Euro enjoys a brief recovery after ECB stands pat on monetary. ECB President Mario Draghi expressed his confidence on inflation outlook due to underlying strength of the economy. But together with other European majors, the common currency is quickly under selling pressure again. Dollar is trading to rally in early US session but stays overwhelmed by Australian and New Zealand Dollar, which are the strongest. Swiss Franc and Canadian are the weakest ones for the moment.

Technically, one development to note is that strong rebound in USD/CAD today. And the focus is back on 1.3132 resistance for the pair. AUD/USD has been very resilient so far despite risk aversion. Nonetheless, it’s equally sluggish in rally attempt. We’d expect more downside in AUD/USD to 0.7040 should Dollar takes back the stage.

In other markets, European stocks are mixed for the moment. FTSE is trading down -0.34%, DAX is down -0.08% but CAC is up 0.89%. German 10 year yield is flip-flopping around 0.4 handle. Italian 10 year yield, though is down slightly by -0.115 at 3.502. German-Italian yield spread is below Italian Economy Minister Giovanni Tria’s 320 unsustainable level, but still well above 300.

Earlier in Asia, Nikkei closed sharply lower by -822.45 pts or -3.72% to 21268.73. Hong Kong HSI lost -1.01% and Singapore Strait Times dropped -0.63%. But China Shanghai SSE staged late rebound to close “up” 0.02% at 2603.80, even reclaimed 2600 handle. On development to note is that Japanese 10 year JGB yield dropped for another day by -0.0206 to 0.114. It was above 0.15 just a few days ago. But such decline should be welcomed by BoJ, which set the allowed range for 10 year JGB yield to be -0.1 to 0.1%. (if you want to make money in the financial market use our forex bot)

ECB stands pat as widely expected, Draghi confident on inflation outlook

ECB left main refinancing rate unchanged at 0.00% as widely expected. Marginal lending rate and deposit rate were held at 0.25% and -0.40% respectively. It also reiterated that interest rates will “remain at their present levels at least through the summer of 2019”. ECB also sticks with the plan to end the EUR 15B per month asset purchase after December.

In the post meeting press conference, ECB President Mario Draghi said “incoming information, while somewhat weaker than expected, remains overall consistent with an ongoing broad-based expansion of the euro area economy and gradually rising inflation pressures.” Also, “the underlying strength of the economy continues to support our confidence that the sustained convergence of inflation to our aim will proceed and will be maintained even after a gradual winding down of our net asset purchases.”

On inflation, Draghi noted while underlying inflation remains muted, they have been increasing from earlier lows. And underlying inflation is expected to increase further over the medium term. For now, Draghi iterated that significant amount of monetary policy stimulus is still needed to support buildup of price pressure. On growth, Draghi said risks can still be assessed as “broadly balanced”. Main prominent downside risks include trade protectionism, emerging markets and financial market volatility.

Overall Draghi’s press conference is composed as usual. EUR/USD recovers mildly but there is no change in it’s near term bearish outlook.

For traders: We recommend you odin forex robot free download for test in mt4 or our best Portfolio of forex robots

German Ifo dropped to 102.8, global uncertainty increasingly taking its toll

German Ifo business climate dropped to 102.8 in October, down from 103.7, below expectation of 103.2. Current assessment gauge dropped to 105.9, down from 106.4 and missed expectation of 106.0. Expectations gauge dropped to 99.8, down from 101 and missed consensus of 100.3. Manufacturing, services and trade indices record decline in the month, but construction hit another record high.

Ifo president Clemens Fuest noted in the release that “firms were less satisfied with their current business situation and less optimistic about the months ahead. Growing global uncertainty is increasingly taking its toll on the German economy.”

Italy Di Maio: Markets not concerned with budget, but false storytelling of Euro exit

Italian Deputy Prime Minister, leader of the Five-Star Movement, Luigi Di Maio reiterates today the government will not change its 2019 budget deficit target of 2.4% despite rejection by the European Commission. He added, “in the following weeks we’ll discuss our budget with the European Union and it will be possible to read out the details of our fiscal plan.”

He also tried to play down recent surge in German-Italian spread, which is a serious sign of investor nervousness. Di Maio said “Markets are not concerned about Italy not respecting the EU budget rules. Investors are worried about false storytelling according to which Italy wants to leave the euro and the European Union. That is not the case.”

US jobless claims rose to 215k, core durable orders missed

US initial jobless claims rose 5k to 215k in the week ended October 20, above expectation of 208K. Four-week moving average of initial claims was unchanged at 211.75k. Continuing claims dropped -5k to 1.636m in the week ended October 13, lowest since August 4, 1973. Four-week moving average of continuing claims dropped -6.75k to 1.6465m, lowest since August 11, 1973.

Also from the US, trade deficit widened to USD -76.0B in September. Headline durable goods orders rose 0.8% September, above expectation of -1.1%. But ex-transport orders rose 0.1%, below expectation of 0.3%. Wholesale inventories rose 0.3% mom in September.

NOTE: if you do not have time to search for strategies and study all the tools of the trade, you do not have the extra funds for testing and errors, tired of taking risks and incurring losses – trade with the help of our Keltner channel forex robot developed by our professionals. Also you can testing in Metatrader our forex auto scalper robot free download .

Fed’s Beige Book: Tariffs getting more attentions from businesses

Fed’s Beige Book economic report, released yesterday, warned that “manufacturers reported raising prices of finished goods out of necessity.” Such price hikes were attributed to higher raw materials costs “which they attributed to tariffs.” Though, overall inflation pressure were just “modest-to-moderate” in all districts. In the 32-page report, the word “tariff” or its derivations were mentioned a total of 51 times. And, with the exception of St. Louis, all districts made reference to tariffs one way or the other. That’s quite a sharp jump from 42 times in September.

For example, In Dallas, it’s noted that “among manufacturers, roughly 60 percent of contacts said the tariffs announced and/or implemented this year have resulted in increased input costs. The share was even higher among retailers, at 70 percent.” In Minneapolis, “a producer of dry beans reported that a large regular annual order from European Union countries was canceled due to tariffs.” In Philadelphia, “other firms reported difficulty meeting the prices of foreign competitors who are not exposed to tariffs on the primary input commodities of their products.”

EUR/USD Mid-Day Outlook

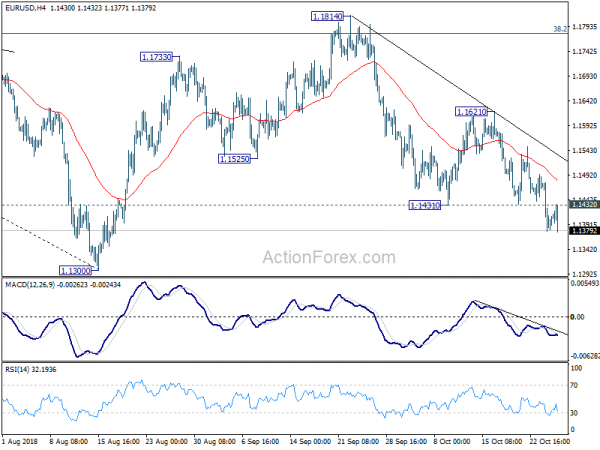

Daily Pivots: (S1) 1.1356; (P) 1.1416; (R1) 1.1454; More….

EUR/USD recovers after hitting 1.1378 but quickly lost steam. Intraday bias stays on the downside at this point. Current fall from 1.1814 should extend to retest 1.1300 low. Decisive break there will resume whole down trend from 1.2555. On the upside, above 1.1432 minor resistance will turn intraday bias neutral first. But outlook will remain cautiously bearish as long as 1.1621 resistance holds.

In the bigger picture, corrective pattern from 1.1300 could have completed at 1.1814 after hitting 38.2% retracement of 1.2555 to 1.1300 at 1.1779. Decisive break of 1.1300 will resume the down trend from 1.2555 to 61.8% retracement of 1.0339 (2017 low) to 1.2555 at 1.1186 next. Sustained break there will pave the way to retest 1.0339. On the upside, break of 1.1814 will delay the bearish case and extend the correction from 1.1300 with another rise before completion.

Economic Indicators Update

-0.20%-1.80%

47B81B

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:45 | NZD | Trade Balance Sep | -1560M | -1365M | -1484M | -1470M |

| 23:50 | JPY | Corporate Service Price Y/Y Sep | 1.20% | 1.20% | 1.30% | |

| 08:00 | EUR | German IFO Business Climate Oct | 102.8 | 103.2 | 103.7 | |

| 08:00 | EUR | German IFO Current Assessment Oct | 105.9 | 106 | 106.4 | 106.6 |

| 08:00 | EUR | German IFO Expectations Oct | 99.8 | 100.3 | 101 | 100.9 |

| 11:45 | EUR | ECB Rate Decision | 0.00% | 0.00% | 0.00% | |

| 12:30 | EUR | ECB Press Conference | ||||

| 12:30 | USD | Advance Goods Trade Balance Sep | -76.0B | -74.9B | -75.5B | |

| 12:30 | USD | Durable Goods Orders Sep P | 0.80% | -1.10% | 4.40% | |

| 12:30 | USD | Durables Ex Transportation Sep P | 0.10% | 0.30% | 0.00% | |

| 12:30 | USD | Wholesale Inventories M/M Sep P | 0.30% | 0.50% | 1.00% | |

| 12:30 | USD | Initial Jobless Claims (OCT 20) | 215K | 208K | 210K | |

| 14:00 | USD | Pending Home Sales M/M Sep | ||||

| 14:30 | USD | Natural Gas Storage |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals