The US stock markets closed sharply lower overnight while treasury yields also dived. Such patterns continue in Asia, seeing major indices pressured while JGB year yields also drop. There are clear flows out of stocks into bonds. Fed has already turned less hawkish with Chair Jerome Powell’s turn last week. US and China also announced trade truce. The current development argues there are problems lying deeper in the global economy.

In the stock markets, DOW dropped -799.36 pts or -3.10% overnight to close at 25027.07. S&P 500 lost -3.24% while NASDAQ declined -3.80%. Technically, it’s actually not a a surprise as DOW is seen as in medium term correction from 26951.81 high. Thus, it’s common to have a down leg in such corrections. But DOW’s failure to break even 26000 with the rebound is a disappointment and a sign of lack of confidence. In Asia, Nikkei dropped sharply to as low as 21708.82 but pares back some losses. It’s now down -0.67% at 21887. Singapore Strait Times is down -1.0%. Hong Kong HSI is down -1.84% while China Shanghai SSE is down -0.68%.

In the treasury markets, US 10 year yield closed below 3% level for the first time since September. More importantly, 10-year yield dropped sharply by -0.68 to 2.924. 30-year yield dropped even deeper by -0.100 to 3.178. US yield curve is inverted between 3- and 5-year and that’s another development that worried investors. It should also be noted that German 10-year bund yield closed at 0.264 yesterday, lowest since May, and less than half of October high at 0.577. Japan 10-year JGB yield dropped to as low as 0.053 earlier today, and hit the lowest since July. And, 10 year JGB yield hit as high as 0.166 just back in early October. So, the movements in the bond markets are rather drastic.

In the currency markets, Australian Dollar is overwhelmingly the weakest one for today. The Aussie suffers double blow of risk aversion and large GDP miss. Sterling follows as the second weakest as Prime Minister Theresa May’s debate of her Brexit deal in the parliament didn’t go too well. Swiss Franc is the third weakest. For today, Dollar is now the strongest one, followed by Canadian and then Euro.

China MOFCOM on US-China trade talk: Will implement specifics as soon as possible

China’s Ministry of Commerce issued an extremely brief Q&A statement today regarding the results of Xi-Trump summit. In short, the MOFCOM said the meeting was successful. And, the economic and trade teams from both sides will actively promote the work of negotiations within 90 days in accordance with a clear timetable and road map. Most importantly, China pledged to implement the specifics, “sooner the better”.

Yesterday, Trump sounded positive with his tweet and said “President Xi and I want this deal to happen, and it probably will”. But he also noted that is a real deal doesn’t happen, “I am a Tariff Man”. And even now, he added, “We are right now taking in $billions in Tariffs.”

BoJ Wakatabe: Inflation only halfway to target, may revert to deflation

BoJ Deputy Governor Masazumi Wakatabe said today that the first characteristic of the current economy is it’s being “widespread”. And it’s “bring about benefits to a wide range of economic entities.” And, the second characteristic is that “inflation rate turning positive”, “which is different from the case in the mid-2000s”.

On outlook, he reiterated the bank’s rhetorics that the economy is expected to continue on an “expanding trend”. But he also noted various risks including US-China trade friction. On prices, he said CPI is likely to “increase gradually” as the economic expansion continues.

Though, Wakatabe also warned that for now, inflation remained at around 1%, “only halfway” to 2% target. And, “in a case where downward pressure is exerted on the economy again, it may revert to deflation. Thus, it’s appropriate to continue with the “large-scale monetary easing”.

Australia GDP grew merely 0.3% in Q3, Aussie pressured broadly

Australia GDP grew merely 0.3% qoq in Q3, just half of expectation of 0.6% qoq. That’s also a sharp slow down from Q2’s 0.90%. On annual basis, GDP growth slowed to 2.8% yoy, well below expectation of 3.4% yoy. In November Monetary Policy Statement, RBA projected GDP growth to be at 3.5% in 2018. And it’s now highly likely to miss such projection. Based on the steep slowdown in momentum, it’s getting doubtful if 2019 forecast of 3.25% growth would be met. And, RBA might need to revise down its projections in the next MPS in February. But after all, the slowdown will firm up the case for RBA to continue to stand pat throughout 2019, and probably deeper into 2020.

Also from Australia, AiG perfomance of services index rose to 55.1, up from 51.1. From China, Caixin PMI services rose to 53.8, up from 50.8 and beat expectation of 50.8.

BoC to keep policy rate unchanged at 1.75%

Bank of Canada is expected to keep its policy rate unchanged at 1.75% today, after a rate hike of 25 bps in October. Despite bets of another move this month, we believe policymakers would take a wait- and- see mode to assess the impact of the sharp fall of oil prices on Canada’s economy. Another focus is BOC’s forward guidance, whether Governor Stephen Poloz would stick to his hawkish stance that the policy rate would need to rise to the neutral rate would be closely watched.

More in BOC Preview: Will Poloz Maintain Hawkish Stance?

Looking ahead

Eurozone will release PMI services final and retail sales. UK will release PMI serices too. BoC rate decision will be a focus and Fed will release Beige Book. Release of other US data, including ISM services and ADP employment, are postponed to tomorrow.

AUD/USD Daily Outlook

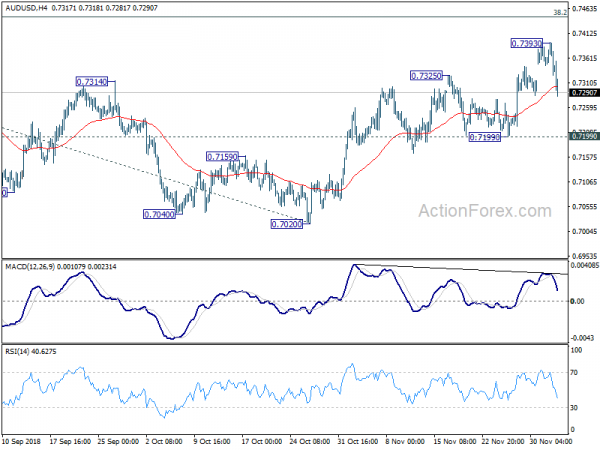

Daily Pivots: (S1) 0.7312; (P) 0.7353; (R1) 0.7380; More…

AUD/USD’s rebound was limited at 0.7393 and retreated sharply. Intraday bias is turned neutral first. For now, as long as 0.7199 support holds, corrective rise from 0.7020 medium term bottom should still extend higher. On the upside, above 0.7393 will target 38.2% retracement of 0.8135 to 0.7020 at 0.7446. However, on the downside, break of 0.7199 will suggest that such rebound has completed earlier than expected. Intraday bias will be turned back to the downside for retesting 0.7020 low.

In the bigger picture, a medium term bottom is in place at 0.7020 ahead of 0.6826 key support (2016 low). Stronger rebound would be seen to corrective the whole fall from 0.8135 high. But we’d expect strong resistance from 0.7500 support turned resistance to limit upside. Medium term fall from 0.8135 should resume and extend to take on 0.6826 low at a later stage, after the correction from 0.7020 completes.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:30 | AUD | AiG Performance of Service Index Nov | 55.1 | 51.1 | ||

| 00:30 | AUD | GDP Q/Q Q3 | 0.30% | 0.60% | 0.90% | |

| 00:30 | AUD | GDP Y/Y Q3 | 2.80% | 3.30% | 3.40% | 3.10% |

| 01:45 | CNY | Caixin PMI Services Nov | 53.8 | 50.8 | 50.8 | |

| 08:45 | EUR | Italy Services PMI Nov | 49.2 | 49.2 | ||

| 08:50 | EUR | France Services PMI Nov F | 55 | 55 | ||

| 08:55 | EUR | Germany Services PMI Nov F | 53.3 | 53.3 | ||

| 09:00 | EUR | Eurozone Services PMI Nov F | 53.1 | 53.1 | ||

| 09:30 | GBP | Services PMI Nov | 52.5 | 52.2 | ||

| 10:00 | EUR | Eurozone Retail Sales M/M Oct | 0.20% | 0.00% | ||

| 15:00 | CAD | BoC Rate Decision | 1.75% | 1.75% | ||

| 19:00 | USD | Fed’s Beige Book |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals