, you do not have the extra funds for testing and errors, tired of taking risks and incurring losses – trade with the help of our best forex robot developed by our professionals. We offer forex auto trading robot free download .

GBP/USD Mid-Day Outlook

Daily Pivots: (S1) 1.3016; (P) 1.3060; (R1) 1.3109; More…

GBP/USD’s fall resumed by taking out 1.3011 and reaches as low as 1.2956 so far. Intraday bias is back on the downside for 1.2921 first. Firm break there will add to the case that corrective rise from 1.2661 has completed. Next target will be 1.2661/2784 support zone. On the upside, above 1.3104 minor resistance will turn intraday bias neutral again. Also, in case of another rise, upside should be limited by 1.3316 key fibonacci level to bring down trend resumption eventually.

In the bigger picture, whole medium term rebound from 1.1946 (2016 low) should have completed at 1.4376 already, after rejection from 55 month EMA. The structure and momentum of the fall from 1.4376 argues that it’s resuming long term down trend. And this will be the preferred case as long as 38.2% retracement of 1.4376 to 1.2661 at 1.3316 holds. However, firm break of 1.3316 would bring stronger rebound to 61.8% retracement at 1.3721. And, the eventual depth of the fall from 1.4376, and the chance of hitting 1.1946 low, will depend on the strength of the interim corrective rebound from 1.2661.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 04:30 | JPY | All Industry Activity Index M/M Aug | 0.50% | 0.40% | 0.00% | -0.20% |

| 12:30 | CAD | Wholesale Trade Sales M/M Aug | -0.10% | 0.10% | 1.50% | 1.10% |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals