The US dollar rose against most major pairs on Friday. Only the Japanese yen was able to gain against the mighty greenback. The FOMC statement eased concerns that the Fed would hint at a pause in its tightening of monetary policy. The lack of changes, and given that there was no press conference, and lacking other details overall boosted the US dollar ahead of the release of inflation and retail sales data. The uncertainty about the US-midterms has passed and the market remains confident in US growth despite political parties splitting house and senate.

US fundamentals have worked in favor of the dollar. European data will decide the fate of the euro with the release of German ZEW Economic Sentiment, German preliminary GDP and the European Union first estimate of quarterly GDP growth. ECB policy makers Mario Draghi and Jens Weidmann will speak in Frankfurt to close the week with investors eager for insights into the next steps of the central bank.

- US core inflation expected at 2.2 percent

- US retail sales to bounce back with 0.6 percent gain

- Italian budget due on Tuesday with little compromise anticipated

Dollar Back in Control Ahead of Inflation and Sales Data

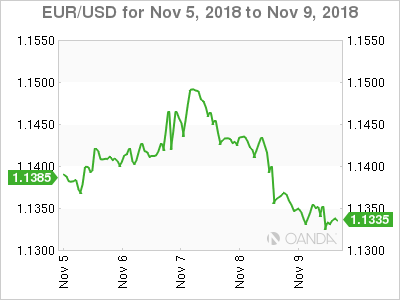

The EUR/USD lost 0.43 percent in the last five trading sessions. The single currency is trading at 1.1334. The euro rose near the 1.15 price level as the results of the midterms was released but as uncertainty cleared andThe FOMC rate statement was published the dollar rose. The gap in rates between the US and Europe will grow bigger as December has high probabilities of an interest rate lift by the Fed.

The slowdown of the Chinese economy is increasing worries about global growth and making the US dollar more attractive as a safe haven, putting more downward pressure on the euro.

Brexit Optimism Broken by Johnson Resignation

The GBP/USD gained 0.11 percent in the last five days. Sterling is trading at 1.2975 versus the USD. The currency pair was lower on Friday as new of the resignation of MP Jo Johnson on Friday. The UK Transport secretary, and brother to Boris, resigned in protest over Theresa May’s Brexit plan. In contrast to his brother, Mr Johnson was a remain campaigner and he has deemed the current deal a terrible mistake.

The Irish backstop has become a bigger headache as what the UK wants will not be acceptable by the EU, and what would be agreed to by the EU would not be easily sold to Northern Ireland.

Kiwi Higher on Employment Data Sensitive to China Slowdown

The NZD/USD gained 1.38 percent during the week. The currency pair is trading at 0.6736 after the Reserve Bank of New Zealand (RBNZ) held rates, but was seen as hawkish. Employment data supported the view of the central bank with the unemployment rate touching a low not seen since 2008. The size of the recovery took the market by surprise and boosted the kiwi against the US dollar.

**Oil Stuck in Downward Spiral **

Energy prices fell this week, West Texas Intermediate dropped 4.67 percent and Brent 3.64 percent as fears that the market will have more oil in play than what it is justified by existing demand. The US sanctions against Iran triggered a rise in prices, with Saudi Arabia and Russia pledging higher production to cover the gap in supply. As sanctions got closer it was announced that Iran’s biggest clients would get waivers, reducing the need for more barrels, but it was already too late to correct production schedules and trades valued oil lower accordingly.

NOTE: if you do not have time to search for strategies and study all the tools of the trade, you do not have the extra funds for testing and errors, tired of taking risks and incurring losses – trade with the help of our best forex robots developed by our professionals.

Gold Drops as Dollar Goes Big After Midterms

Gold fell 1.92 percent during the week after the Fed’s Federal Open Market Committee (FOMC) statement made clear the central bank will continue its pace of monetary policy tightening. A December rate hike. The CME FedWatch tool shows a 75.8 percent probability of a lift to the Fed funds rate at the FOMC meeting on December 19.

Market events to watch this week:

Monday, November 12

- 8:30pm AUD NAB Business Confidence

Tuesday, November 13

- 5:30am GBP Average Earnings Index 3m/y

- 5:30am GBP Unemployment Rate

- 6:00am EUR German ZEW Economic Sentiment

- 7:50pm JPY Prelim GDP q/q

- 8:30pm AUD Wage Price Index q/q

- 10:00pm CNY Fixed Asset Investment ytd/y

- 10:00pm CNY Industrial Production y/y

Wednesday, November 14

- 3:00am EUR German Prelim GDP q/q

- 5:30am GBP CPI y/y

- 5:30am GBP PPI Input m/m

- 5:30am GBP RPI y/y

- 6:00am EUR Flash GDP q/q

- 9:30am USD CPI m/m

- 9:30am USD Core CPI m/m

- 8:30pm AUD Employment Change

Thursday, November 15

- 5:30am GBP Retail Sales m/m

- 9:30am USD Core Retail Sales m/m

- 9:30am USD Retail Sales m/m

- 9:30am USD Empire State Manufacturing Index

- 9:30am USD Philly Fed Manufacturing Index

- 12:00pm USD Crude Oil Inventories

- 5:30pm NZD Business NZ Manufacturing Index

Friday, November 16

- Tentative GBP Inflation Report Hearings

- 9:30am CAD Foreign Securities Purchases

- 9:30am CAD Manufacturing Sales m/m

We offer you free download forex robot based on stop and reverse system for testing results in Metatrader.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals