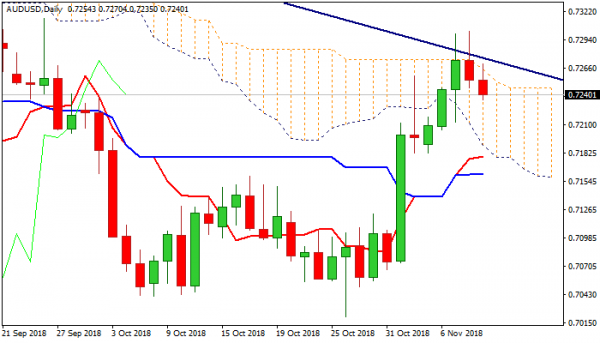

The Australian dollar stands at the back foot on Friday and extends pullback after double upside rejection at 0.7300 zone and repeated failure to close above cracked top of falling daily cloud.

Lower Asian stocks and weaker than expected Australian housing data added to negative near-term sentiment, offsetting overall positive tone from RBA’s monetary policy statement, with bearish signal coming from reversal of daily slow stochastic from overbought zone.

Overall structure remains bullish with pullback seen as positioning for renewed attempt at strong resistances at 0.7260/75 zone (20WMA/100SMA/daily cloud top/Fibo 38.2% of 0.7676/0.7017/trendline resistance).

Strong supports at 0.7190/80 zone (Fibo 38.2% 0.7020/0.7302/rising 10SMA/daily cloud base) need to contain extended downticks to keep bulls in play for fresh advance. Conversely, close below 0.7180 pivot would sideline bulls and signal further weakness.

Res: 0.7299, 0.7314, 0.7381, 0.7446

Sup: 0.7235, 0.7194, 0.7180, 0.7161

We offer you free download forex robot based on stop and reverse system for testing results in Metatrader.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals